The growth of the Chinese economy is constrained by the global economic cycle and can not find a relay through its internal demand.

China will have to negotiate with the USA

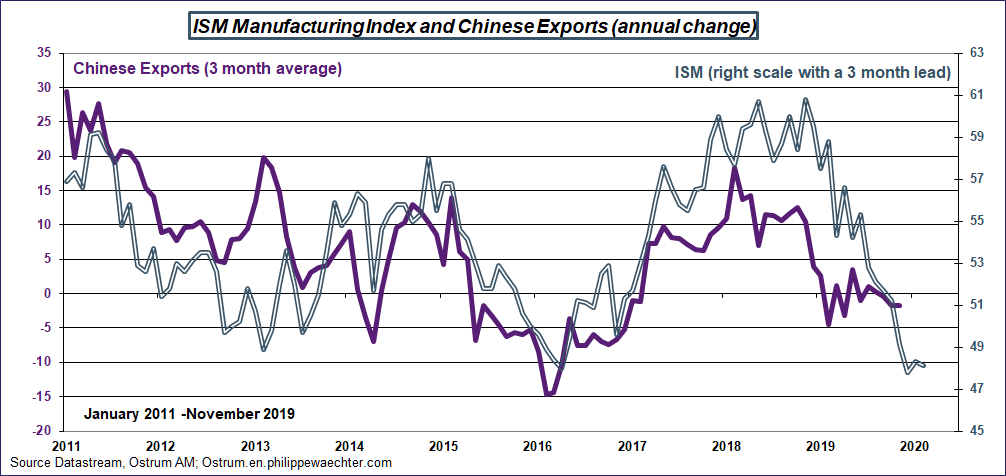

China’s export momentum remained weak in November. Exports of the last three months compared to the same months of 2018 declined by -1.8% after -1.7% in October.

It is a source of fragility for the Chinese economy since this slowdown causes a sharp slowdown in industrial activity while domestic demand is struggling to take over. This last point can be seen on imports which continue to deteriorate (-4.8% over the last 3 months compared to the same 3 months of 2018) but also on retail sales which are increasing slowly and do not appear as the relay needed for foreign trade.

This question on household demand has been highlighted in the latest report of the Chinese central bank on financial stability. In this one the authorities are worried by the continuous and monotonous progress of the Chinese households’ indebtedness. At the end of 2018, its amount represented 99.1% of disposable income. This is considerable and constrains households’ ability to be at the heart of Chinese growth.

The global business cycle weakens Chinese exports

In other words, domestic demand will not take over from declining exports. This may be a good reason for the Chinese authorities to negotiate a first trade agreement with the Americans even if we know that it will not solve all the questions asked.

These pressures for an agreement are all the stronger as the economic slowdown measured by the ISM manufacturing will penalize even more Chinese products. The slowdown in the global cycle, as measured by the US indicator, will push exports down and further weaken Chinese growth. This also pushes for an agreement.