Written with Zouhoure Bousbih

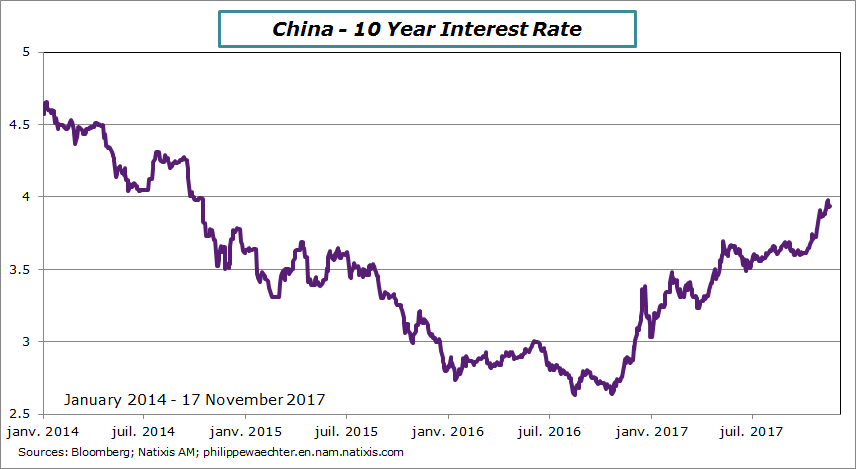

This week, the Chinese bond market has again been under selling pressure. The yield on 10-year Chinese government bonds once again flirted with the 4%, the highest in 3 years.

The Pboc (the Chinese Central Bank) intervened twice this week by injecting liquidity into the market, for a total amount of 810 billion yuan or USD 122bn , the largest injection since mid-January.

Should we worry?

No. The movement began just after the end of the C.C.P congress (end of October) when the Chinese authorities signaled clearly that they would continue their fight against high leveraged finance, ie shadow banking.

This has resulted in massive sales from Chinese government bondholders notably from mutual funds that are the second largest holders of Chinese state bonds. They feared a tightening of financial conditions.

China’s interest rates have been low so far because of the loose Pboc’s monetary policy. The orientation has not changed but the action of the Chinese monetary policy is now more focused.

The Pboc intervened in the market by injecting liquidity in order to reduce volatility and it will continue to intervene if necessary to correct the excesses of the financial markets.

The Chinese central bank must find an equilibrium between its deleveraging campaign and the stabilization of Chinese financial markets so as not to penalize economic activity.

Does this question the attractiveness of the Chinese bond market for international investors? and the willingness of the Chinese authorities to open their bond market?

At 4%, Chinese government bonds remain attractive compared to their counterparts in developed countries, helped by a stabilized yuan. China’s deleveraging campaign is rather a positive signal sent to international investors. China will not come back on the opening of its bond market to international investors because of the internationalization of the yuan. China’s economic activity remains sound. This is only a moment of turbulence to pass …

Philippe Waechter's blog My french blog