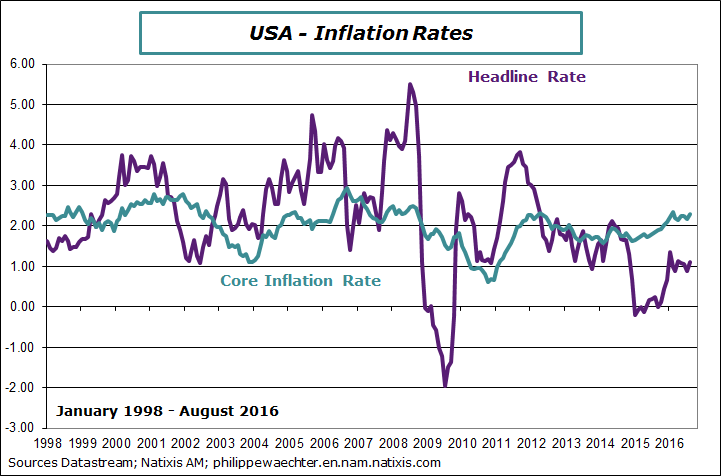

The inflation rate was 1.1% in August, close to the average seen since the beginning of the year (1.1%). The core inflation rate was at 2.3% the highest number since last February.

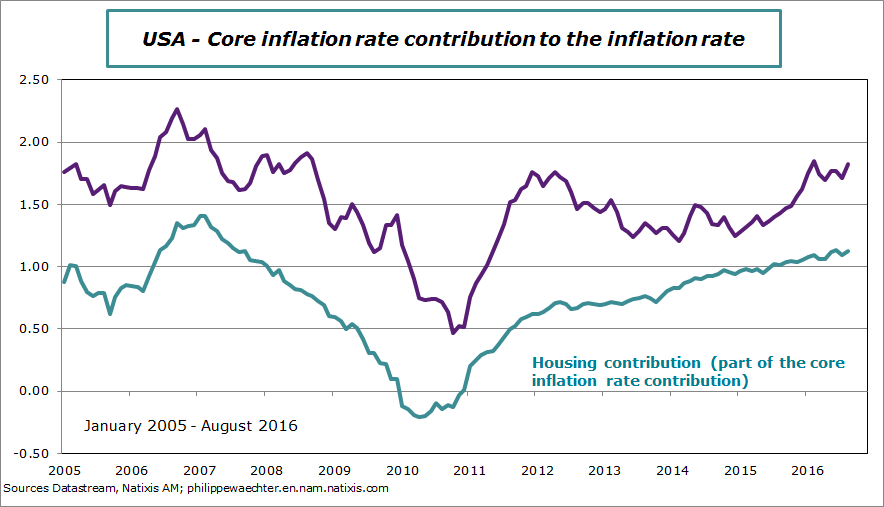

The surge in the core inflation rate can be decomposed between Housing and the rest of the index.

The following graph shows the Housing contribution to the inflation rate and the core rate contribution to the inflation rate. The Housing contribution explains more than 60% of the core contribution to the inflation rate. This the weight of the housing sector that makes a difference with the PCE index followed by the US central bank. It corresponds to a very different methodology. This means that all the other components of the core price index explain only 40%.

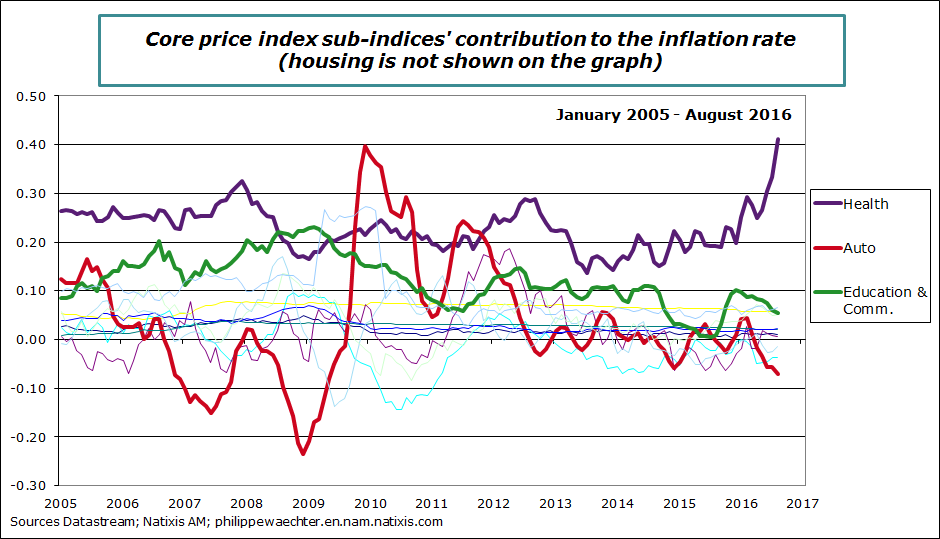

In the 40% it is interesting to see each sub index contribution. We see a strong contribution from the Health price index. All the other contributions are low and some are declining.

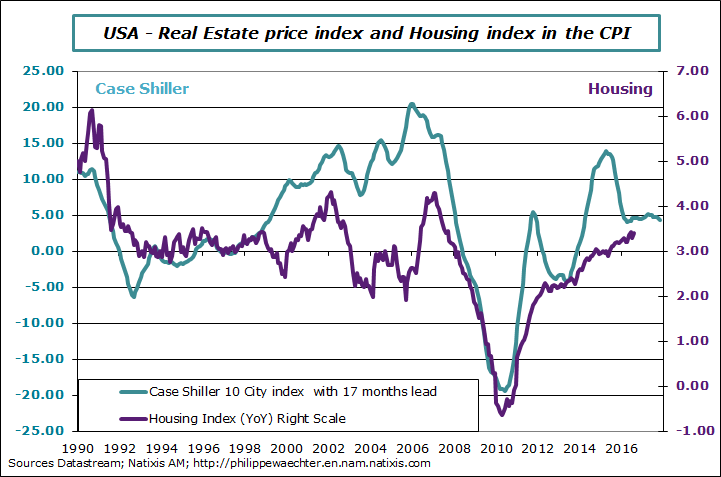

OK the core inflation rate is up to 2.3% but only through strong contributions from the Housing sector and from the Health sector. The first reflects the higher real estate price and a catch up effect. The real estate adjustment seen on the graph below is beyond the CPI issue. The Health index price is up but this is not a market price.

As all the other sub indices in the core price index are not accelerating we can say that the core inflation rate has a bias on the upside linked to Housing and Health but this doesn’t reflect tensions inside the US economy. That’s why the Fed must be careful in the way it takes this index (which is not its favourite) into account.

Philippe Waechter's blog My french blog