This post is available in pdf format My weekly Column – Italy Standpoint – PW

What were last week’s major changes?

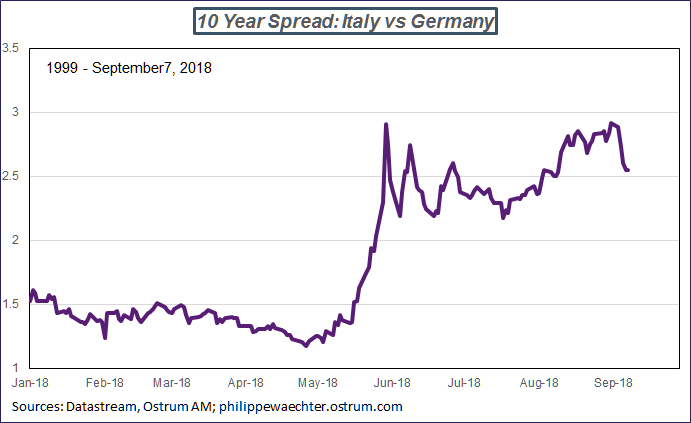

The main change was in Italy with a strong and rapid drop in the interest spread with Germany.

Why ?

Since the new coalition government came to office, fears have emerged on exactly how the campaign-trail program would translate into the forthcoming budget – an answer to this question is expected on September 27.

The government’s stance so far has been to be fairly relaxed, especially on the 3% threshold (of budget deficit as % of GDP), which explains why the yield spread with Germany widened considerably over recent weeks.

This was a source of concern as the Italian economy would soon have run up against financing difficulties due to the reluctance of non-resident investors – who hold around 35% of the country’s debt – to revisit the Italian market after withdrawing their investment in the country all summer. Italians cannot and do not want to leave the euro area, so additional pressure on liquidity and interest rates could have hampered funding for Europe as a whole.

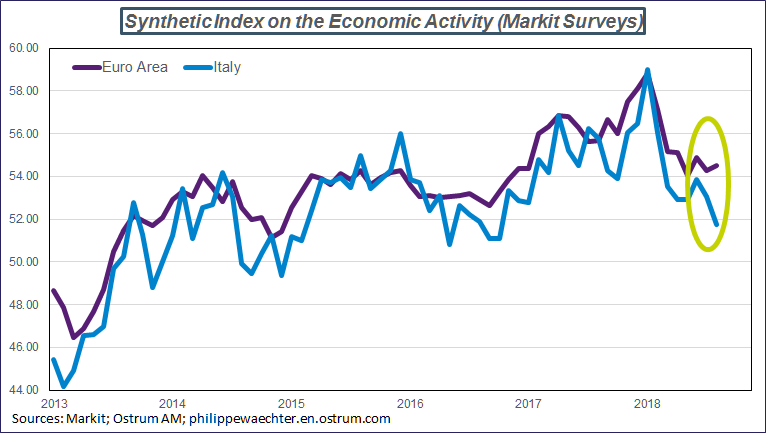

However, the economic situation is swiftly changing in Italy, as economic activity slowed sharply over the summer months, while employment has also seen a shift. The Markit index on economic activity as a whole in the country plummeted over the summer months as compared to the equivalent index for the euro area.

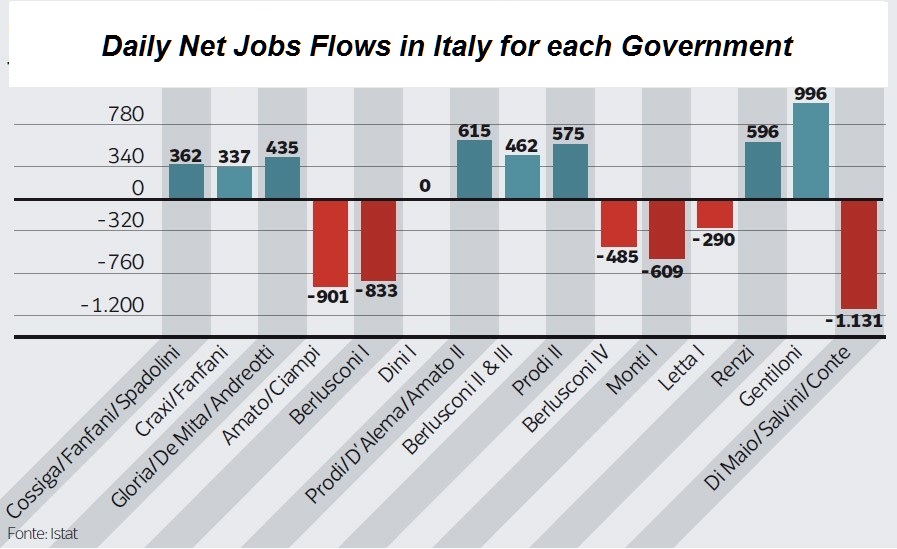

Job figures have been falling for the past two months, especially when we tally up the number of jobs created as compared to those lost. The country’s buoyant performance since the recovery in 2013 has reversed since the arrival of the coalition government.

For Italian leaders, this reflects the Italian economy’s inability to generate self-sustaining momentum, and the rise in interest rates already seen, combined with any potential increase if investors run into further uncertainty, could be even more damaging.

This swift deterioration in the Italian economy and its inability to get on the path to self-sustaining growth prompted the government to change its stance on the budget. An excessive budget deficit would dent the economy much more swiftly than the actual impact of the related budget measures.

A swift sharp slowdown in growth and jobs could trigger discord between voters and the government as well as within the odd couple formed by the Five Star Movement and the League.

This turnaround reveals the extent of the Italian economy’s fragility, which hampers the government’s endeavors to reform, despite the recent political watershed triggered by the arrival of the coalition. There is usually a short window to apply the program that propels a party or coalition to power, but this is not even the case in Italy and this economic fragility is very worrying for the euro area too given the size of the Italian market.

It is worth taking note of this change, but we need to remain cautious as the current government could have some other surprises up its sleeve … and they may not necessarily be good ones.

What else is worth noting?

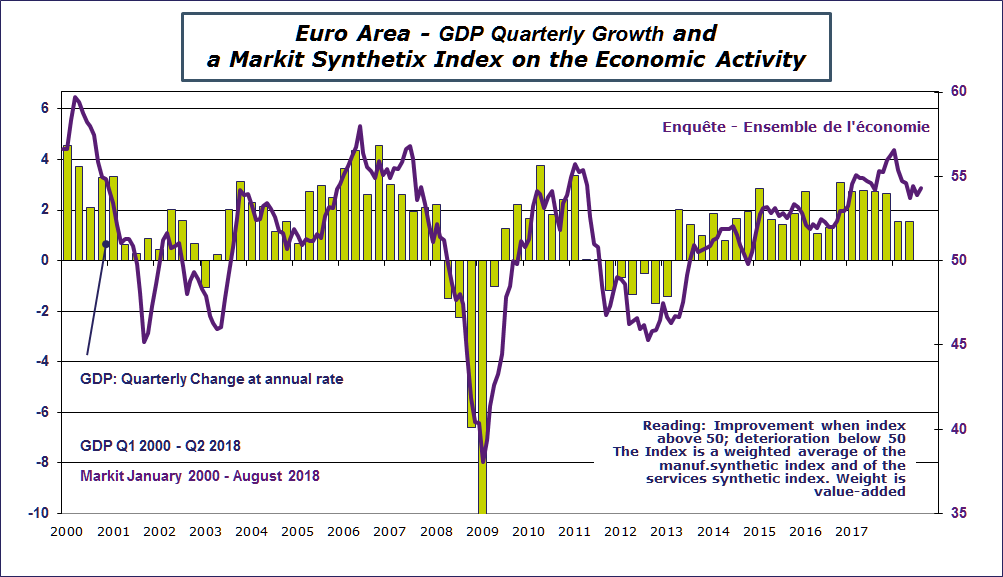

The economic outlook in the euro area as reflected by the Markit survey has been stabilizing since the Spring. After a surge in 2017, the economy is settling into a more sustainable trend for the medium term. Growth is more sluggish than in 2017 but it is not set to spark tensions that would require swift intervention from the ECB, which is not a bad thing.

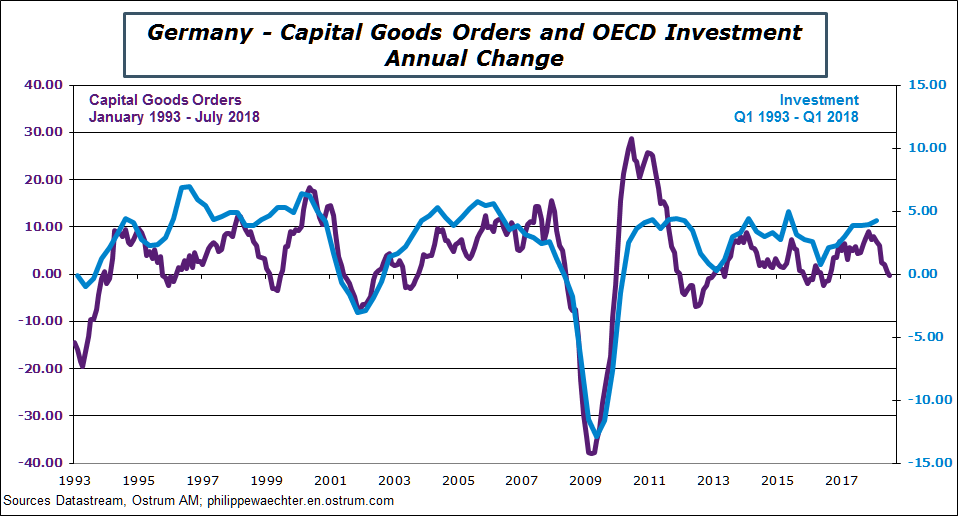

What about German industrial orders?

The situation is still worrying as trends in capital goods orders are still in line with investment trends for OECD countries. These orders dipped 0.25% yoy in July, pointing to a forthcoming slowdown in investment in production. This downturn looks set to be widespread as the slowdown in capital goods orders seen in the euro area combines with a slowdown worldwide. Recent uncertainties on emerging markets and trade momentum, after moves from the US government, have a role to play.

The decline in exports is not the spontaneous result of Trump’s measures on trade barriers – the monthly figure is volatile. We would particularly note that exports have no longer been rising in volume terms for a year, reflecting the slowdown in world trade. And the impact of Trump’s moves is still to come.

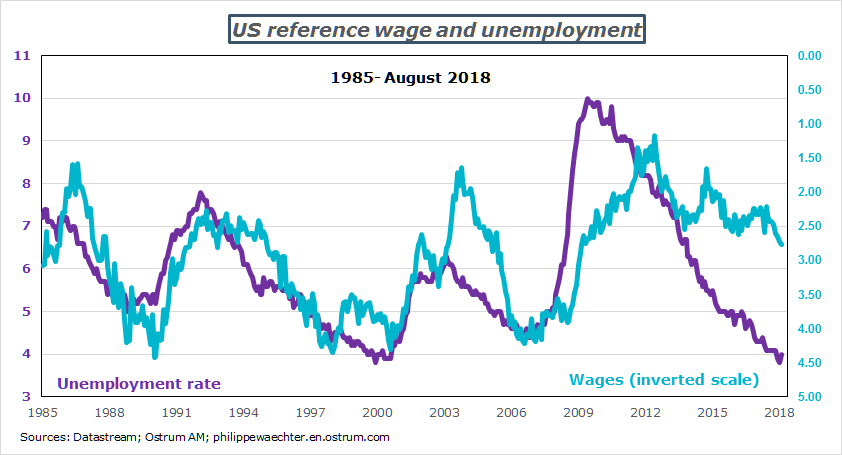

The US economy created 201,000 jobs in August, similar to previous figures (207 000 on average since the beginning of the year), with a jobless total of 3.9%. Is the absence of wage pressure at this stage in the cycle not a cause for concern? And are we not seeing excessive optimism in the ISM index, which is moving towards record highs?

Wage growth comes out at 2.8% or 2.9% depending on the metric used, which is low compared to previous cycles and ultimately very close to inflation figures. This means than during the current economic cycle – the second longest in US history – workers are enjoying few or no purchasing power gains on average. They derived no gains previously due to the lack of pressure, and now it is because inflation is quickening the pace. The US cycle is not very virtuous and we are concerned about the fact that the wage profile is not following the unemployment trend: based on current jobless trends, wages should have risen much more quickly than they actually did.

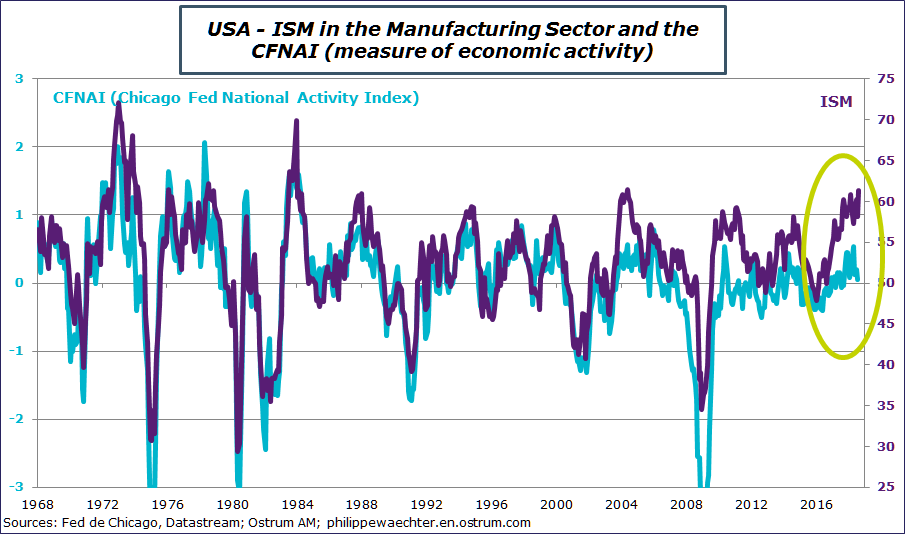

Meanwhile, business leaders are very optimistic. I compared the ISM manufacturing index and the index calculated by the Chicago Fed on the basis of 85 indicators i.e. industrial output, jobs, personal income, etc. Both cycle metrics are broadly similar, but over recent months there has been a real divergence. The ISM index no doubt reflects excessive optimism from business leaders as compared with reality.

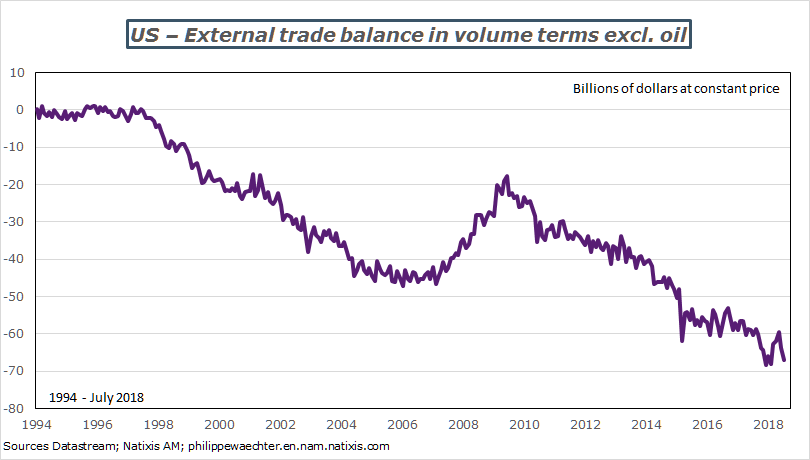

The deterioration in the US external balance (excluding oil and in volume terms) is a reflection of the imbalances triggered by the country’s policy to drive domestic demand, which is a cause for concern as this will have to be offset by more restrictive moves from the Fed.

Philippe Waechter's blog My french blog