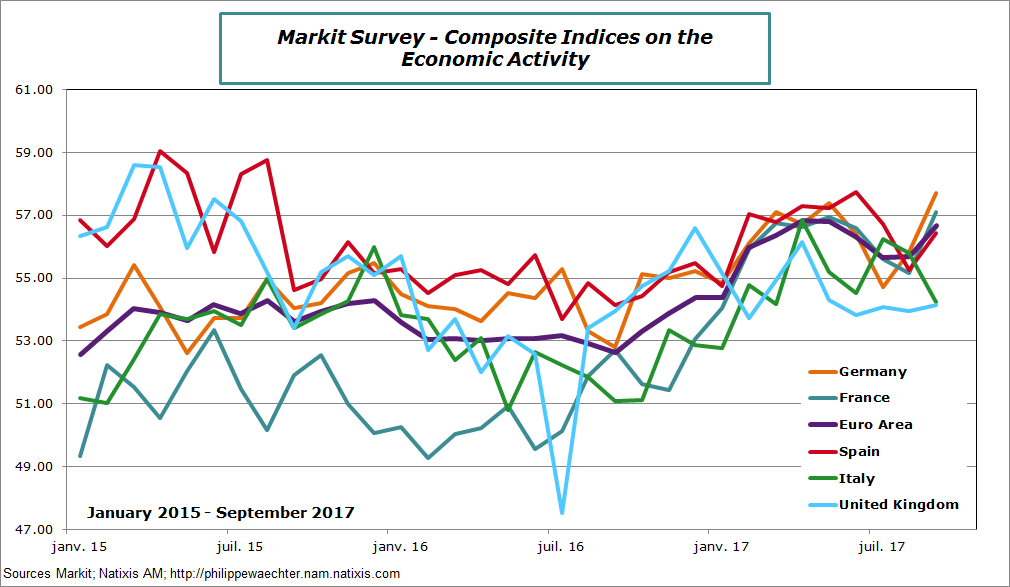

The economic prospects in the Euro Area are clearly on the upside in September. The synthetic index which is a weighted average of the manufacturing and services indices is at its highest since April 2011. This suggests a rapid growth figure for the second part of 2017.

The manufacturing index is at its highest since February 2011 and the index for services is close to top levels seen at he beginning of the year.

Growth and employment are on the upside. It’s time for the Euro Area to create conditions for a long term sustained growth strategy with structural reforms locally and for the European institutions

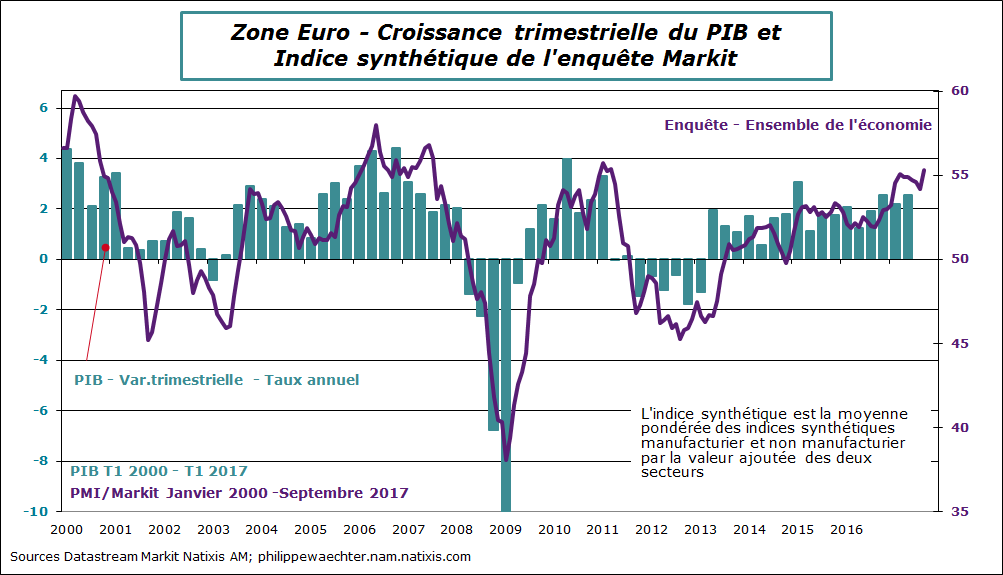

The graph compares the composite indices for the 4 major countries of the Euro Area plus the United Kingdom

The French economic momentum is now close and in phase with what is seen in Germany pushing the Euro Area dynamics on the upside. Spain remains a major contributor. It’s hard for Italy to follow the other 3 notably in the service sector.

The question of Spain is important: it has been a major contributor to the EA growth since 2014 but internal troubles after the referendum in Catalonia could create a less homogeneous trend in Spain and could damage the EA prospects. For the moment the uncertainty remains high.

The United Kingdom does not take advantage of the contagion that may come from the Euro Area. We see that since mid-2017 there is a divergence between the Euro Area and the UK. That’s Brexit uncertainty.