Let me show you one chart on Chinese growth. It represents contributions to yearly growth by large sectors.

- The contribution from the manufacturing sector is now very limited. It is no longer the backbone of Chinese growth

- The real estate sector has also a minor contribution.

- The Chinese economy has moved to a model that is driven by services. The growth model has been rebalanced from the industry to services

- The finance sector has a robust contribution. But this latter mainly reflects the bubble seen on the equity market. The strong and deep intervention of the Chinese authorities is expected to limit the market fall after the bubble burst. But we cannot anticipate that the finance contribution will remain at this high level.

With a more limited contribution from the finance sector, GDP growth momentum will converge to a lower path. We can expect slower growth in the future.

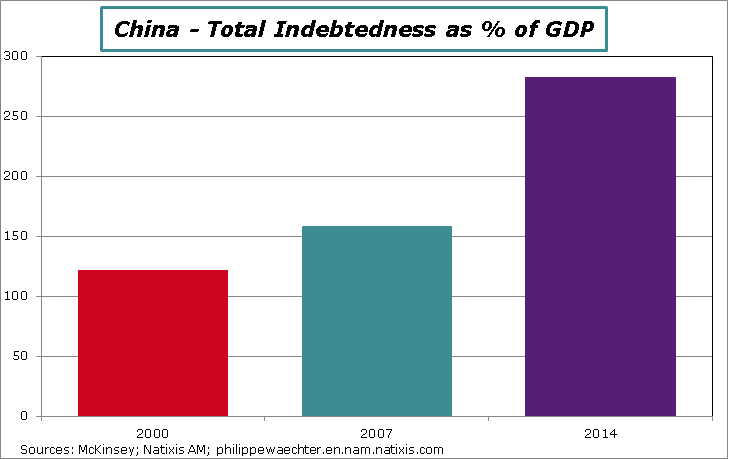

In other words, growth has been supported by higher indebtedness since 2009 but it’s no more a source of impulse. A large part of this debt had real estate price as collateral. The real estate price fall since 2014 implies that the current mechanism for debt is no longer operational. With this failure, there was a need for a new instrument to support growth.

This has been the equity market where constraints have been reduced by the Chinese authorities (more relaxed rules on margin trading). The consequence was a large bubble that has burst since mid-June. It will no longer be a support for the GDP growth through the finance sector.

Moreover the will to limit the equity market adjustment is probably wrong. After the 1987 market crash on the U.S. market there was a task force who concluded that it was better to let the market to adjust and to converge to its fair value. It’s a way to limit constraints on investors and to ease and to improve resources allocation. These conclusions were right but the Chinese regulation authority is currently doing the contrary. It will be damaging for growth.