The Fed main interest rate was increased by 25bp at the June meeting of the FOMC. It will now be in the corridor [1; 1.25%]. This is the fourth hike since December 2015 (start of the tightening cycle).

The impact of this monetary policy change has been very limited. The Fed’s communication strategy is to clearly say in advance what it will do. The Fed doesn’t want to create surprises to investors. Therefore investors can adapt their expectations and their portfolios to the new monetary policy stance. The impact of the measure when it is announced is null.

This is interesting notably on emerging markets. In the past, the Fed’s tightening cycle had a strong impact on them as capital flows were back to the US at the expense of emerging countries. Investors were surprised by the Fed’s move. That’s what economists call a sudden stop. Here, no one is surprised so there are no reversal in flows and emerging markets remain strong.

The Fed considers that the economy is now close to full employment (employment rate is 4.3%) and the inflation is close to its 2% target. Therefore it can be rational to increase rates. But as mentioned earlier, the Fed doesn’t want to create too much volatility and to create a persistent shock on the economy. That’s why its measures are announced loudly in advance.

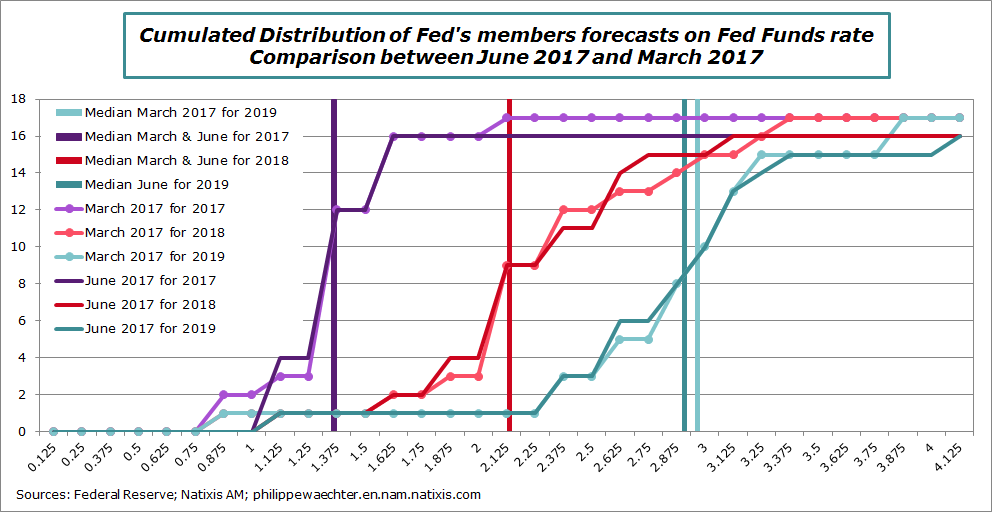

Following FOMC members’ expectations, there is still one hike this year (25bp) and three next year.

The graph below shows the cumulated distribution of FOMC members’ forecasts for 2017, 2018 and 2019. I compare March and June forecasts. There are little changes between the two meetings. The median is the same in March and June for 2017 and 2018, it is a little lower for 2019 in June. (this graph is easier to read than the dots graph)

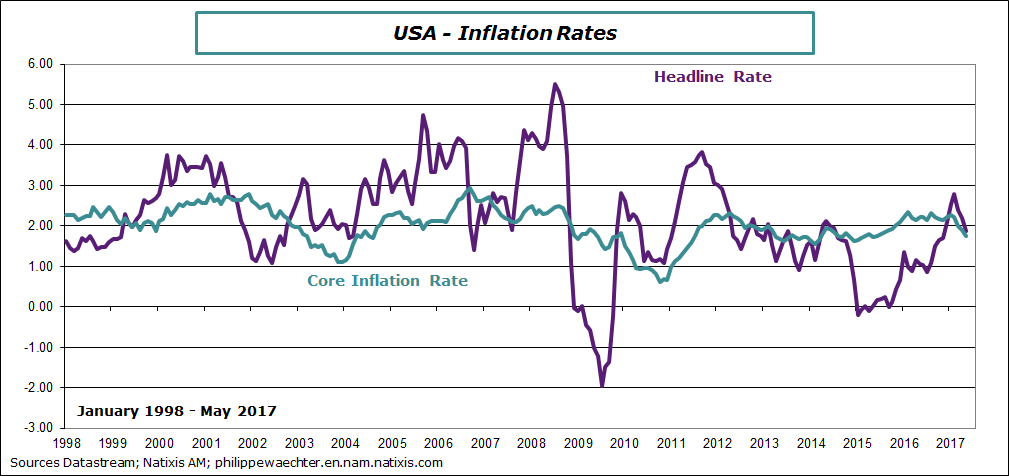

The main source of concern for the Fed is inflation. The CPI inflation rate was down to 1.9% in May and the core inflation rate was at 1.7% (see the graph at the bottom of this post). Due to low oil prices, headline inflation rate will remain low in coming months. On the core inflation side, the sub-sector “Housing” which explains 2/3 of the core inflation contribution to headline inflation is receding. And in the very short term, auto prices, health price and communication price dropped. In other words we cannot expect a strong rebound in the core inflation rate in coming months.

What should the Fed do in the case of lower inflation in September? Probably nothing waiting for December to act.

The other important point of this Fed’s meeting was the announcement of details on the way the Fed will manage the reduction of its balance sheet.

Currently, all the revenues of its portfolio are reinvested in equivalent assets. The balance sheet’s level was stable since 2014. The new strategy is to reduce this level.

The Fed has given details on the way it will operate.

When the operation will start, it will reduce, each month, its reinvestment by USD 6bn on Treasuries. The eventual marginal part above this cap will be reinvested. This cap will be increased by USD 6bn every three months until the level of USD 30bn.

For assets from Agencies and for RMBS, the cap will be USD 4bn, he step will be 4 and the final cap will be USD 20bn.

In other words, one year after the beginning of the operation, the monthly reduction of reinvestment will be USD 50bn. This operation will continue until a level that is not currently known. The Fed just said that the balance sheet’s level will be at tend end of the operation higher than before the 2007/2008 crisis. But there is no precise indication on it.

This operation could start as soon as September with an application in November. The rate increase would be in December if the inflation rate is too low in September.

The Fed said that it will start the management of its balance sheet when the fed fund rate will be high enough. During the press conference, a journalist asked Yellen what was this level. She said it was not a public information.

Graph of inflation

Philippe Waechter's blog My french blog