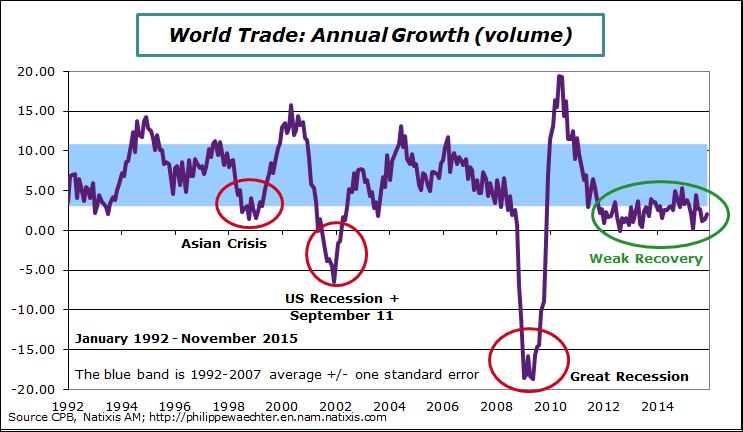

Point #1 – The global economic momentum remains weak

World trade was up by only 2% when November 2015 is compared to November 2014. This growth rate is still below the average seen before 2008 (blue band on the graph). The explanation framework based on the absence of growth drivers seems always the good one. No impulse from the US or China and the incapacity for the world economy to converge to a higher growth trajectory.

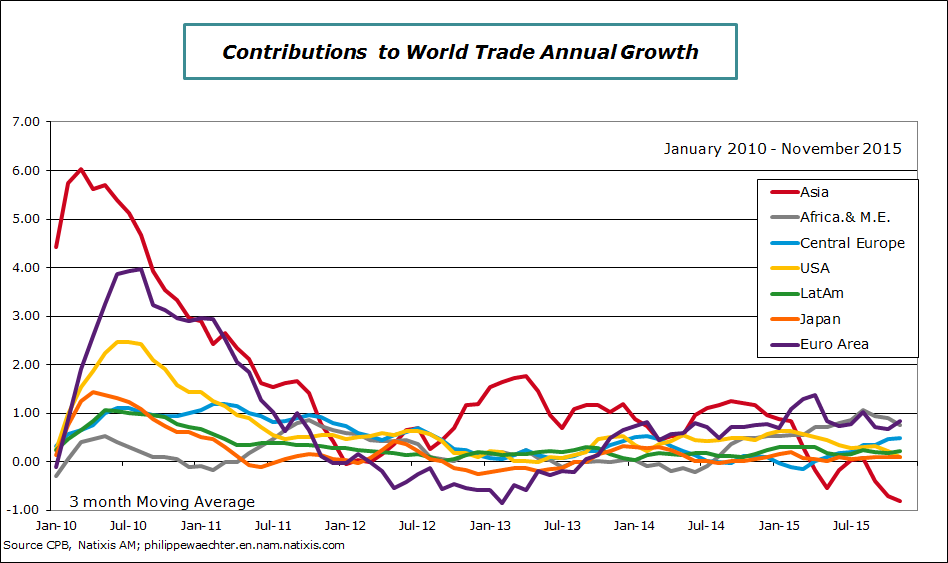

Asia ex Japan has the weakest contribution and is a drag to world trade dynamics. China has an important impact. The US are not a strong support to trade. The Euro Area and Africa and Middle East have the strongest contributions. They are not those that are expected, showing the fragility of the current business cycle.

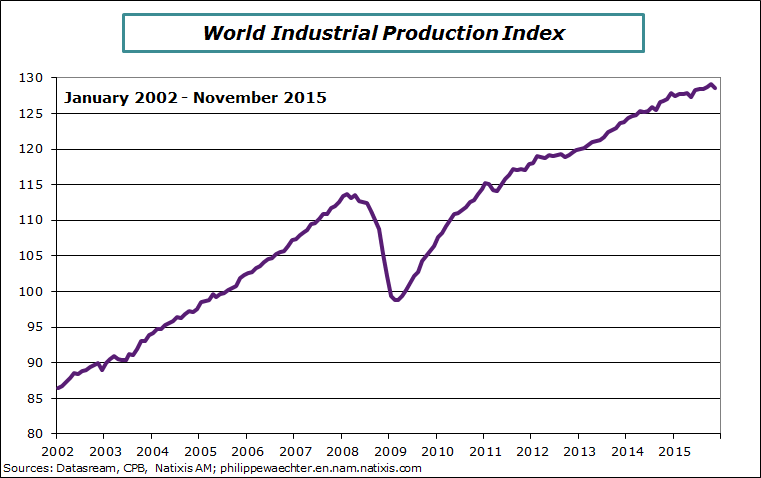

The world industrial production has not a strong profile. The carry-over for the last quarter of 2015 is just a mere 0.7% at annual rate. This is lower than the 2.2% seen in the third quarter. Negative contributions mainly come from the US (see here), Latin America and Africa and Middle East.

The poor trend seen in the world economy is consistent with the downward revisions of the IMF forecasts in January. World growth will be a tick lower than what was expected last October. Forecasts for the US are lower than in October (-0.2% at 2.6% in 2016 and 2017). The Euro Area is creeping up 0.1% in 2016 at 1.7%; it is also 1.7% for 2017.. Chinese growth has not been revised at 6.3% and 6% in 2016 and 2017 respectively.

The specificity of the current situation is that the economy is not able to converge to a strong growth profile. The persistence of the current low trend and the too mild reaction to economic policy measures are part of the puzzle we have to solve.

Point #2 – The ECB is lost

In December 2015, the ECB has changed its policy stance because its inflation expectations were too low, postponing the convergence to the ECB target at 2%. In late January, Mario Draghi said that their December forecasts didn’t integrate the deep drop in the oil price (below USD 30). As a consequence the inflation rate will revised downward in March projections (lower than 0.5% from 1% in December). The ECB president then said that new measures will probably be discussed at March ECB meeting. This was sufficient to provoke a rebound of market and of oil price.

The ECB just told us that it hasn’t the good analysis and it’s a boost for markets???????

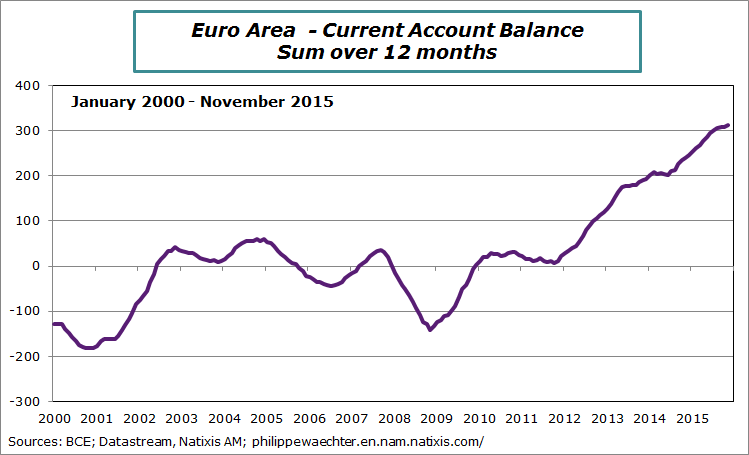

Point #3 – A current account surplus at EUR 312bn in November

This means that there is an excess saving in the Euro Area. A balanced current account would be consistent with higher imports or lower exports. On way to do that is to have a proactive fiscal policy in order to boost demand.

Companies tell us that their demand is not strong enough so an impulse is necessary in order to change this profile. Fiscal policy beside an accommodative monetary policy is able to do that. That would be a way for the Euro Area to have a more autonomous growth model. That’s also what Draghi said at its last press conference.

There is an old law in economic policy theory: the number of instruments must be equal to the number of targets. Growth and inflation are lower than what is expected meaning that both fiscal and monetary policies must be accommodative.

Point #4 – The Euro Area growth momentum is still robust

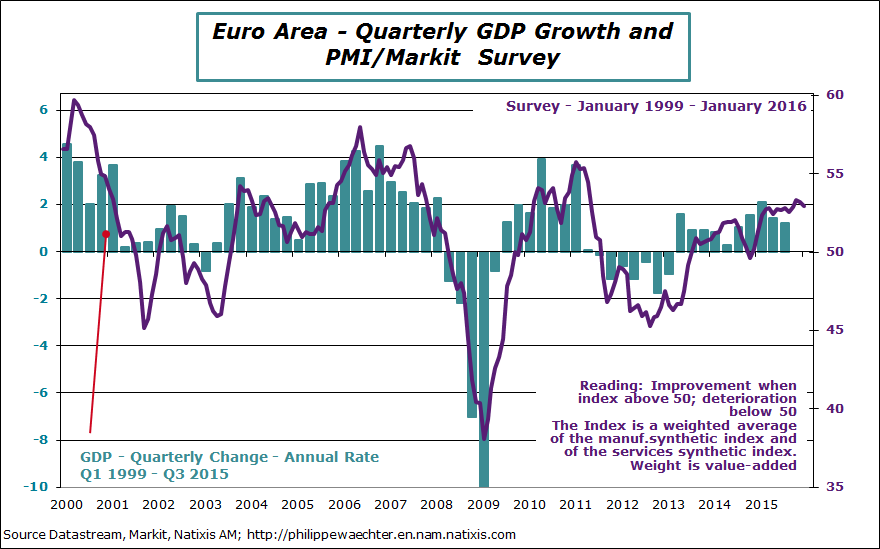

The Markit survey for January is marginally lower than the fourth quarter but is still consistent with a robust growth in 2016.

The synthetic index for the whole economy was at 52.9 versus 53.1 for the mast three months of 2015. The two sectoral components are lower: 52.3 versus 52.8 in Q4 for the manufacturing sector and 53.1 versus 53.2 in Q4 for the service sector.

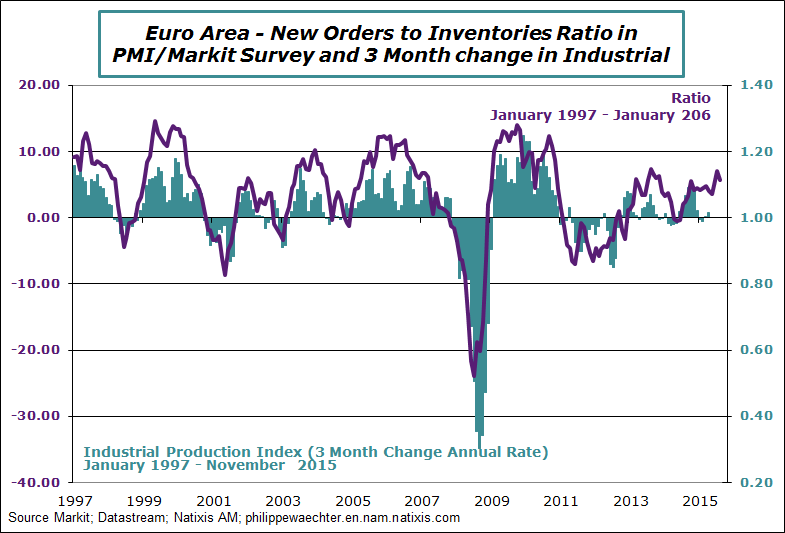

The employment index is stable at 52.8 and the new orders to inventories ratio is a bit lower at 1.1 versus 1.14 in December. It’s still consistent with a stronger growth momentum for the industrial production.

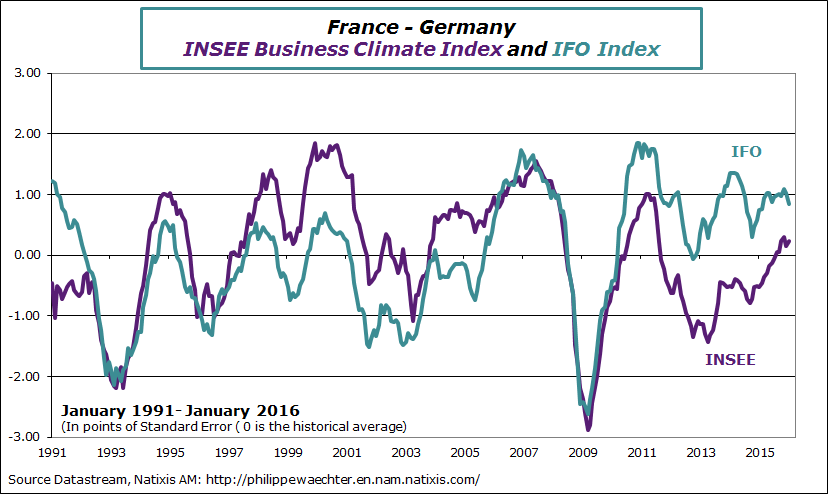

Point #5 – France and Germany

In France we were afraid of the possible negative consequences of Paris attack on November the 13th. In Germany the Chinese lower momentum was a point to look at carefully.

For France, there was a positive but limited rebound in January after a small drip in December. There is no break in the French economic momentum after the attack.

In Germany the IFO index was lower in January and this is associated with a lower index for the industrial sector. Both the current situation and the expectations are lower. This can probably be linked with the Chinese lower growth profile.

The risk of a lower dynamics is limited.

Point #6 – Miscellanies

1 – There was no surprise with the Chinese growth figure. At 6.8% from Q4 2014 to Q4 2015 and 6.9% for 2015 compared to 2014 these growth numbers are not something new as investment is still trending downward as is the industrial production index

China is on a transition path from an industrial led economy to a services led economy. This is always associated with a lower growth profile (remember the UK or France in the 70’s, they followed the same type of transition)

2 – The core inflation rate at 2.09% in December in the US reflects the strong contribution of shelter (ex energy) and a higher contribution for Education. The other sectors have stable or negative contributions. Wait for the PCE measure which the one followed by the Fed to have a clearer view (core inflation was at 1.3% in November)

3 – Earnings dropped rapidly in November in the UK. Despite a strong job momentum there are no pressures on wages. That’s weird and worrisome for the UK consumer even if the inflation rate is close to 0 (0.2% in December).

4 – With lower condominium in December, the housing starts figures is not strong even if we perceive that single houses follow now a robust trend

In the housing sector, the existing home sales figure was up rapidly in December (+14.7%) but it was after a deep drop in November (-10.5%) due to a change in mortgage rules. It’s not a change in trend. The last quarter was weaker than the 3 summer months.

5 – The South Korean growth was 2.3% at annual rate during the fourth quarter. For 2015 growth is 2.6% and the carry over for 2016 at the end of 2015 is 1.15%. The 2016 target is 3%

Point #7 – This week

The Fed’s meeting is schedule to print a press release on Wednesday but no change in monetary policy is expected.

GDP for the fourth quarter are expected in the UK (Wednesday), in France and in the US (both Friday).

On Friday, the inflation rate for January in the Euro Area will be available. It will also be available for France (flash estimate)

The inflation rate, employment, retail sales and production for December will be published in Japan on Thursday.

Durable goods orders will be available on Thursday.

Philippe Waechter's blog My french blog