Several issues this week

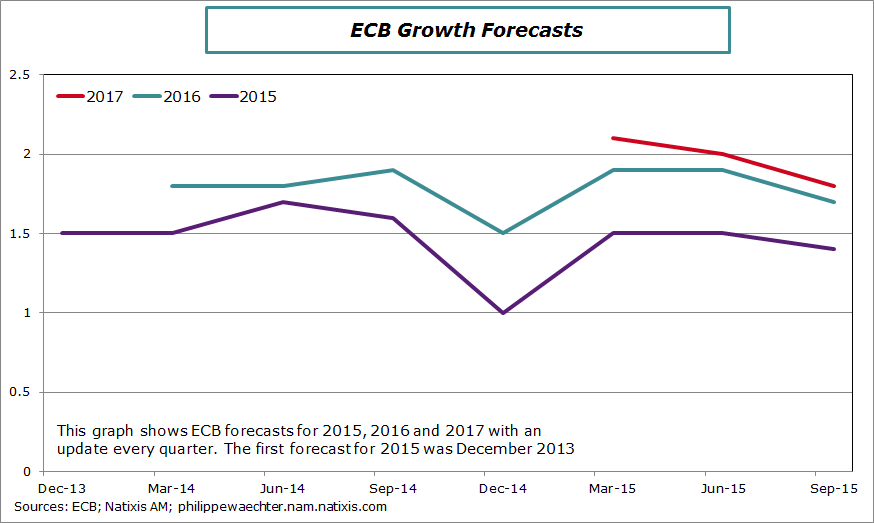

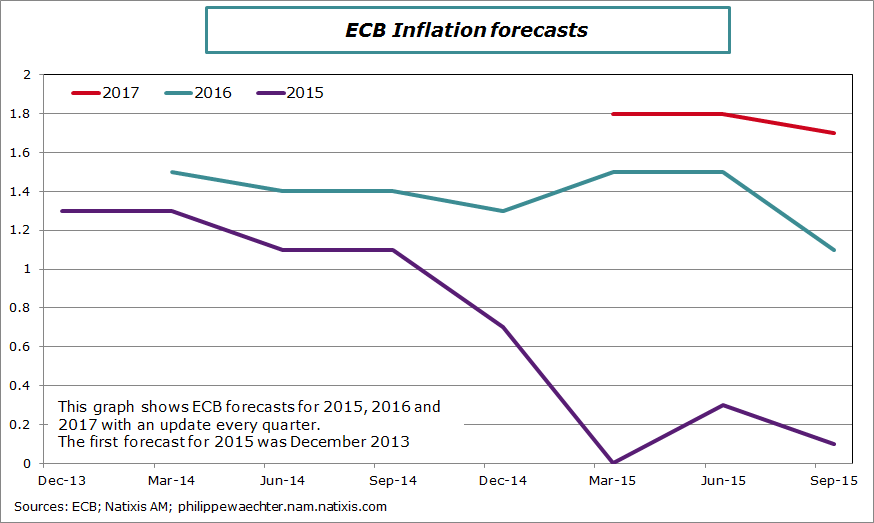

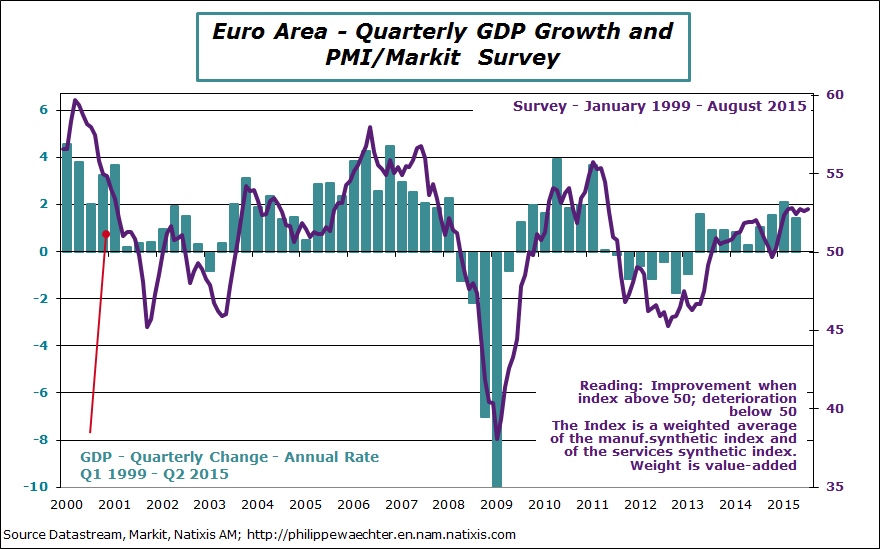

The first point is the downward revision by the ECB of its GDP and inflation forecasts for 2015, 2016 and 2017.

Three things to notice

1 – For 2015 the forecast is almost stable close to 1.5% and 1.8% for 2016. In spite of a very accommodative monetary policy, there is no improvement in the growth momentum in the forecasts’ profile. The pace is not so strong and slows moderately with the last publication (in September 2015)

The very accommodative monetary policy does have the expected impact on growth and on inflation which doesn’t converge to 2%.

There are two questions here

1 – Is it necessary to go beyond EUR 60bn per month? Would it be more efficient? There is a doubt as this is already way above governments’ issuance.

2 – In fact there is a need for a more active fiscal policy beside the ECB strategy which must be extended after September 2016. Fiscal policy must improve internal demand. (There is a rule in economic policy: the number of targets must be equal to the number of instruments. If growth and inflation are two targets, there is a need for fiscal policy and monetary policy).

To improve its efficiency within the Euro Area, fiscal policy must be more coordinated and must give a stronger role to public investments.

Of course this will create more public debt but it’s not an issue as this policy could improve growth prospects and because interest rates are low. Doing nothing is taking the risk to continue with low growth and low inflation and at the end of the day low jobs dynamics.

The flow of refugees can be a catalyst for using fiscal policy: to new circumstances there is a need to use fiscal policies. I say that as experience from the past, US recently, has created a support for growth. The Euro Area and France can follow this way.

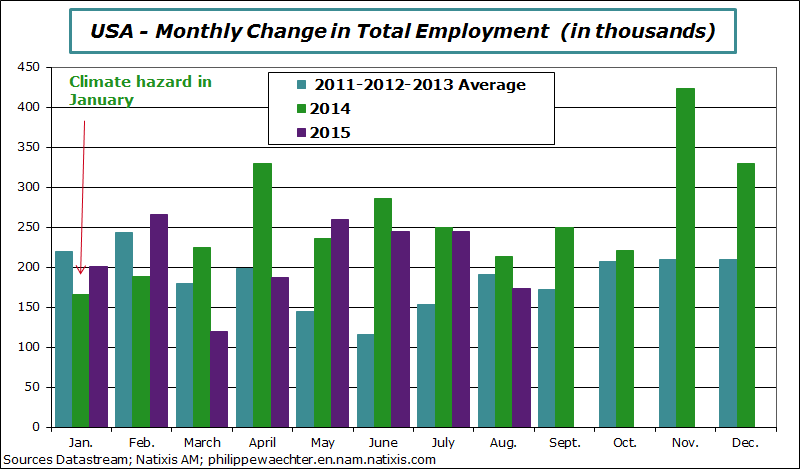

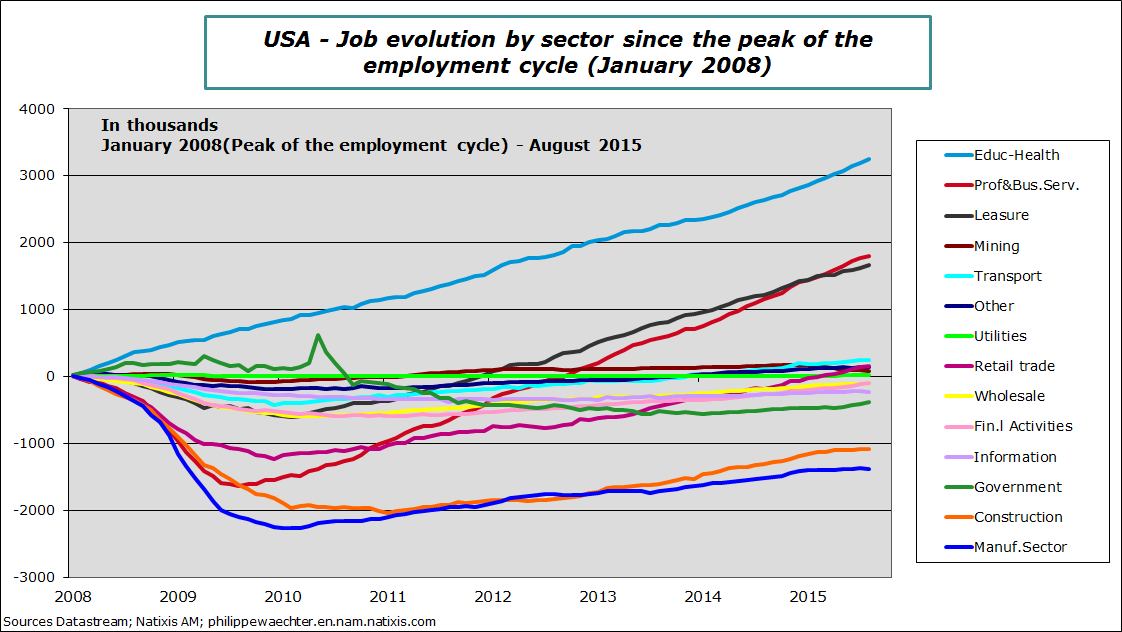

The second issue is related to the US employment report for August.

The employment figure was less dynamic in August with 173 000 new jobs, compared to 245 000 in July. Since the beginning of the year, the monthly average is 212 000 versus 237 000 for the first eight months of 2014. In the private sector, the average is 200 000 since the beginning of 2015 versus 232 000 last year.

The perception is that these figures will not be decisive for the Fed’s meeting next week.

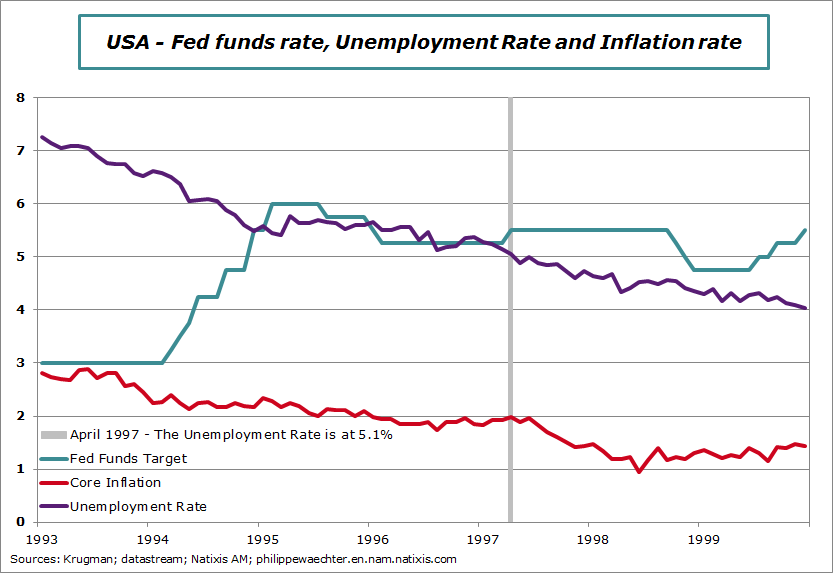

What has been important in last Friday discussions was the fact that the unemployment rate was now at 5.1%. It is perceived as close to full employment. Therefore it should lead to nominal pressures and a higher inflation rate that should push the Fed to be more active.

But this is not that simple: In April 1997, the unemployment rate is at 5.1% and the Fed increased its rate. But the unemployment rate was still trending downward and the inflation rate remained less than 2%. After its April 1997 the Fed has kept the interest rate at this level for months. Was it useful? (see here)

There is no determinism in the economic dynamics and by consequence on monetary policy.

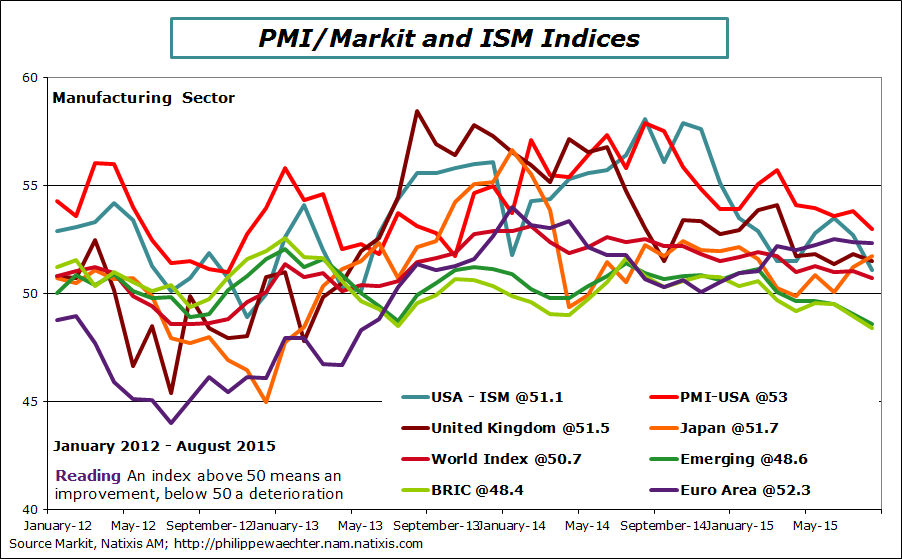

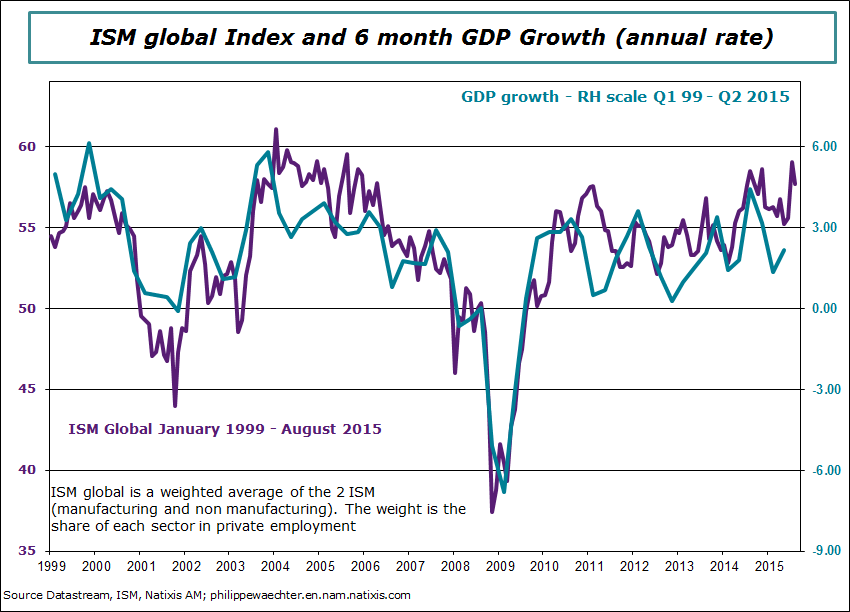

In August, for the manufacturing sector and in our sample, Japan is the sole country to show an improvement. In the USA, the two indices are trending downward. This is the case specifically for the ISM which is at 51.1, its lowest level in 2 years. The United Kingdom and the Euro Area are marginally lower as is the world index. The most problematic issue is the continuous drop seen in the two emerging indices. Both are close to 48.5, showing a contraction in their activity and at a pace which is quicker than in spring and in July.

The global picture shows a low dynamics in the manufacturing sector. As most of the goods that are traded (except commodities) are manufacturing goods, the world trade puzzle will not be solved rapidly (see here)

The unemployment rate is now below the threshold of 11% at 10.9% in July. It’s its lowest level since February 2012.

For the coming week

We will have the first figures for August in China: on Tuesday the trade balance and on Thursday the inflation rate

On Thursday there is a meeting of the monetary committee of the Bank of England. Nothing is expected but may be will we have comments after Simon Wren Lewis comments that the next move in interest rates should be on the downside (see here).

On Tuesday, the GDP details for the second quarter will be published by Eurostat for the Euro Area

Industrial production indices will be published in Germany (Monday), in the United Kingdom (Wednesday), in France (Thursday) and in Italy (Friday)

Originally published in French on September the 7th (here)

Philippe Waechter's blog My french blog