Donald Trump hit out again recently at the Federal Reserve for its monetary policy management, taking it to task for hiking interest rates, which he claims would hamper US growth. But this is something of a bold statement given the White House’s fiscal policy.

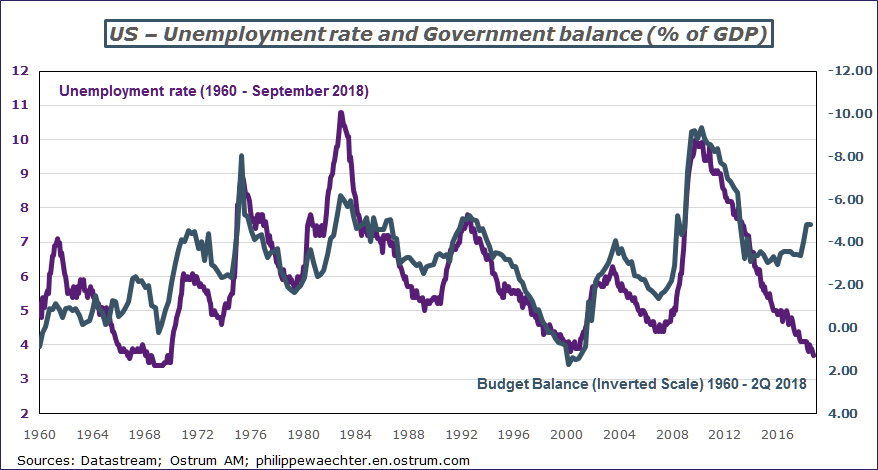

The chart below depicts US unemployment and the government balance as a percentage of GDP, revealing that the two indicators have trended in a similar way over almost 60 years, each reflecting the US cycle. When economic activity is robust, jobless numbers decrease, while at the same time, tax income increases and spending to support the economy is lower, thereby improving the budget balance. This twofold trend has always worked well, even when Ronald Reagan embarked on economic stimulus at the start of the 1980s. Meanwhile, the budget surplus at the end of the 1990s is also an illustration of this trend, with Bill Clinton’s – fairly smart – moves to implement austerity policies to gain leeway in the event of a downturn in the cycle.

But the current period marks an exception. The cycle is robust, as reflected by the drop in unemployment to 3.7% in September 2018, hitting its lowest since 1969, yet the government balance is not improving, but rather it is deteriorating under the influence of Donald Trump’s policies. The public deficit stands at close to 5%, yet it should have fallen significantly on the back of the economic cycle. The government is driving economic stimulus at a time when the economy is running on full employment.

So it is reasonable for the Fed to take action to counter these excesses and avoid the emergence of persistent imbalances. We cannot rule out the possibility that fiscal policy will bolster domestic demand, triggering a significant surge in inflation and a larger external imbalance despite the White House’s protectionist measures (demand is rising sharply – due to tax cuts and increased spending – and supply does not have time to adjust, which leads to a swell in imports).

The Fed, as embodied by Chair Jay Powell, has clearly indicated that this policy is not sustainable in the medium term and that it must be offset, which is why the Fed is hiking interest rates – and it is right to do so – thereby setting the US economy on a more sustainable path for the medium term.

However, the risk lies in the event of a severe negative economic shock, as there would be no leeway for fiscal policy to adjust, and there would be no scope for raising the budget deficit or implementing a stimulus plan like Obama did in 2009, as the budget deficit is already extensive before a potential shock: the US economy would therefore be hampered over the long term. Trump’s policies will only help the better-off in society, who benefit from lower taxes, while the cost of this policy is spread out across the population via the ensuing increase in the public deficit. And this approach will create even more inequality in the longer term as some Republicans are alarmed at the extent of public debt and are arguing for a reduction in social spending to make this debt sustainable in the medium term. For now, America seems to have lost sight of the meaning of the words equality and fairness.

Philippe Waechter's blog My french blog