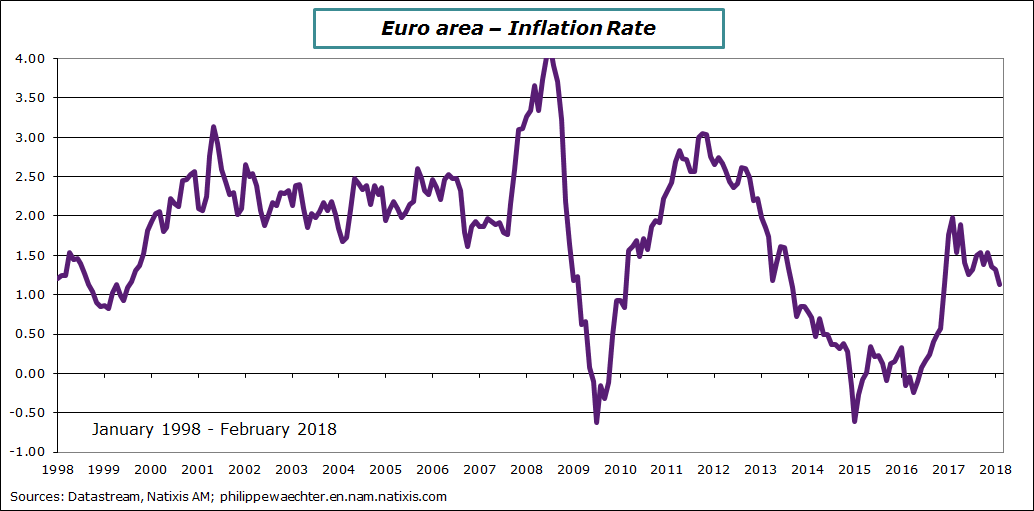

Inflation figures at 1.1% in February do not trigger expectations of a fast and sharp change in the ECB’s monetary policy, and Mario Draghi and Peter Praet did not indicate that they were in any hurry to implement swift or sudden change in their comments at the end of last week.

The ECB’s monetary strategy is dependent on reaching inflation in line with its medium-term objectives: the 1.1% figure does not point in this direction.

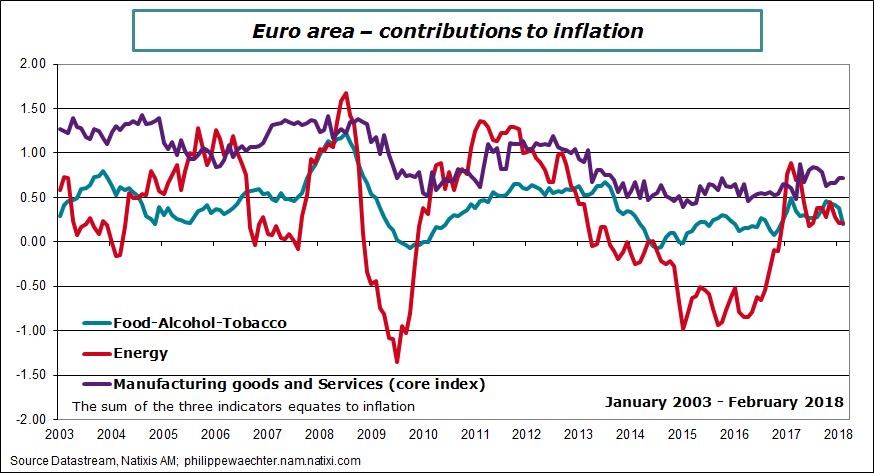

The chart below shows the contribution from each of the three main sectors to the rise in inflation, and we can see that none of them display a marked uptrend.

In view of oil price trends and expectations, we do not envisage a strong and long-lasting jump in prices. Meanwhile, the lack of wage pressure suggests that the full employment jobless rate is probably lower than widely thought.

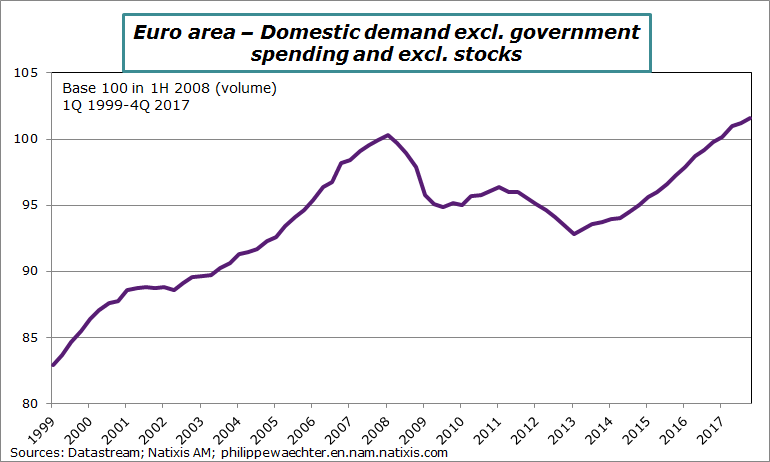

The euro area can still create jobs before running into physical restrictions, and this would help further drive private domestic demand and make growth more self-sustaining. If we look at past trends, private demand only returned to pre-crisis levels at the start of 2017, so it took almost 10 years for household spending and corporate and household investment to return to the high seen in the previous cycle. This is a very long time and implies very high costs for all concerned.

This is why monetary policy must continue to accommodate. It is crucial to bolster domestic momentum and create jobs in order to finally trigger strong nominal pressure in the euro area.

The same approach as the Fed’s recent strategy should be adopted here: there is no reason to become overly restrictive for such times as nominal pressure remains low, as growth could be hampered at a time when inflation has not yet taken off.

This point fits with comments from ECB heads, who seem to be in no rush to change the ECB’s monetary policy. In other words, I do not expect a rate hike from the ECB while Mario Draghi remains at the helm.

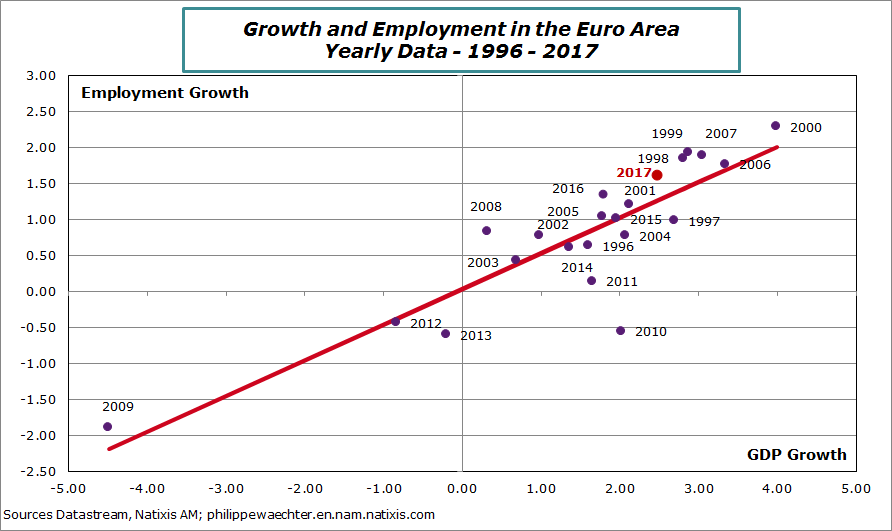

Meanwhile, Eurostat reported 4Q employment statistics for the euro area. Growth was slower over the last three months of 2017 at 1.1% annualized vs. 3Q, as compared with 1.55% the previous quarter. This is the slowest rise since 1Q 2015, but this is not a concern as long as domestic momentum remains robust as I explained in the previous paragraph.

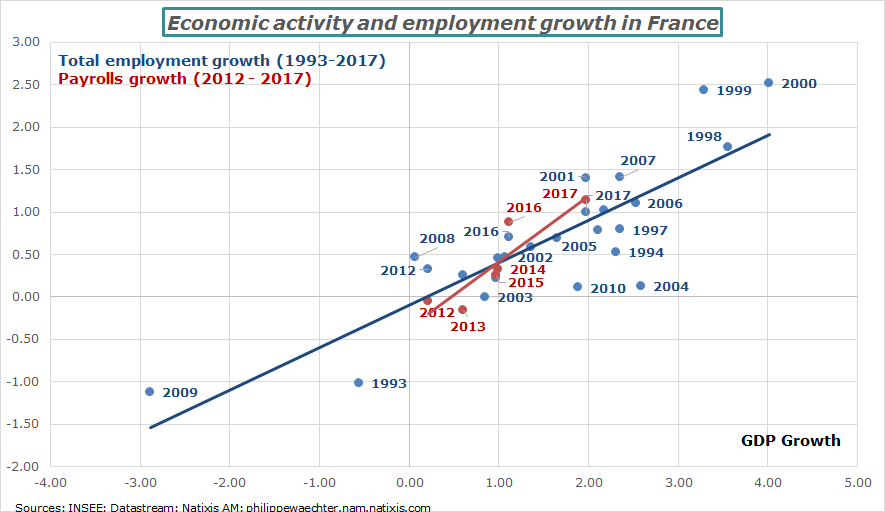

Employment rose 1.6% over the full year, which is a bit higher than suggested by the relationship between GDP trends and employment trends, as shown in red on the chart. Growth forecasts for 2018 suggest that there is no cause for immediate concern. Employment growth stands at half of GDP growth on average, but we can see that the euro area is able to create jobs very quickly when economic activity takes off, which is a good sign. In view of economic growth forecasts for 2018, jobs should increase by 1.3%, all else being equal.

This week’s Fed meeting will be a focal point. In view of the various analyses I have published recently (see here, here and here), I expect the Fed to hike interest rates, with the Fed Funds corridor moving from [1.25 – 1.50] to [1.50 – 1.75%].

This move is not the result of a need to take swift action to counter inflation, but rather it is the first necessary signal from the Fed to address overly expansionary fiscal policy with the economy already running on full employment. Adjustment will come from the Fed to avoid creating massive imbalances, consequence of the White House’s adventurous strategy. In this respect, the external deficit has already worsened since the summer.

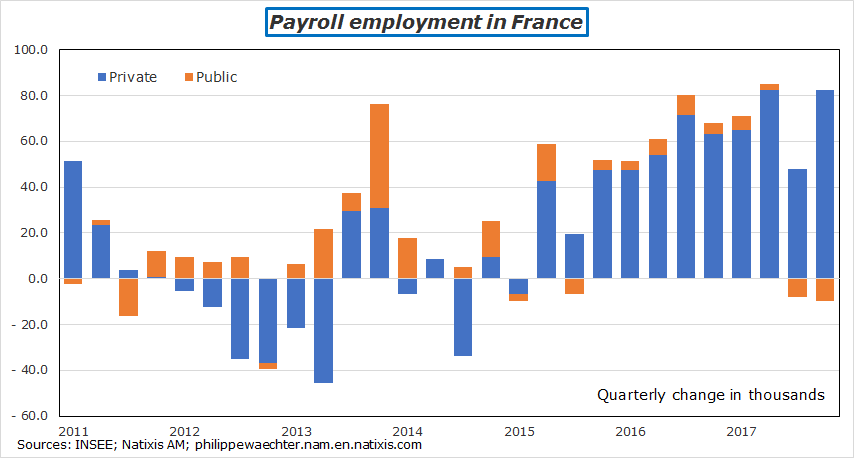

Looking to France, payroll employment staged robust growth in the last quarter of 2017, and the statistics office INSEE has considerably upgraded its initial estimate. The private sector created 82,300 jobs in 4Q 2017 while the public sector shed 9,600.

Payroll employment rose 269,000 yoy in 4Q 2017 vs. 260,000 in 2016, reflecting 280,000 private sector jobs and a 9,000 contraction for the public sector due to the impact of the elimination of supported employment.

A few points are worth making.

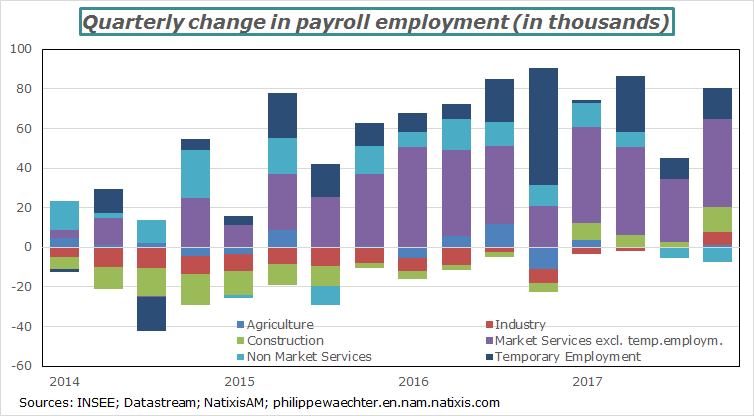

The first is that a sector breakdown reveals strong trends for construction and industry, where adjustments have been very strong and severe in the past. The improvement in the economic cycle has prompted a recovery in construction since the start of the year, while industry stabilized and then rose in the last quarter. The decline in jobs in non-market services is a reflection of the reduction in supported employment.

Jobs in services and temporary employment remain on a strong trend that is poised to continue.

Here again, these sectors are able to regain leeway as a result of continued monetary policy accommodation, for such times as nominal pressure does not re-emerge: this is why the ECB should take its time.

The second point worth making is that payroll employment reacts to trends in activity more quickly than overall employment, although this is not new. The chart shows employment and GDP trends, and the trend line shows the greater responsiveness of payroll employment. The red line represents payroll employment, with a sharper increase than for total employment, and this remains the case even if the two samples are the same size (2012-2017 as payroll employment figures are over a shorter period).

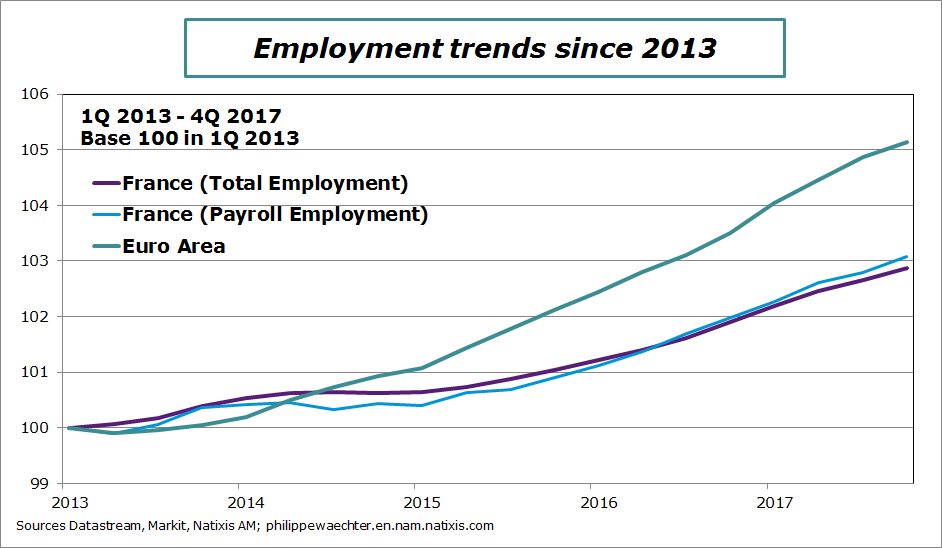

The third point is that employment does not react as quickly in France as in other partner countries. After the upturn in economic activity in France and the euro area at the start of 2013, we can see that French employment took off later and grew more slowly than jobs in the euro area as a whole. More work is therefore required on this aspect to make French growth more self-sustaining in the longer term: this is one of the aims of the government decrees to help growth create jobs more quickly.

Philippe Waechter's blog My french blog