In an article in the Financial Times, this morning (see here), Joseph Stiglitz suggests a two-speed euro area. There are two points in this article: One is the usual bashing of the euro as a very bad idea, the second is on the necessity of a two-speed Eurozone from the current situation. The main reason is associated with the absence of adjustments between countries that do not go at the same speed and with very different characteristics. Therefore the dynamics is far from optimal leading to a very inefficient situation according to Stiglitz.

A two-speed euro is not a good idea as I think that it would be the end of the Euro Area.

The creation of the Eurozone was historical in 1999. It was the accomplishment of the European institutional construction. The euro was launched in a period of strong growth and low inflation rate. This has eased the calculation of the fix exchange rate between national currencies and the new currency. Moreover, as growth prospects were strong at this moment the adjustment through changes in currencies value were not the main question.

Can we imagine that the split of the Euro could be easy to do, in a period characterized by low growth rate for long, almost deflation and interest rates close to zero ? For sure it will not and that’s why the proposal of a two-speed euro is flawed.

Suppose that it has been decided to split euro area in a “northern euro” and in a “southern euro” (this is the Stiglitz’s cutting).

The first question is countries’ distribution in each group. OK we can have an idea even if France is not easy to put in one or the other group.

The second step is to find an exchange rate between the two currencies; probably the “northern euro” will be stronger than the “southern euro”.

But by doing this, we can imagine that, taking account of the current conditions, countries will want to have an advantageous exchange rate in the new currency. We can imagine that Italy, Greece or Portugal could have advantage to fix a new exchange rate at a very low level in order to boost their outlook. Their economy is not going well and this could be a rapid improvement of their competitiveness.

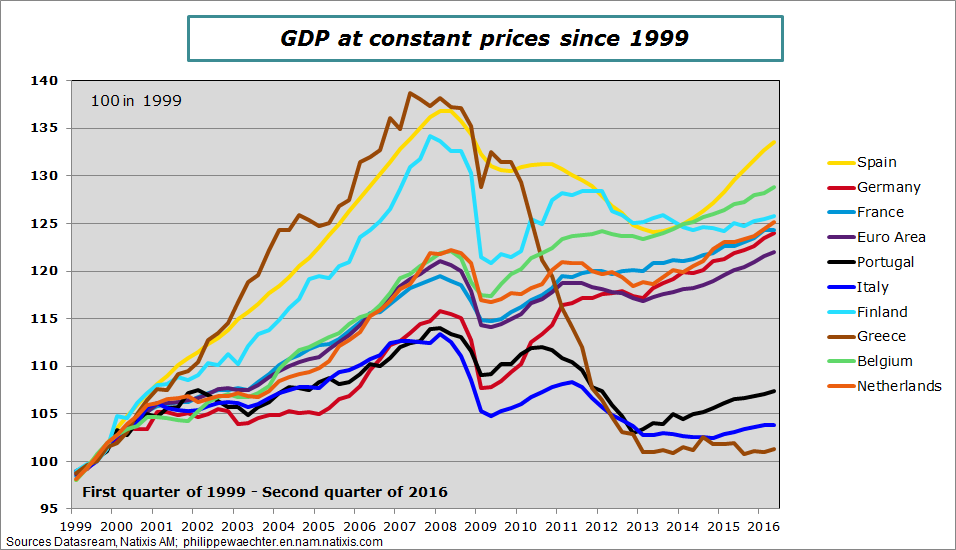

We can also imagine that a strong currency is also a way to limit inflation. Italy could use this quality of the euro to avoid a devaluation. But will Spain or France have the same expectations? The economic situation of these countries are very different as it is shown on the graph below. Therefore the optimal level of the exchange rate would be very different between “southern euro” countries. The convergence is far from guaranteed. Therefore there is a risk of a “northern euro” but without any “southern euro”.

But even for the northern euro it will not be easy. Will all the expected countries have the same level of expectations? And will they converge to a specific exchange rate? Not sure. It seems natural to see an appreciation of the German currency. Will all the northern countries be able to follow Germany?

During the episode of the European Monetary System (before the euro March 1979 – December 1998), the only currency that was able to follow the strong Mark was the Dutch guilder, the currency from the Netherlands. All others currencies devalued during the EMS. Will this group of two currencies be able to be the “northern euro”?

In other words, from the current framework, it would be hard to find a new equilibrium that could satisfy all the countries embedded in the current euro program. Each country will try to make an advantageous new choice and the probability of all theses choices to be consistent and compatible is low. The new equilibrium would probably be with 19 currencies and not 2.

We have to keep in mind what has happened after the end of Bretton-Woods in the early 70’s (the International Monetary System went from a fixed exchange rate framework to a free float system). European countries have tried to create an adjustment process between European currencies (the European snake). It has not worked as adjustments that were needed for every country were not consistent with a kind of fixed but adjustable exchange rate. At the end, Germany was the last country of the snake.

If we had to reshuffle the monetary construction of the Euro Area it would be different. But we have first to think at the transition and the chance of a convergence appears low as economic and political interests are not necessarily consistent between countries.

In 1999 the moment was historical and was the accomplishment of a long scenario that started in the 60’s. During this period everyone, from politicians to European citizens, was convinced of the importance of the European construction. This is no longer the case. The recent referendum on Brexit clearly shows that something has deeply changed. It would currently be very hard to find again a consensus on monetary issues. Everyone agrees with the common currency as a citizen but reshuffling the whole construction would probably lead to instability. No consensus, with the convergence to specific exchanges rates, would mean a high probability of a burst of the Euro Area and the convergence to 19 national currencies. In that case, the single market would be harder to manage. The current European framework would be more fragile.

The Euro Area is before all a political construction and solutions have to be found within this space. That’s the reason of the complicated and slow adjustment.

In this period of low growth and poor employment dynamics, solutions are needed instead there is a political risk. Every country could have the temptation to find its own way. I’m sure that this would lead to a non cooperative and non coordinated dynamics in the Euro Area and it would be non-optimal for every country.

Philippe Waechter's blog My french blog