Five points to keep in mind

Minutes of the Federal Reserve

The good thing with the minutes of the last meeting of the Monetary Policy Committee of the Federal Reserve is that you can find what you want to find.

The main sentence to perceive this is the following “Members generally agreed that, before taking another step in removing monetary accommodation, it was prudent to accumulate more data in order to gauge the underlying momentum in the labor market and economic activity. A couple of members preferred also to wait for more evidence that inflation would rise to 2 percent on a sustained basis.Some other members anticipated that economic conditions would soon warrant taking another step in removing policy accommodation.(page 12)”

The first part tells that the FOMC is cautious but the end of the sentence tells that improvement in macrodata could lead to a new strategy.

The Fed is also very attentive to the international context forcing the US central bank to remain cautious “In addition, it was noted that the dollar is a principal reserve currency and that monetary transmission in the United States occurs through funding markets that are quite globally connected.(page 3)“

What was interesting was the comment, on Wednesday, by William Dudley the president of the New York Fed. His message for investors was to stay attentive to a possible hike in September (20-21). The Fed’s strategy is to maintain uncertainty on its action. Dudley has taken advantage of the strong report on employment for July to keep this uncertainty alive.

Macro data do not give a framework for a rapid increase in the Fed’s interest rate: retail sales for July were flat but the employment report and industrial production report were robust in a context of slower inflation. I continue to think that on hike is the maximum this year and probably in December if it takes place.

Rebound in the US activity

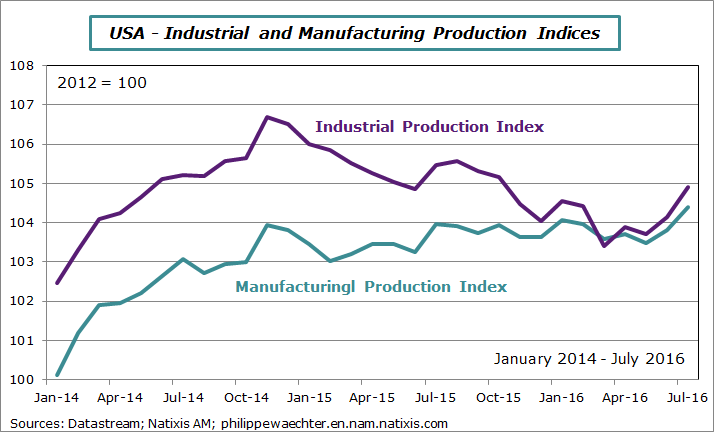

The industrial production index was up in July but it is still -1.7% below the November 2015 peak. The manufacturing production index was also on the up side but its pace is slow, almost flat since the beginning of 2015. The graph is explicit. The difference between the two indices is the oil sector. The decline in oil production explains the slump in the industrial production index. Nevertheless we don’t see a strong momentum in both indices.

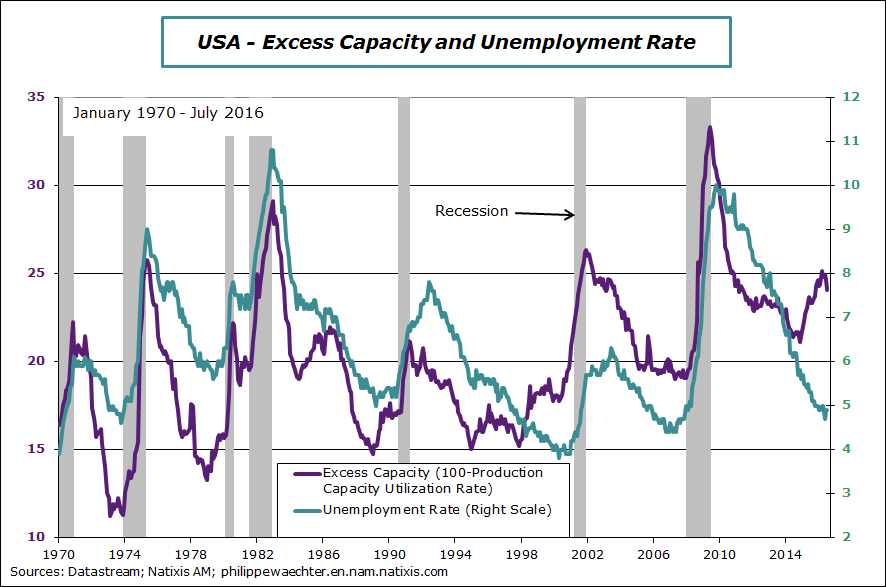

For a long time I have been very attentive to the Production Capacity Utilization Rate. I noticed that there was a negative momentum since January 2015 (see here) showing a real risk of slowdown (and there was a slowdown in the US economy see here). Since June there is a reversal in the index showing the possibility of an improvement with a stronger business cycle in the short run.

Japan: A weak momentum

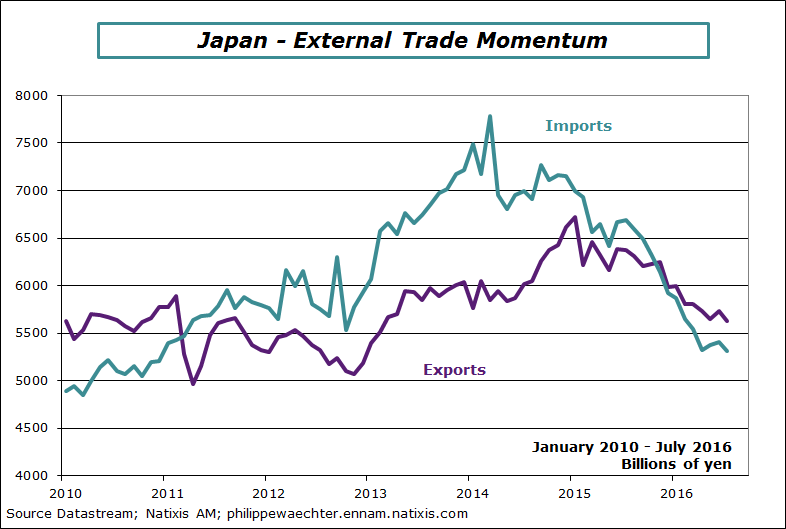

The Japanese external balance sends a negative message on the current economic outlook.

Its exports and imports are trending downward even after the stabilization of the oil price (for the imports). It shows that the domestic market momentum is low. That’s a justification of Abe’s plan to reshuffle the economy.

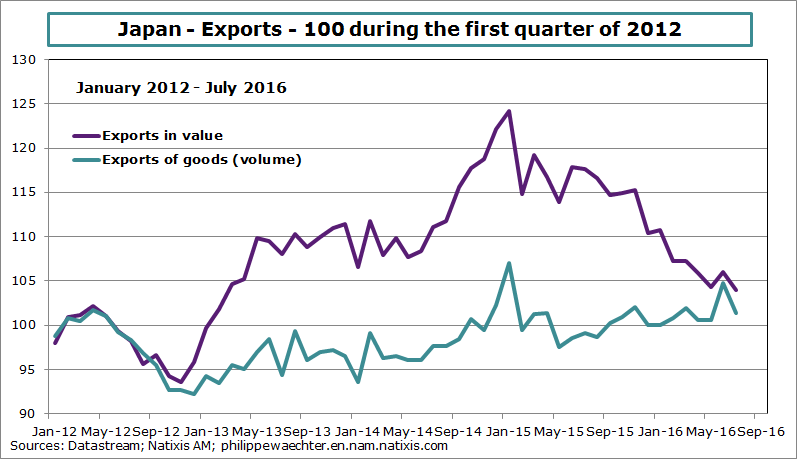

But exports are down since the peak of February 2015. the important point is that in real terms, exports of goods are flat since the beginning of 2015. This reflects the world trade low dynamics and specifically the strong decrease of exports to China.

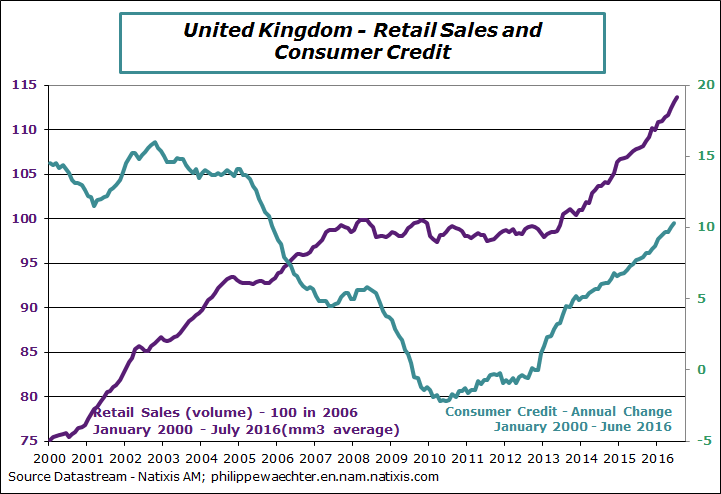

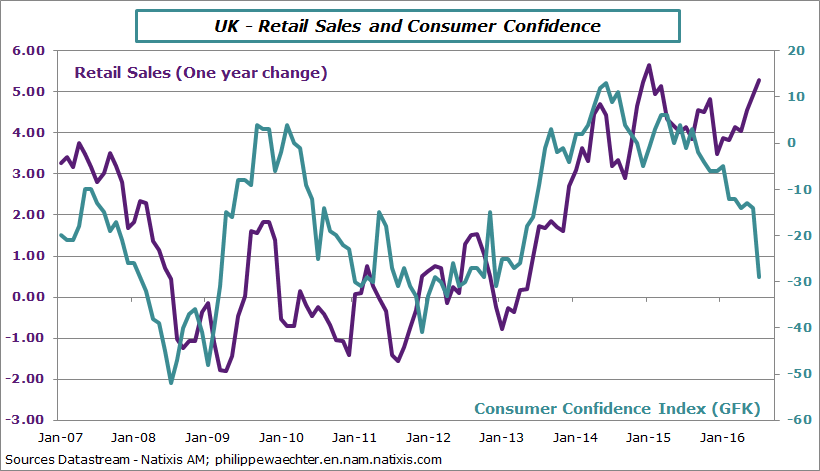

Strong improvement in UK’s retail sales in July

Retail sales were up by 1.4% after -0.9% in June. For the last three months it’s up by +7.5% at annual rate.

There is no change in trend after the Brexit referendum.

One reason is the growth of jobs and the strong pace seen in consumer credit. All sectors have had positive contributions.

For the moment, the Brexit has had no impact on consumers’ behavior. Nevertheless there is a strong divergence in July between their perception of the environment (12 month ahead index) and their expenditures. Who will win?

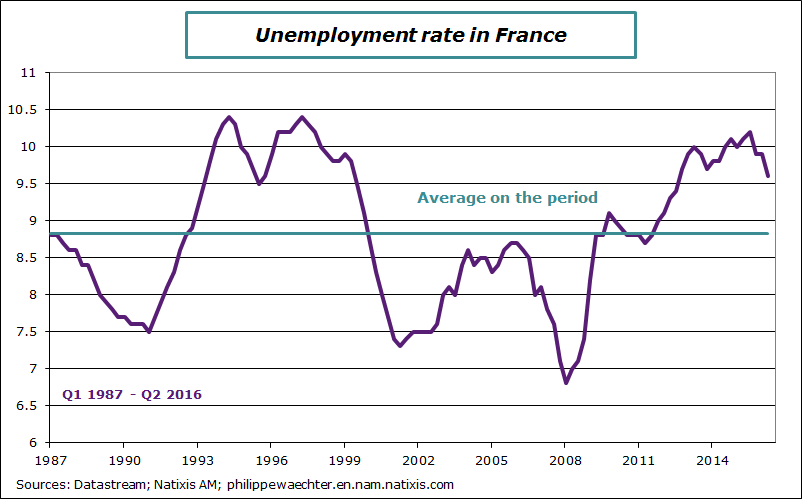

Improvement of the French Unemployment rate

At the end of the day, François Hollande, the French president, may win his bet. The unemployment rate is showing a rapid improvement since its peak a year ago (Q2 2015). François Hollande said that he will be candidate for a second mandate in case of a real reversal in the unemployment rate. This is the case even if the unemployment level is still very high. It is, in the second quarter, 0.8 point above its 30 year average.

This reflects the slow recovery seen in France since 2015. French employment for the private sector (ex Agriculture) is up for the last 5 quarters (+181 000 during these 5 quarters).

There is still a lot to do. But the real issue is the slow growth trend. It is not sufficient to create a strong momentum on the labor market. Fiscal policy would have a stronger impact in the short term before may be some structural reforms.

Philippe Waechter's blog My french blog