The ISM index for the manufacturing sector is, in August, at its highest since May 2004. It was then at 61.3 versus 61.4 in May 2004.

The reading of this index is puzzling for different reasons

1 – Since 2011, the average growth in the US is 2.2% but the trend was 2.7% between 2000 and 2007. But the ISM index was, on average, higher since 2011 than before the crisis. Its average was 54.1 from January 2011 to August 2018 but only 52.1 from January 2000 to December 2007. A higher ISM index doesn’t not reflect a stronger growth momentum. We can see that also when looking at the manufacturing production index. On the same periods, the annual growth rate was 1.8% from 2000 to 2007 but 1.15% from 2011 to July 2018.

In other words, the index is higher than in the past while growth is lower.

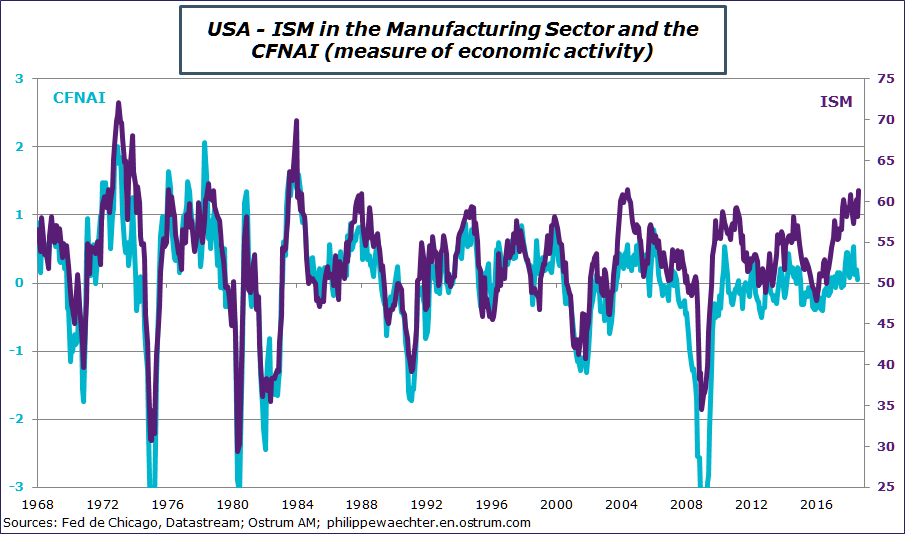

2 – There is a robust index calculated by the Federal Reserve of Chicago. The CFNAI (Chicago Fed National Activity Index) is the synthesis of 85 indicators (industrial production, employment, personal income,….). It’s reading is easy with an average at zero and a standard deviation of one.

The CFNAI is an accurate measure of the business cycle based on observed variables. Usually the two profiles are consistent as the graph shows.

Recent data show a persistent divergence between the two. The CFNAI is close to 0 while the ISM is at a high historical level. It is probably too high giving a wrong signal of the US growth strength.

Philippe Waechter's blog My french blog