Highlights

Minutes of the last Fed’s meeting (Nov. 20) and of the last ECB’s meeting (Nov.21)

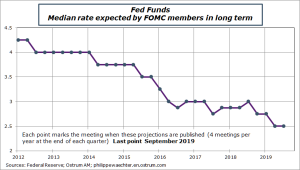

The Fed’s minutes will reveal the discussions on the drop of the Fed’s benchmark rate but the most useful part will be on the commitment to stop, at least temporarily, the downside trend on the benchmark rate.

In the ECB minutes, the focus will be on the discussions related to the important disagreements between governing council members after September decisions.

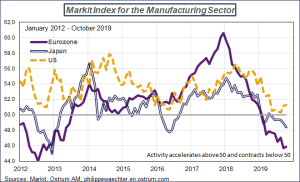

Markit flash estimates for November in the Euro Area, Japan and the US (Nov.22)

In October a rebound in the US for the manufacturing sector was a surprise reflecting mainly the spike in the New export Orders index. The divergence with the eurozone and Japan was astonishing. The November survey will highlight the possibility for the US to remain strong while Japan and the EA are still weak.

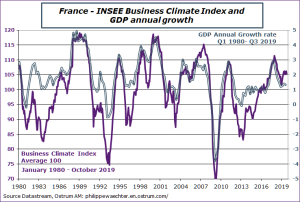

The French Climat des Affaires for November (Nov. 21)

The French index has been above its historical average for months. This is consistent with the stronger momentum of the French growth when compared with the Euro Area. This is linked to the specificity of the French economic policy that feed domestic demand in order to cushion a possible external shock. This strategy limits the possibility of a downturn.

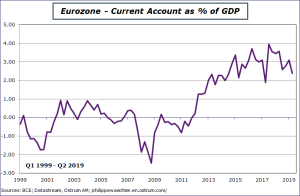

Eurozone Current Account for September (Nov.19)

The Euro Area current account shows a large surplus. It is circa 3% of GDP. This means that there is an excess saving in the Euro Area and that we have means to invest in order to improve the autonomy of our growth process. Because accumulating surplus is just useless.

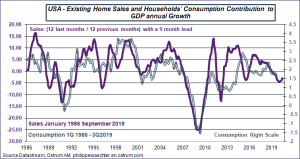

Existing homes sales in the US for October (Nov. 21) and Housing Starts (Nov.19)

Existing home sales indicator is a measure of a wealth effect on consumption expenditures. Its recent profile suggests a slowdown in expenditures during the last quarter of this year before a mild rebound at the beginning of 2020.

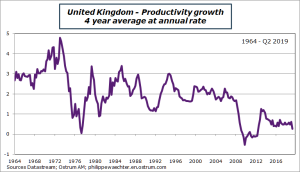

Productivity in the third quarter for the United Kingdom (Nov. 20)

The strong slowdown in the UK productivity suggests an extended period of low growth except if investment rebounds strongly. This will not be the case whatever the Brexit agreement because Brexit will continue to provide large uncertainty.

The Phylli Fed index will be release on November the 21st. The Japanese trade balance on November the 20th, the Japanese CPI for October on November the 22nd and the German Consumer Confidence index on November the 21st.

This document is available for download.