This post is available in pdf format My Wedenesday Column – November 7

US job growth is buoyant, but is it all down to the Trump effect?

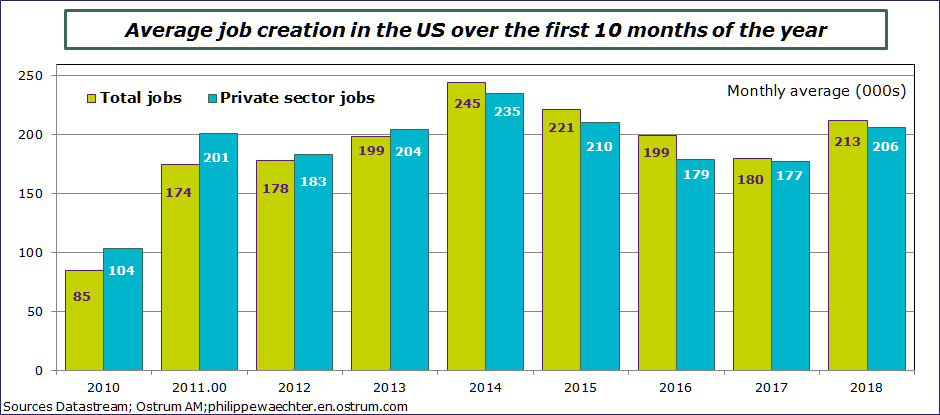

The US economy created 250,000 jobs in October, which is a bit higher than the average of 213,000 witnessed since the start of the year. However, October is usually a fairly good month for new job creation, with 271,000 in October 2017, and an average of 246,000 in the month of October since 2013 as compared to an average of 206,000 for other months.

The labor market is buoyant overall, reflecting a solid pace of economic growth although nothing to write home about with 2.25% per year on average since 2011.

Is this uptrend spurred on by Trump’s policies?

No, if we look at the trend, we will see that the US economy’s trend is dictated by the framework laid out by the Obama-Yellen tandem. The Fed Chair had set the stage for a seamless recovery at a time when inflation was low, and this has driven a smooth growth path, which is good news for the job market.

Trump’s policy reflects a continuation of this profile: the slightly more marked uptrend for jobs in 2018 is a result of the White House’s aggressive policies, which led to solid domestic demand on the back of tax cuts and higher public spending, and also pushed the public deficit to more than 5% of GDP.

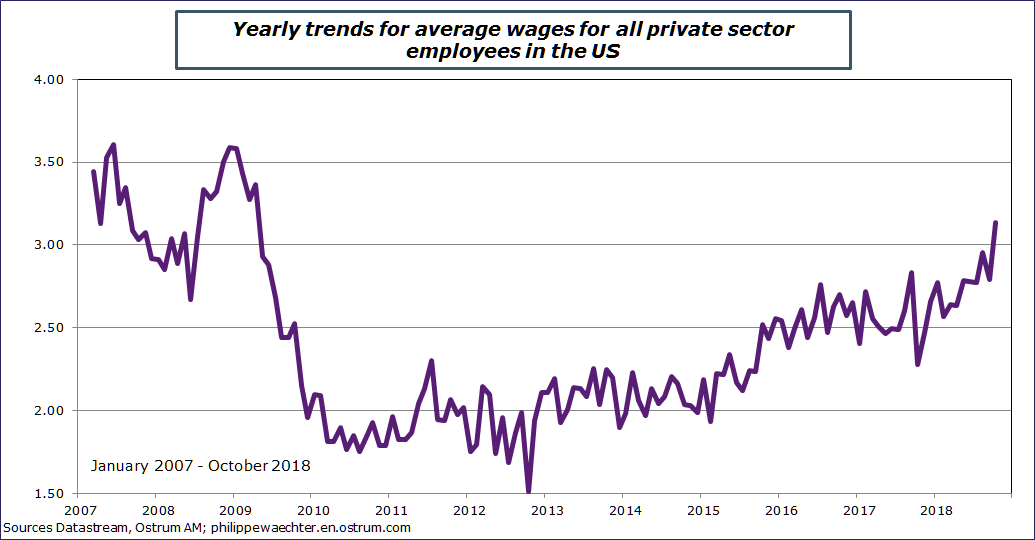

Do inflationary risks not increase alongside faster wage growth?

Average wage growth in the private sector has moved above the 3% mark for the first time since 2009. Nominal pressure is increasing at last with the accentuation and the extension in the economic cycle, so we are seeing conditions that are consistent with more inflationary pressure, especially as productivity remains low. However, there is no rise in unit labor costs, which are still around 2%.

Is this not the right policy if we want to create more jobs?

With Donald Trump’s arrival to the White House, the US adopted highly expansionary policy at a time when the Fed’s monetary policy was also expansionary. The US economy is not a particularly open market, so this had a fairly positive effect on the economic cycle: growth is solid and job creation is robust, leading to very low unemployment at 3.7% of the working population. This figure could fall even further as the number of people (as % of the working age population) who have a job or are looking for a job is still lower than before the crisis.

So is this a magic wand?

Unfortunately not. Firstly, as we can see, the Fed has changed tack since this policy was introduced: its interest rates are rising and the Chair Jay Powell is not going to stop there, as he thinks that fiscal policy is not sustainable in the medium term. The policy mix will have to become less accommodative if the US economy is to stay on the growth track in the medium term.

The Fed is concerned about the emergence of imbalances that could damage the economy. We should still expect to see slightly stronger inflationary pressure, independently of oil prices. Stronger domestic demand should lead to upward pressure and it is here that we can best see the change in the Fed’s policy. In the past, during Janet Yellen’s time at the helm, inflation was well below the 2% target and the Fed had no reason to toughen its stance as that would have meant taking risks on growth at a time when inflation posed no threat. In today’s context, Jay Powell wants to take preventive action to curb the risk of inflation picking up as a result of excessive domestic demand.

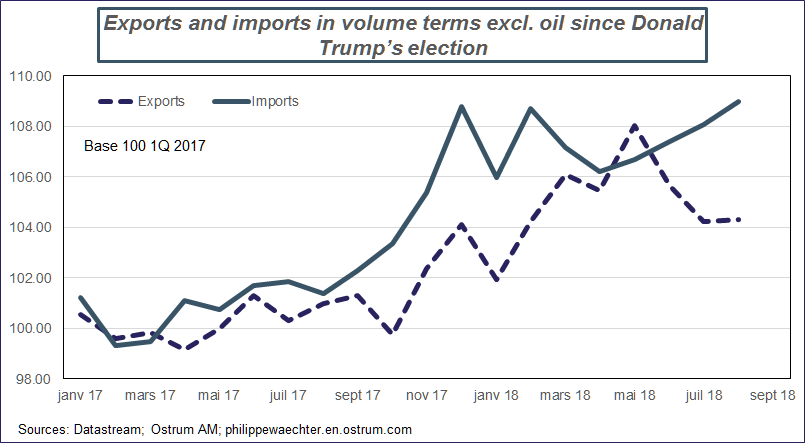

The other risk is an increase in the external deficit. Imports have already been rising faster than exports in volume terms excluding oil since Donald Trump took over, as stronger domestic demand is pushing up imports, which is a standard trend seen in most countries. Meanwhile more recently, part of this rise in imports could well have been a result of pre-emptive purchases ahead of further potential border tariff hikes. This phenomenon is not viable.

And so the Fed would rather hamper economic activity than allow these imbalances to gain traction.

The last point here is that this policy is only feasible because the US implemented and holds the world currency, which is a massive advantage that no other country enjoys.

Could the euro area not go the same way?

It’s not quite that simple. The bloc’s institutional framework does not allow for such expansionary fiscal policy. We have seen during recent discussions that there is no consensus on the role for fiscal policy, with Hanseatic League countries that want to keep fiscal policy independent, while Germany and some others want virtually constant budget balance, and then there is France with some others that want an active shared fiscal policy – there is absolutely no agreement across the European Union or the euro area, with the only alliance witnessed during the 2008 crisis, which was a very specific situation.

Another point worth noting is that the euro is not the reference currency and does not afford the euro area the same clout as the US, as shown during the introduction of sanctions on Iran when the euro area had to follow the US’ wishes, otherwise it would have risked losing access to the dollar market. No country or no company wants to take that sort of risk. Europe – and particularly the euro area – are not the US and do not enjoy the great advantage of being able to choose quite so easily.

But will this advantage not disappear soon?

It will only disappear if the US political authorities are no longer able to impose their views, but so far the US President has managed to hang onto this ability. The country is admittedly shaken up by China from an economic standpoint, but not politically just yet, and this is the potential shift that we need to look out for in the future. So it is a bit premature to expect a loss of power for the US, even though many would like to see it happen.

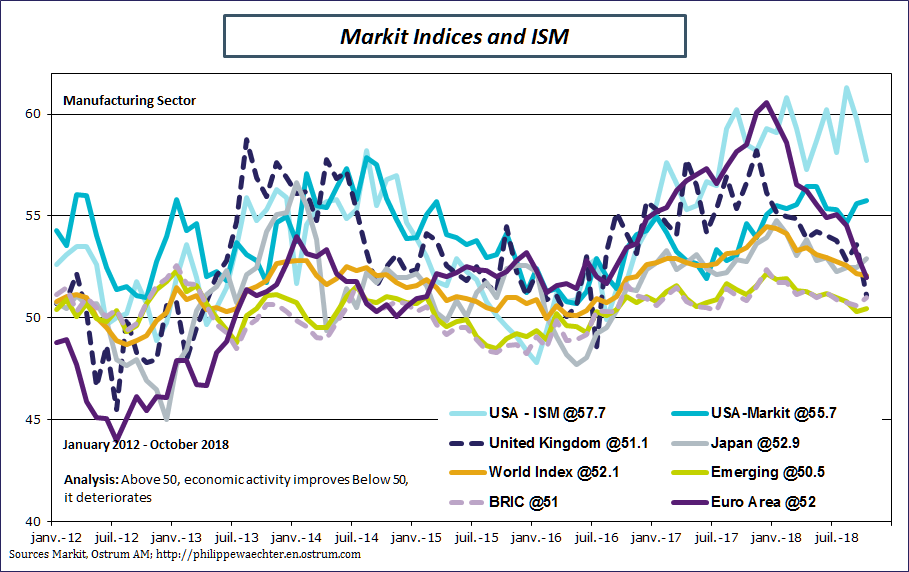

How is economic momentum this fall?

The worldwide manufacturing sector Markit survey continues to reflect slowing growth, with the index coming out at 52.1 in October vs. 52.2 in September as compared with 54.5 in December 2017. This reflects a world economy that is no longer accelerating and hence world trade is following a more moderate path.

Picking out some noteworthy points from this series of surveys, we highlight ongoing slowing manufacturing momentum in the euro area, which is why it is fanciful to expect a turnaround in the growth trend in 2019. The second point worth noting is the swift downturn in the UK index, which at 51.1 is the lowest over the period surrounding the Brexit referendum. We may well wonder whether these figures factor in the possibility of a tougher situation for the UK once it has left the EU. We also note that the services index has declined.

The US ISM index is more moderate and emerging indices are slightly better than in September.

So there is no real watershed, but rather the world economy is unable to make it back on a clear path to growth.

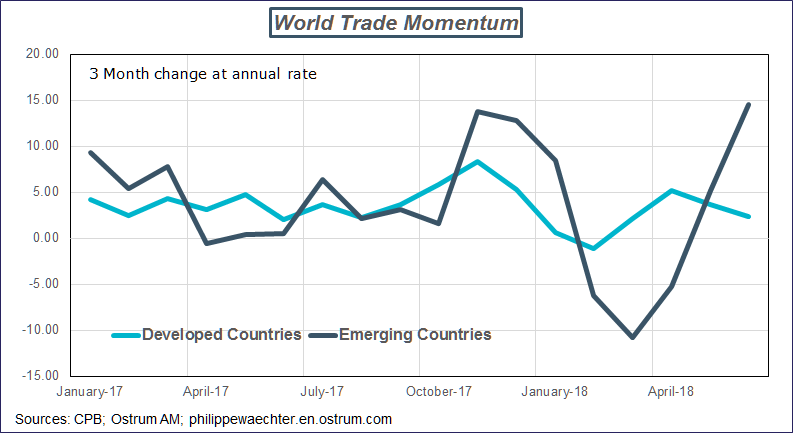

Is world trade consistent with this trend?

World trade picked up some speed again in August, if we smooth data out over three months.

However, the chart on the right shows that this trend is largely propelled by emerging markets, especially Asia, while momentum on trade remains modest in western markets, and is contracting on a 3-month basis in the US and Japan.

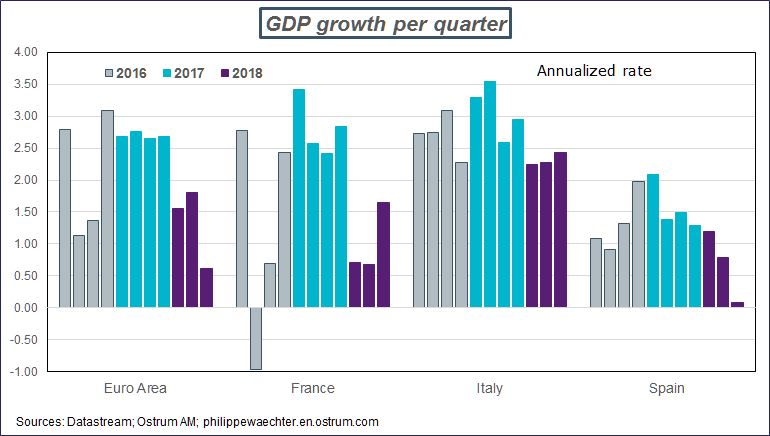

Should we be worried about growth in the euro area?

The pace of growth slowed severely in the euro area in the third quarter of the year, plummeting from 1.8% annualized in 2Q to 0.6%. This slowdown was not triggered by France, where growth was slightly better, or by Spain, where economic activity is growing at a similar pace to figures over the first two quarters of the year. The performance was partly attributable to Italy, although this is not explanation enough to truly understand the European downturn, so we are waiting eagerly for the German figure (see my analysis on France on my French Blog).

Current momentum now confirms that the cycle reached a peak at the end of 2017, and that the economy is now moving towards its potential growth rate, which is slightly lower than the robust showings posted in 2017.

Growth carry-over for 2018 at the end of 3Q stands at 1.8% for the euro area, 1.5% in France, 2.4% in Spain and 1% in Italy.

Philippe Waechter's blog My french blog