Negotiations on Brexit may lead to a negative and persistent shock in the United Kingdom as it will deeply change rules for the external trade. Therefore there is a need to carefully look at the domestic demand momentum in order to eventually counterbalance this negative and persistent shock.

At the same time, the Bank of England has mentioned (Carney in Sintra or Saunders here) that the monetary policy could be normalized. In other words, the BoE is wondering if there is still a need for stimulus. Here too it is interesting to carefully look at the domestic demand to see if the need for stimulus is superfluous or not.

The domestic demand is usually conditioned by households’ expenditures. In the UK, they represent more than 60% of the domestic demand in real term. In other words, the domestic demand and the economic activity depend a lot on households’ behavior.

Last Friday, the Office of National Statistics (ONS) unveiled the second estimates of the National Accounts for the first quarter of 2017/ There was a lot of details on households’ behavior and constraints.

Two are really interesting and problematic.

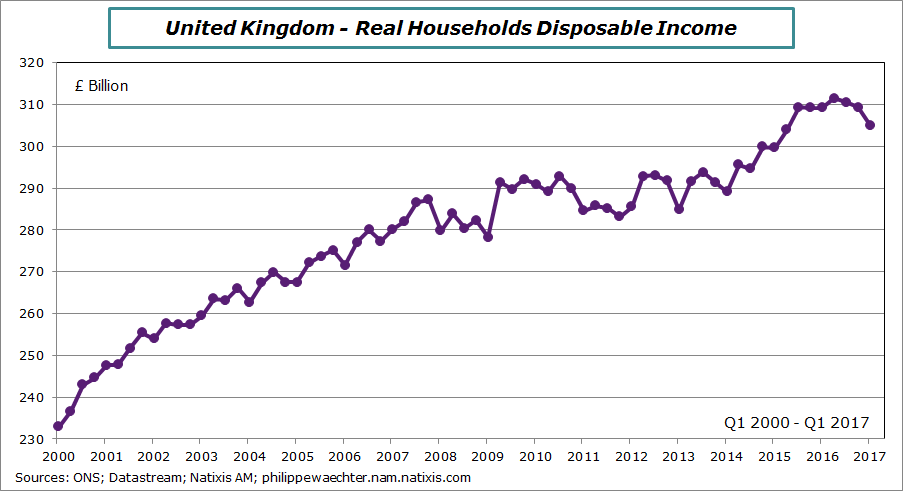

The first is the real disposable income profile. The graph below shows its evolution in level since 2000. The remarkable point is the fact that it has decreased during the last three quarters. Such a profile has not been seen since 1976-1977.

The rapid improvement since 2014 has now stopped and the real disposable income is now falling. Without improvement in real disposable income we can’t expect strong expenditures.

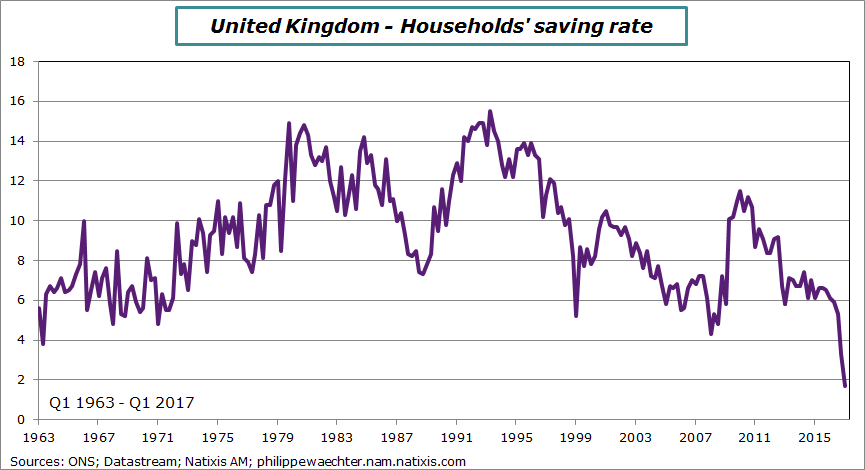

The second is the saving rate which dropped to 1.7% of disposable income, it lowest ever (since the beginning of the statistics in 1963). With such a low saving rate households have no margin to spend more.

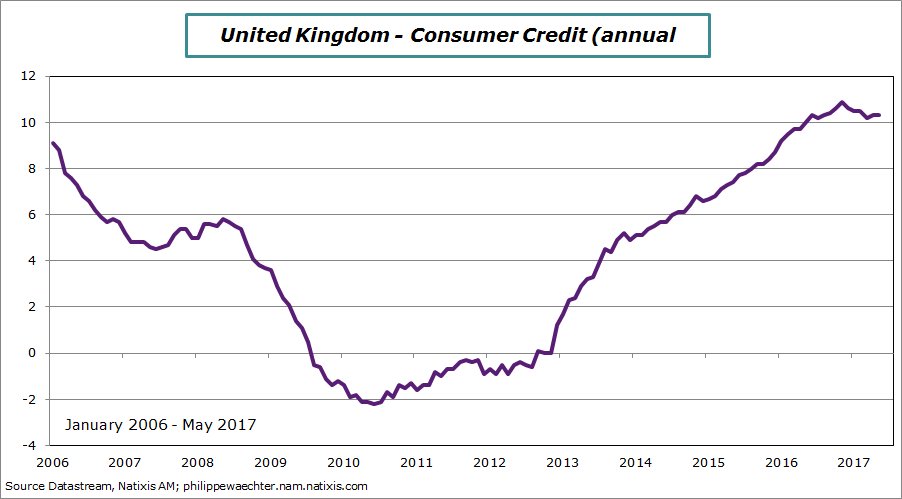

At the same time, the consumer credit momentum is still very strong. It is growing at a pace which is above 10% a year. It has fed expenditures and there is a robust parallel between the retail sales dynamics and the consumer credit profile. In its last “Financial Stability Report” the Bank of England is worried by this trajectory.

On consumers side we see that to compensate a large drop in their real disposable income, households have reduced their saving rate dramatically while the increase in the consumer credit is still very high. In other words, consumption expenditures have been funded by lower saving and still high credit not by their real disposable income.

These figures do not show a possibility of improvement on consumer side. In other words, the probability of a rapid recovery on consumption expenditures is low. Therefore, if external trade is disturbed by negotiations on Brexit and if the Bank of England increases its main rate then both will be perceived as a supply shock that will not be compensated by a strong domestic demand as the households’ situation is rapidly deteriorating.

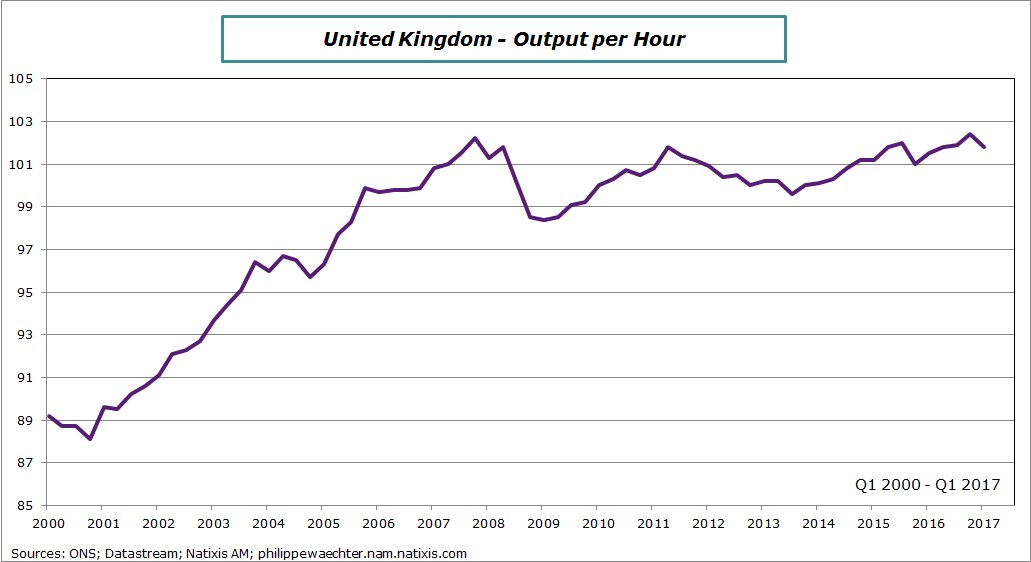

Moreover, productivity (output per hour) is still not increasing. Figures from the first quarter of this year show that there is no improvement in the short term and since 2007.

In other words, the rapid improvement seen in the recent recovery only came from the increase of hours worked. Flexible rules on the labor market has led to the possibility to hire a lot of people and this is the production of these people that has increased the GDP. It is not productivity. It is not a strong and robust process. It is the weakness of the UK economy.

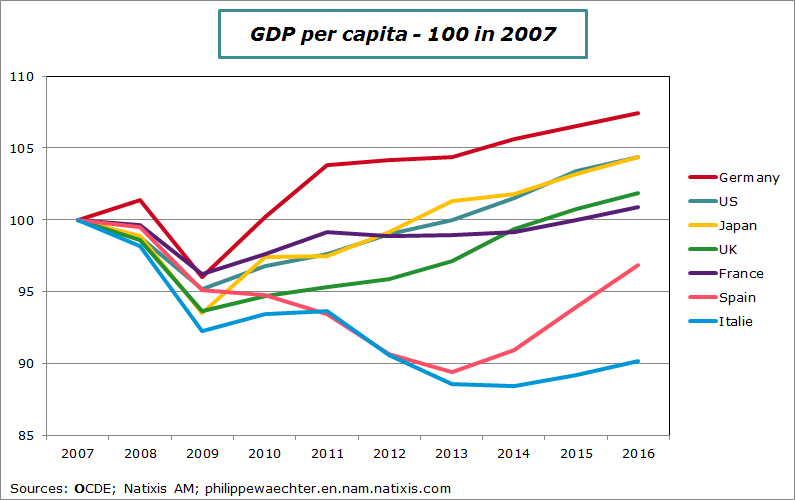

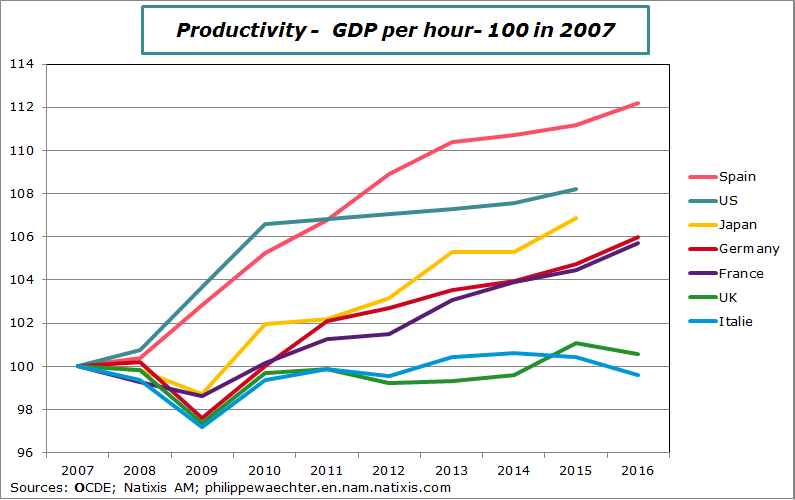

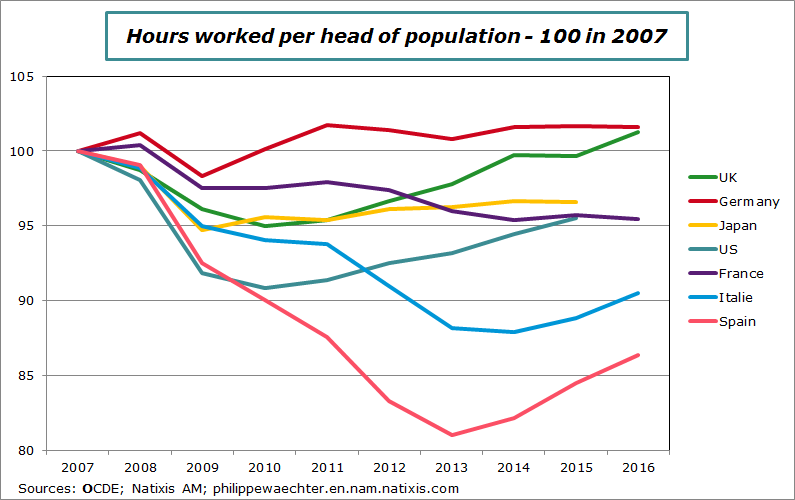

An international comparison is interesting to understand the specificity of the UK.

The three graph below show 1 – a comparison of GDP per capita from 2007 to 2016; 2 – a comparison of output per hour on the same period and 3 – hours worked per head of population. (In a formal way GDP per capita is the product of GDP per hour, hours per worker and employment rate. Mixing the last two is the hours worked per head of population)

GDP per capita

The UK is back to its pre-crisis level in 2015

GDP per hour

Consistent with the graph shown above on productivity, the British situation is not strong and the trajectory of its productivity is way below other countries except Italy

Hours worked per head of population

The UK improvement in GDP per capita is just associated with the number of hours worked. It has grown rapidly as was the number of employees in the UK.

The British economic process is not improving on its fundamentals as productivity growth is very low.

In the short term, parameters that conduct the households’ consumption are weak and this will not be a strong support for growth in coming months. There will be trouble rapidly in the future on external trade due to negotiations on Brexit. The British economy is not following a strong trajectory.

So why would the BoE increase its interest rate? The normalization can only take place when the economy is following a balanced trajectory. This is clearly not the case.

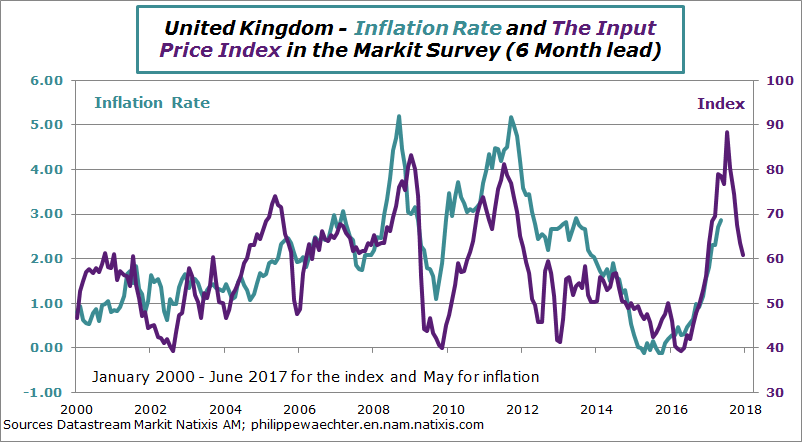

The spike in the inflation rate will be temporary as it can be seen below. I said recently (see here) that the monetary policy arbitrage was on a the possibility of a negative shock on the economic activity if the normalization was too early or the possibility of a temporary higher inflation. The economic situation in the UK is too weak to support a interest rate positive shock. It is probably better to have a little more inflation than increasing the risk of recession that would be associated with a interest rate hike.

Philippe Waechter's blog My french blog