Jerome Powell said that the yield curve flattening was not a source of concern and that it wasn’t showing a risk of recession as the economy is following a strong trajectory.

This point of view can be challenged for at least two reasons

1 – A negative yield curve (10 year rate below 2 year rate on government bonds) has always been a signal of recession with a lead of 18 to 24 months. The following graph is clear. Each negative yield curve is followed by a recession with a lag. The current spread is lower than 30 basis points, almost one increase of the fed funds rate.

We expect this yield curve profile for the end of this year due to the tighter monetary policy and therefore we have a strong probability of recession for 2020.

2 – The yield curve flattening reflects higher short term rates and no strong expectations on the long duration side showing that investors do not forecast a bright and strong future.

The tighter monetary policy means that the funding of the economy will be constrained for consumers and companies. We’ve seen recently that companies’ debt (as % of GDP) is at a record high and that consumer credit is still increasing rapidly. The impact of higher short term rates will be negative for both of them.

On the real estate market, around 50% of the financing is coming from brokers whose funding is linked to short term rates. For them too the situation will dramatically changed.

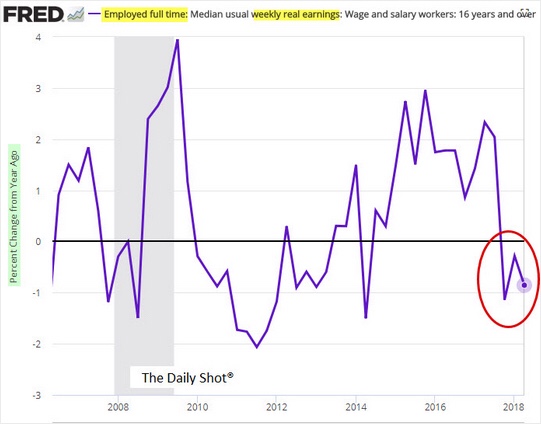

Moreover, an expected tighter monetary policy has provoked higher mortgage rates which will be damaging for households as real wages are no longer creeping up.

The argument saying that “this time is different” must be related to the discussion Reinhardt et Rogoff had in their famous book “This time is different”. Investors always think that the situation, at the moment they live it, is different from what was observed in the past with same type of signal. Reinhardt and Rogoff just say that it is not different on financial markets. An unbalanced situation must be adjusted. Current sources of “this time is different” argument are based on the neutral and non observable long term rate and also on the Fed’s balance sheet operations that have an impact on long bonds through the Fed’s reinvestment of their portfolio proceeds

In other words, the impact of higher short term rates will be negative on the US private sector and could be the source of the expected lower momentum on the economic activity. It it just the impact of a tighter monetary policy as we’ve always seen it in the past. This time is not different.

A discussion of Jay Powell’s speech at the congress can be read in the following FT article

www.ft.com/content/116455e2-8a33-11e8-bf9e-8771d5404543

Philippe Waechter's blog My french blog