I have recently written a series of posts (here, here and here) in which I said I was worried by the poor trend of the world economy.

The point I developed was the following

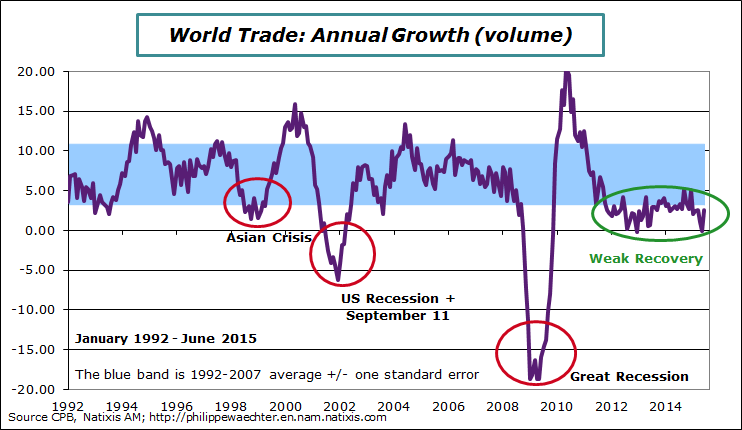

World trade momentum is atypical and low, lower than what it used to be in the past.

The main reason is the absence of growth drivers that could pull up the world economy. In the past the United States did the job. More recently, at the beginning of the 2000’s, China was the main source of world growth improvement. They were able to push up the world economy in order to converge to a higher trajectory.

Currently neither the US nor China have the possibility to play this role. Europe which is at the start of a moderate recovery is not able to create such impetus.

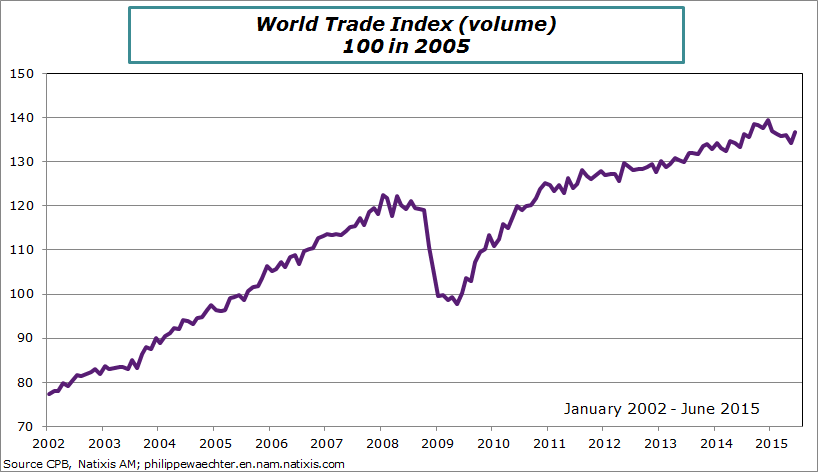

In other words, even if trade level is still very high, there are no sources that are able to improve world growth trade dynamics.

This implies that growth will not come mainly from world trade and that every country, every region must improve its own internal demand (HH consumption and investment) in order boost economic activity. As a consequence, economic policy must remain accommodative for an extended period.

That’s why there is no reason for the Fed to hurry and to lift-off its interest rates.

That’s why public debt is important now. It must be a way to finance public investment and to repay it in the future when the economic momentum will be stronger. There is the possibility to support current demand and to catch up a higher growth trajectory. (see here).

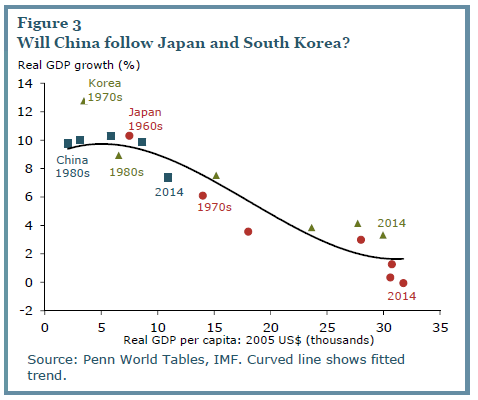

In this framework, China is no longer the strong source of growth it used to be. And probably in the future, its profile will mimic those of Japan and South Korea as it is shown in a graph I have extracted from a recent publication of the Federal Reserve of San Francisco. Chinese growth will converge to a 3-5% range in the coming ten years.

We mustn’t expect a recovery from China to converge to a higher growth profile. We have in western countries to focus on our internal demand to improve our economic outlook. That’s a deep change.

August 10, 2015

A weak internal market can be boosted by an increase in the country’s competitiveness. That’s what the ECB did for the Euro Area. Its monetary policy became very accommodative in June 2014 and is still expected to remain accommodative for an extended period. It can also be an interpretation of the Chinese Central Bank’s move at mid-August.

The analysis, I have posted earlier, relied on May 2015 data. We now have the data for June.

On the first graph, I have shown world trade annual change. It has been revised down in May to -0.1% but there is a small recovery in June. The annual change is still below the blue band and it is not sufficient.

Philippe Waechter's blog My french blog