Political tensions in the Middle East could translate into a permanently higher oil price, penalizing households’ purchasing power and weakening consumption, a major support for the global economy

The year has barely started when international tensions are once again the focus of attention after General Ghassem Soleimani was killed in an attack carried out on orders of Donald Trump. Reactions were immediate and generally negative on the political ground due to the risk of conflagration in the region.

I’m not a specialist to make a political analysis of these tensions. The situation is complex and specialists do this job very well (read this paper in the New Yorker).

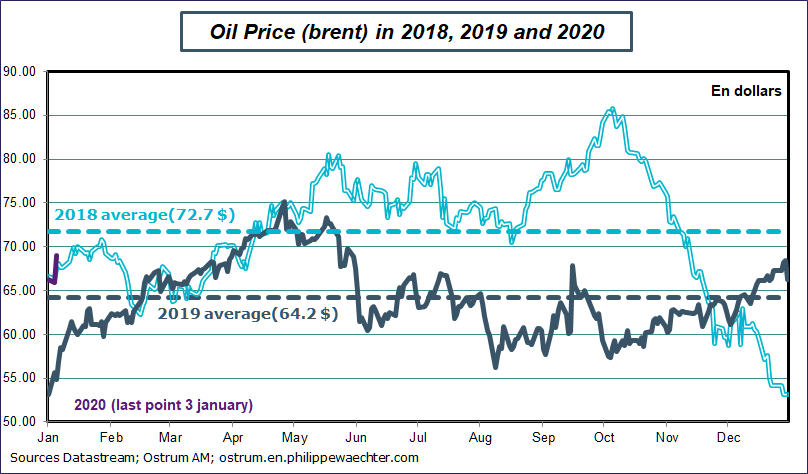

My concern is the rise in the price of oil which could result from further escalation of tensions. After the attack on Baghdad, it rose to $ 69, a price comparable to those observed in the past two years since the average price in 2018 was 71.7 dollars and that of 2019 was 64.2 dollars.

However, let us have not doubt that a conflagration in the Middle East, tensions in the Strait of Hormuz or any other source of uncertainty could push up the price of a barrel beyond 80 dollars with inflation rates on the upside (this will already be the case in January 2020 since the price was particularly low a year ago)

Secondly, the continuation of bellicose tensions would keep the price high. The consequence would be a drop in purchasing power all over the world, including in the United States, even though it is the world’s largest producer.

Wages are not rising much and the consequence would be an immediate negative impact on purchasing power. As productivity gains are limited, companies will not be able to compensate with increases in nominal wages.

The risk is a lower momentum in households’ consumption.

This is where the situation gets complicated.

Business investment is weak in most developed countries (this can be seen in the decline in German capital goods orders) and the economy is holding up only because consumption is robust. The fall in purchasing power would have a strong impact.

Demand could slow everywhere.

At the same time, the productive dynamics are reduced in most economies. The Markit indices for the month of December or the ISM index for the US manufacturing sector confirm the industrial recession. The ISM at 47.2 in the US for the month of December is of particular concern as orders contract quickly.

The risk is that of a further slowdown in overall growth. Consumption was the main driver of the economy, it could be permanently affected in the case of a sustained rise in the price of oil.

This issue is a source of trade-off. The USA is in an election year. Can President Trump accept a fall in purchasing power that year and a high risk of recession? He may be tempted to calm the political tensions to avoid this, but he is no longer alone in deciding. Iran is now as much a decision maker as America.

Since this morning, the risk of a global recession has increased. Central banks no longer have any room to be more accommodative and a concerted stimulus is very unlikely in a bellicose context. The rise in risks continues and increases over time.