World growth has stopped accelerating and hit a plateau, inflationary risk is now more visible in investors’ behavior, and the ECB is advocating urgent reforms to the euro area’s institutional framework in order to make it more resilient.

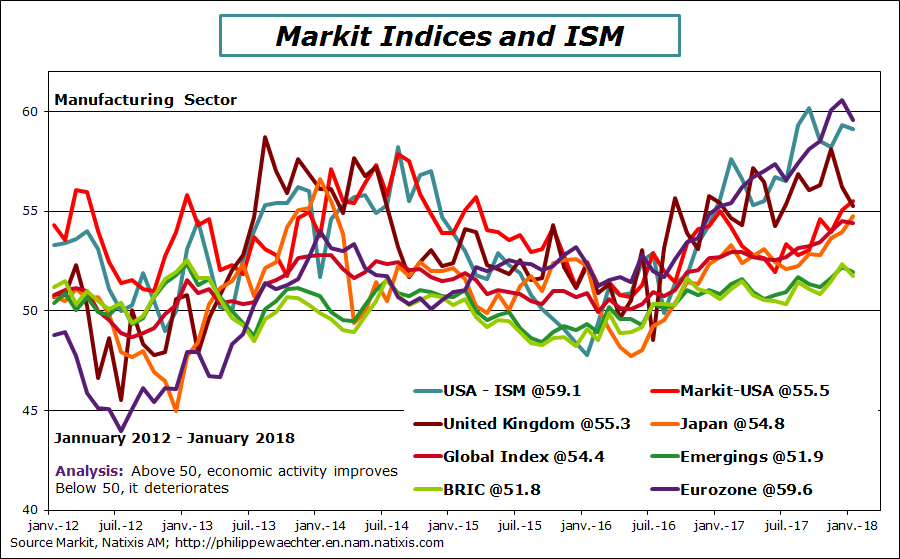

After an acceleration in the last quarter of 2017, is world growth hitting a plateau? This is what manufacturing sector Markit surveys seem to suggest. The swift growth seen right throughout 2017 has ground to a halt, and while indices all stand at admittedly impressive levels reflecting swift growth in economic activity, they are no longer rising.

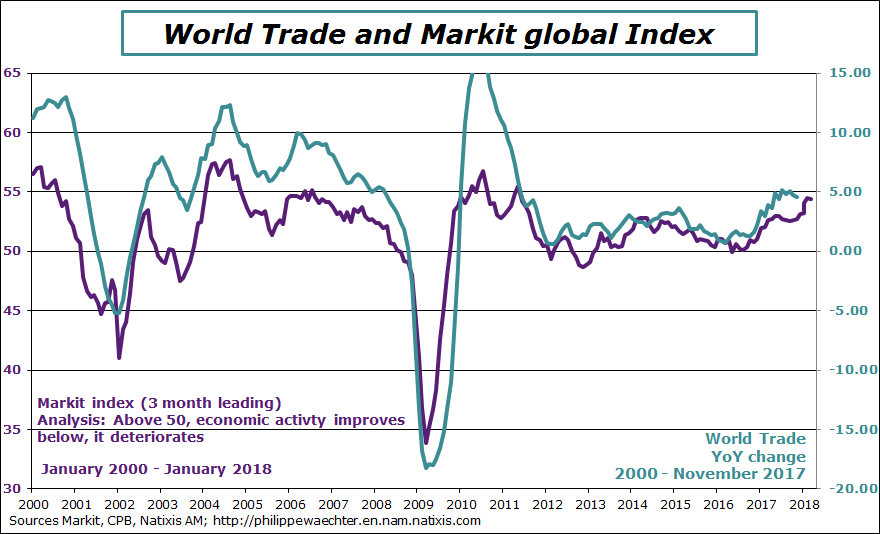

The global index was flat in January at 54.4 vs. 54.5 in December. This figure is very useful as it acts as a leading indicator of world trade trends. The relationship between the two metrics is important and world growth was so extensive and uniform precisely because this correlation worked well again in 2017. In this respect, monetary policy accommodation across the globe was a prerequisite for a recovery in growth, and in 2017 provided sufficient impetus to truly spark it off.

This is also why monetary policy needs to remain accommodative, otherwise growth would quickly be hampered, as potential growth is much lower than before the crisis, especially in developed counties. Signals of monetary tightening must not be given too quickly, i.e. until such times as the potential growth profile has staged a lasting recovery, which is not yet the case.

The chart here points to a close correlation between business leaders’ view on their immediate environment worldwide and trade volumes.

If we look at a breakdown of areas involved in the survey, we see that all zones maintain robust growth, with no warning signs anywhere, yet the extent of growth in activity has narrowed, especially in the euro area.

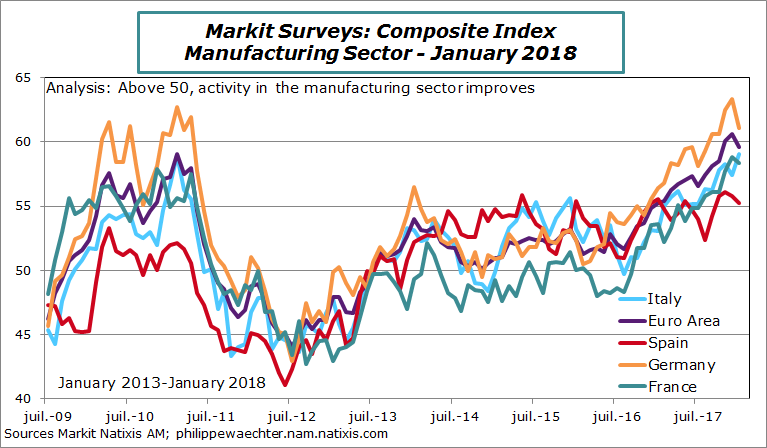

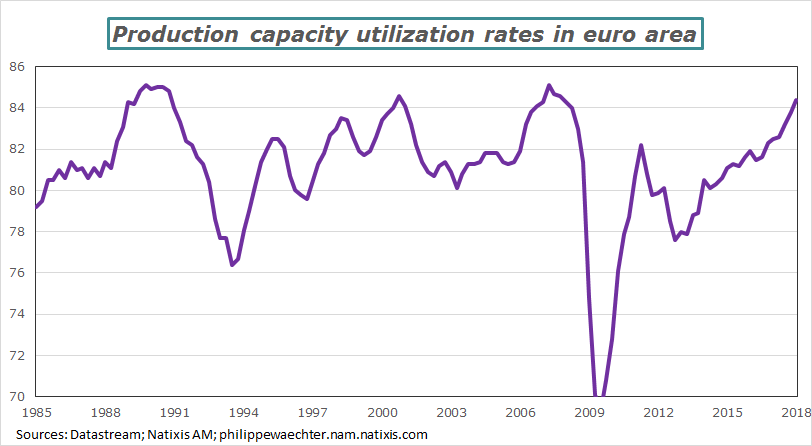

The global chart shows that the index for the euro area is slowing, but looking at the chart with a breakdown of the main countries in the euro area, we can also see a downturn in Germany, France and Spain, with only Italy displaying an uptrend. This failure to drive growth any faster is also consistent with trends in capacity utilization rates, which are close to a high in the euro area. So it is vital to make long-term investment to ease this restriction and avoid the development of imbalances that would be damaging for the area as a whole (see charts in appendix).

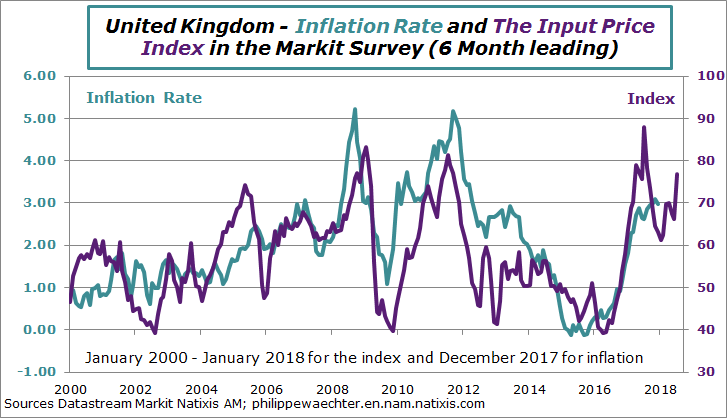

Performances are slowing considerably in the UK. Based on the price index available in this survey, inflation should step up a pace again in the UK (see appendix for chart).

Meanwhile, the situation in the US is still robust. According to the Atlanta Fed’s Nowcasting model and based on information currently available, expected growth is set to come to 5.4% in the first quarter of 2018 (annualized). This is consistent with information available via surveys and job figures published for January.

Japan continues to grow swiftly and emerging countries also maintain their solid trend.

. . .

The Fed’s press release following its January meeting (30/31) merely needed to hint that inflation could pick up a gear and converge towards the 2% target in a limited period of time and stay there for investors to start believing that inflation is poised to rise and stay high. At the end of the week, the announcement of a rise in private sector wage growth to 2.9% lent further credence to this view of rising inflation.

Three points are worth raising

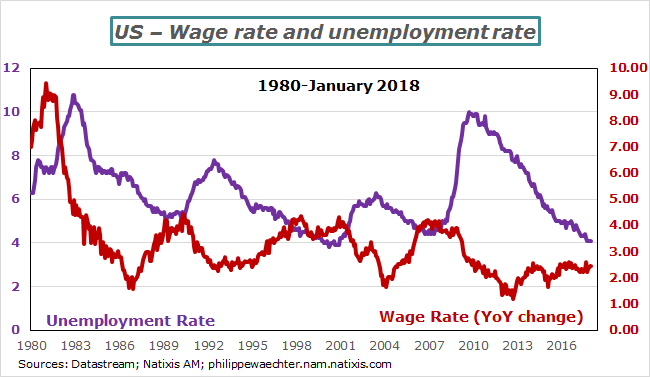

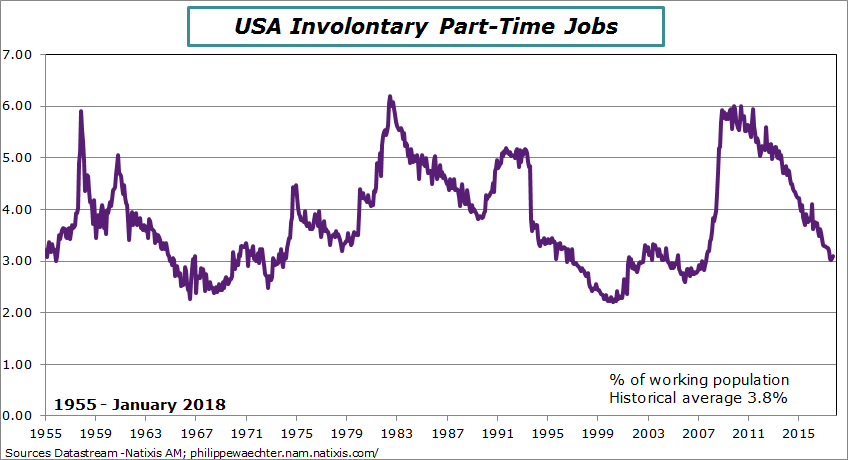

Labor market rebalancing is a source of wage inflation pressures. The Fed long believed that labor market imbalances, for example more involuntary part-time employment (see appendix for chart), prevented wages from rising at a faster pace.

For such times as these imbalances remained, there was a smaller chance of the wage rate accelerating, thereby delaying convergence of inflation towards the 2% target. But these imbalances have eased considerably and there should therefore be greater upward wage pressure.

Secondly, the correlation between unemployment figures and wage trends no longer holds in the current cycle, as shown in the chart below. Since the start of the 1980s, we have seen that as unemployment falls, wages simultaneously and systematically increase, but in the current cycle, this mechanism no longer operates. Unemployment has fallen spectacularly and the US economy is now running on full employment if we base our assessment on this criterion. Yet the wage rate profile is not at all as we would have expected i.e. the Phillips curve has flattened.

The wage-setting mechanism has changed as a result of value-added sharing that tends to favor companies, along with the very inconsistent implementation of innovation across the US economy and weak productivity trends. None of these factors has changed and there has been no change to indicate that the wage profile will see a similar trend to past cycles. There will probably be some wage pressure but let’s not get carried away just yet

Let’s say we expect convergence of inflation towards the 2% target as suggested by the Fed. This looks reasonable but there is no question of outstripping this figure at this stage. In view of the US 10-year rate profile, this means that a large proportion of the interest rate adjustment is already behind us and we should not expect US long rates to move much beyond current levels. The recent rise in European rates is a result of pressure witnessed in the US spreading across the pond. I therefore do not think there will be a surge in interest rates in the euro area.

However, this will not prevent the Fed from adopting a tougher stance on monetary policy with higher interest rates. We should also expect a further flattening in the yield curve in the US. The rise in short-term rates would then hit households who take on debt to make consumer purchases, with the risk of hampering domestic demand.

Another point worth addressing is that the adjustment witnessed on US interest rates has had a clear impact on the equity markets. Investors’ moves to factor in a potential inflationary premium have played a role in interest rate movements and the equity markets’ adjustment as higher interest rates lead to changes in asset allocation strategies. It is still a somewhat unusual time as Janet Yellen only left the Fed this weekend and Jay Powell has not yet officially taken over. He will obviously talk about monetary policy and his stance may dictate the profile on long-term rates and hence investors’ future allocation moves on the risky asset markets.

. . .

Political uncertainties remain in the euro area. Talk of potential coalitions in Italy a month ahead of the March 4 elections may suggest a government that is partly against the euro. We must be prepared for an outcome that could raise fresh questions on the euro area and how it is run. Meanwhile in Germany, if a CDU/SPD tie-up is finalized, it is worth pointing out that the leading opposition party would then be Afd.

On February 2, Benoit Coeuré reiterated the need to reform the euro area to reduce the risk of a break-up of the bloc in the event of a crisis. The European institutions indeed need to change if we are to avoid being held hostage by opponents of the euro area.

Appendix