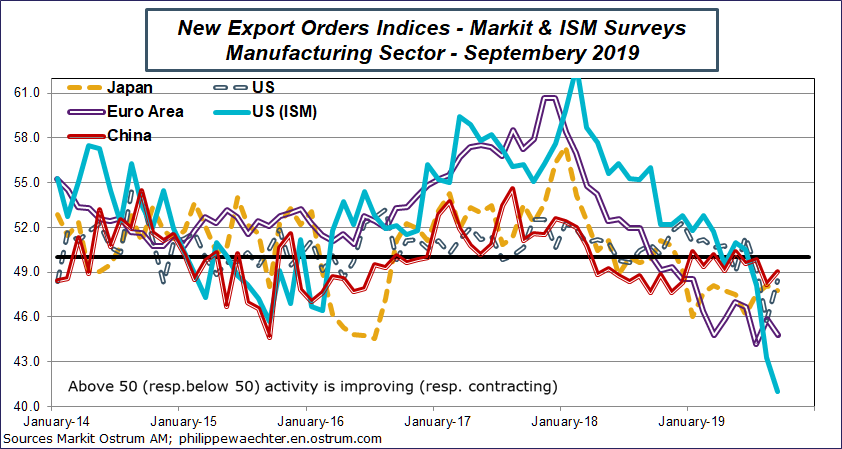

Reduction in new export orders is the most important economic phenomenon for the business cycle in recent months. It cannot be ruled out that measures to constrain international trade have had a negative effect on trade and growth.

In the monthly Markit manufacturing survey, the new orders index for developed countries was at 47.4 in September. Order flows have contracted continuously since January. In these circumstances, it is not surprising that the pace of manufacturing output is also degraded in most countries. In August, it contracts in the US over a year.

In emerging markets, the new orders flow index reflects a contraction at 48.7. Since the beginning of the year, the average index is at 49.7.

The ISM survey export order flow index is at its lowest since the 2009 recession (the previous low point was March 2009). This reflects a particular situation that in the past has penalized the US economy.

The shock is severe and international trade is no longer a source of impetus for the economic activity as in the past, but rather a constraint that permanently penalizes growth.

On the graph, we observe the change of regime throughout the year 2018. Tariff measures, non-cooperative strategies and the political consequences of insufficient growth explain this change in trend. Spontaneously, we do not perceive a rapid reversal of the trend.

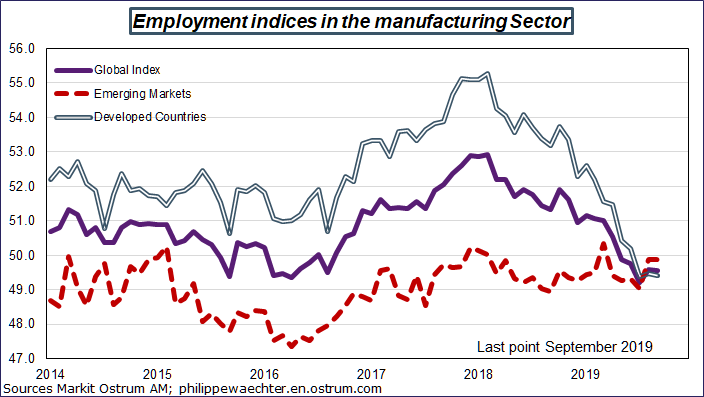

The other source of concern in the manufacturing sector is employment . After a strong improvement until early 2018, especially in developed countries, it is now contracting. This means that the solvent demand, which improves with the increase in employment, is deteriorating. Internal dynamics fades.

The growth of the manufacturing sector is now strongly constrained. It no longer has a strong impetus from international trade and the solvency of domestic demand is deteriorating due to the low momentum in the labor market. We can expect a negative contribution from the manufacturing sector to growth in the coming months. The only question now is whether services can compensate for this effect. Generally this is not the case. This argues for a further slowdown in activity.