There is a lot of talks about the German savings rate, which is supposed to have increased recently in response to the drop in interest rates, notably the ECB rates. The anxiety caused by the fall in interest rates would encourage Germans to save more to counteract this uncertain environment.

It does not work. Germans do not vote against the ECB by increasing their savings as savings rates are stable.This story about the Germans’ behavior is supposed to show the frustration of our neighbors and the inability of the ECB to manage monetary policy. Very Smart People are still alive and in action.I have looked at the series of the household savings rate (savings on disposable income) and the global saving rate (Total income minus private consumption minus public consumption as a% of total income). These are the two relevant series for measuring the savings rate, in Germany or elsewhere.These two series, in recent years are flat like the back of the hand.

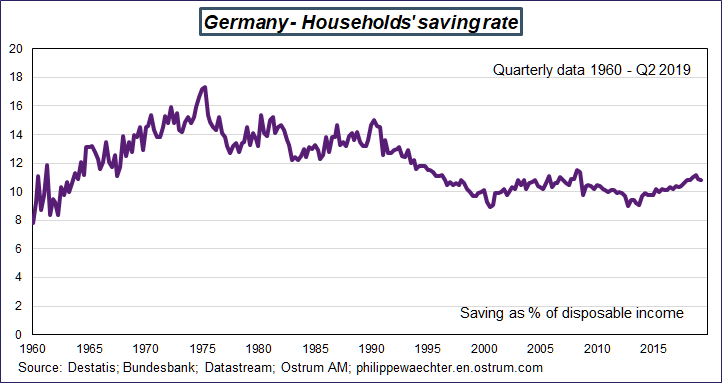

The household savings rate has fluctuated between 9% and 11.2% since the first quarter of 2009 and stands at 10.8% in the second quarter of 2019. It can even be said that since the start of the euro area, the German household savings rate is stable on these same levels.

Yet since 2009 the refi rate has declined by 250 basis points, same for the deposit facility rate. There is no impact of the ECB rate on the behavior of the savings rate.

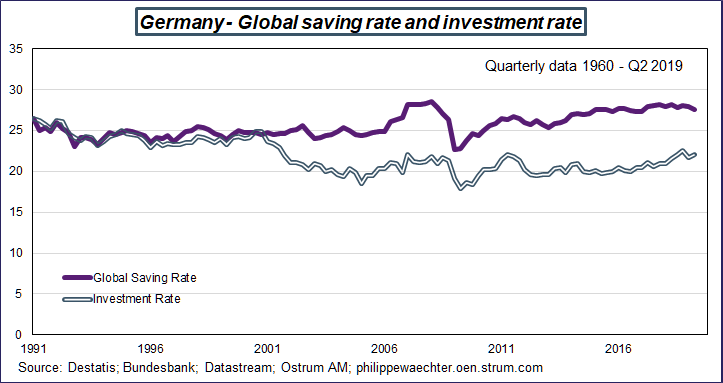

We can also look at the overall saving rate, that of the German economy as a whole. As the households’ saving rate, this one is stable. Since 1991, it has been slightly above 25% of GDP. It is not an additional saving behavior that explains the increase in the German external balance but the decline in the investment rate (the difference between the savings rate and the investment rate is the current account balance as a% of GDP). For the overall saving rate also, the impact of the Bundesbank rate and then the ECB rate does not seem to exist.