In a recent post I was worried by the potential weakness of UK domestic demand after the fall of the real disposable income for three quarters in a row and by the downturn of the saving rate (see here). I also said in this post that consumer credit was growing too quickly. This post is a complement.

We can go further by looking at all the households’ financial liabilities.

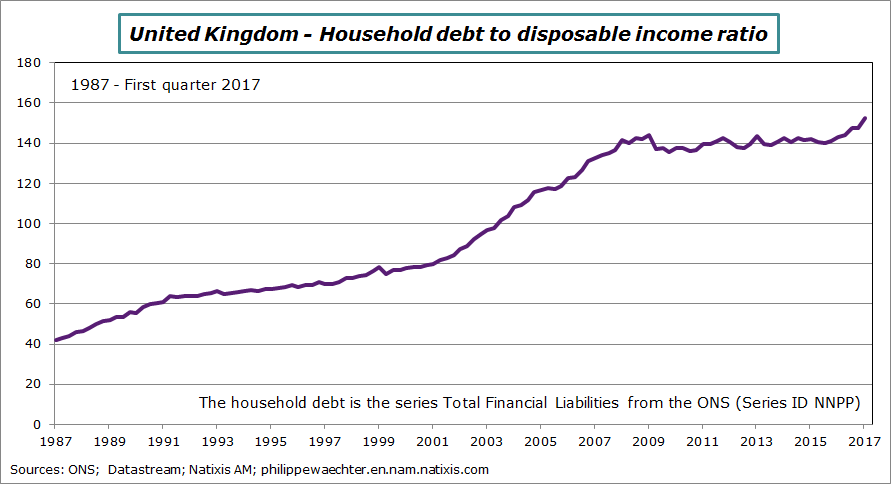

The graph below shows the ratio of the households’ total liabilities to the disposable income. This ratio is now higher than the level that triggered the 2008 financial crisis.

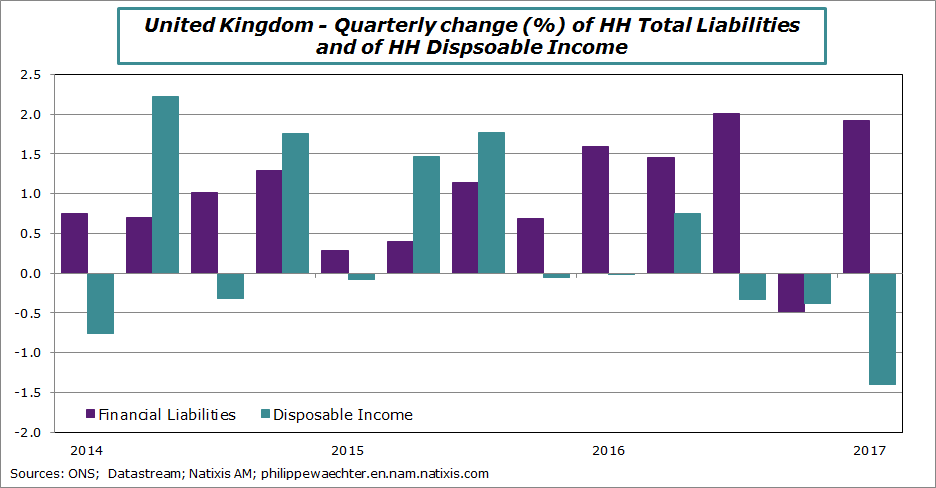

When we go into details we see two divergent trajectories for the debt and the disposable income. These profiles are a source of constraints for households. Debt is growing too fast and a rebound in disposable income is necessary to avoid a further weakness first on consumption and after on real estate.

Philippe Waechter's blog My french blog