The price of oil is around $60 a barrel, a drop of just over 20% compared to the 2024 average.

There are three dimensions to understanding the trend of oil prices.

The first is that of supply and demand.

In February, the International Energy Agency estimated excess supply at 600,000 barrels per day by 2025, causing a downward bias on prices. Since then, Trump’s tariff announcements have weakened global growth and, therefore, oil demand.

More recently, OPEC+ decided to reverse its strategy. It initially shifted from a supply cut to a limited increase of an additional 137,000 barrels per day before a sharp upward acceleration (411,000) over the May 1st weekend. The market, already oversupplied, shifted further, pushing prices toward $60.

The second dimension is that of producing countries.

For most of these countries, the price of oil is essential for balancing their budgets. According to the IMF, this equilibrium price would be between $60 and $100 per barrel depending on the country.

It has long been observed that when prices are too low, there are always one, two, or three countries that marginally produce a little more to increase their revenues. The market imbalance worsens, pushing prices even lower. Subsequently, the situation normalizes through a reduction in supply. But in the meantime, the price has been very volatile.

The third dimension is political.

Donald Trump had promoted the “drill baby drill” to boost supply, lower prices toward the $50 target, and benefit consumers. In this troubled period, where alliances are being redefined, OPEC+ may want to form an objective alliance with the US, hoping that a low price will allow them to gain market share, particularly at the expense of US producers, penalized by operating costs that are becoming too high.

The price of a barrel of oil is likely to remain low for some time. But beware: oil prices are volatile, and it would be foolhardy to think this situation will last long. Producers will eventually react.

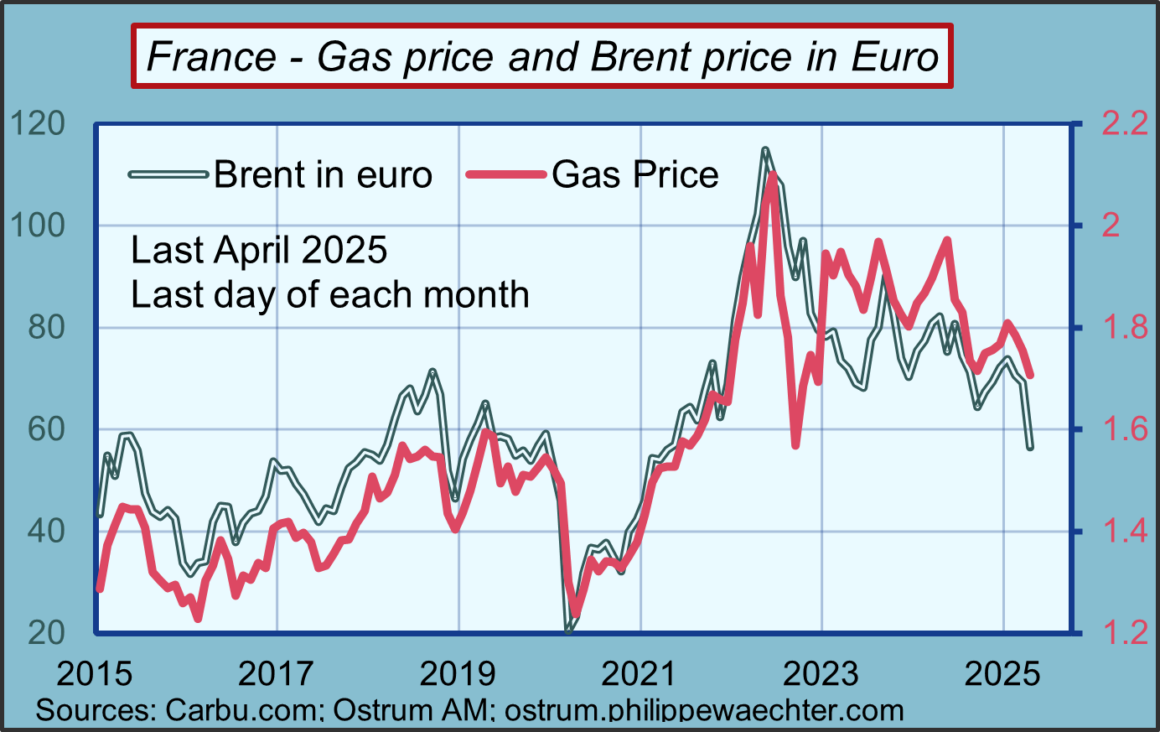

For consumers, the price of a barrel is consistent with a price per liter of gasoline between 1.5€ and 1.55€ for SP 95. This will provide strong support for consumption. The price of gasoline is always an important indicator of household behavior.

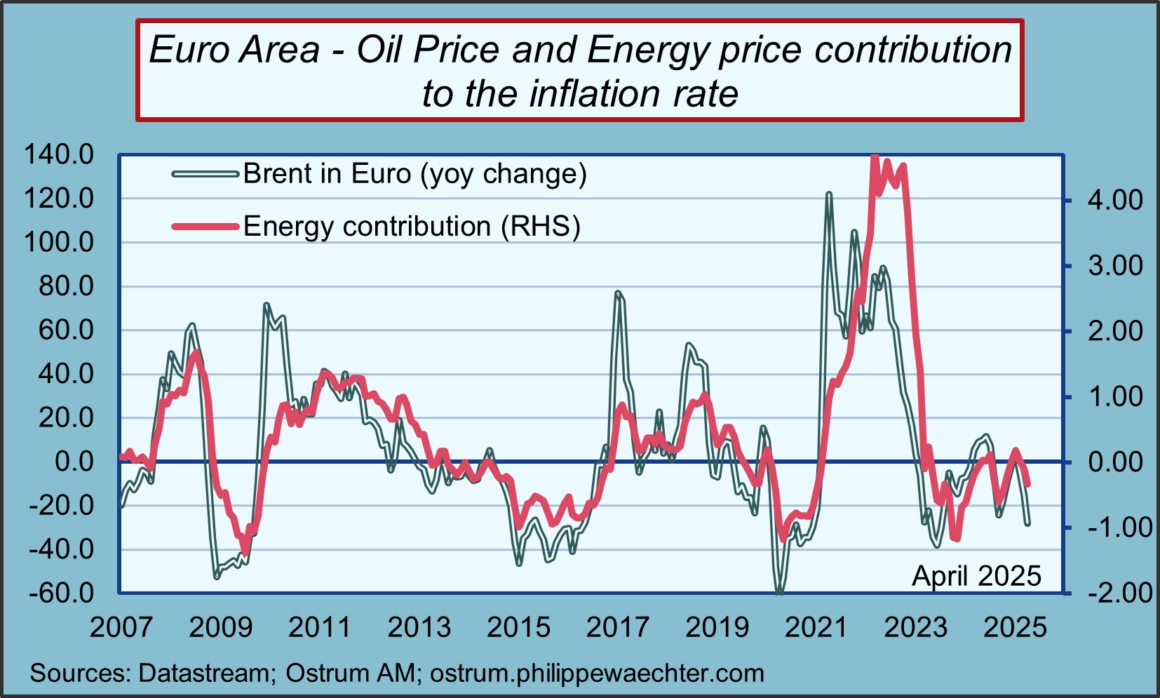

The other point is that the contribution of energy prices to inflation will fall sharply over the coming months, pulling down inflation in the Eurozone. Supporting this trend by the ECB could help strengthen domestic demand and the Eurozone’s ability to increase its autonomy.

The point to be emphasized is that the low price will further encourage oil consumption and once again postpone the start of the energy transition.