China’s emergence over the past twenty years

has upended the world balance.

During the SARS epidemic,

the world did not need to rely on China.

But in today’s era and as the coronavirus spreads,

China’s role now shapes the world.

Writing about

trends for China’s indicators means looking into the most incredible transformation

in post-war economic history.

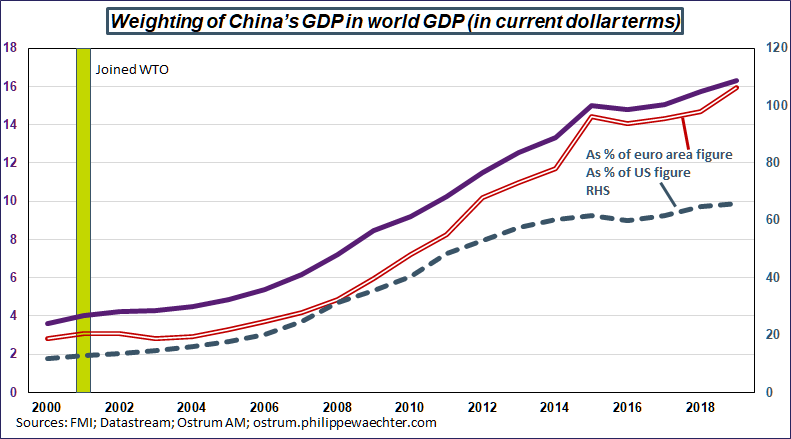

When China joined the World Trade Organization (WTO) in 2001, its

weighting in the world economy was similar to France (in dollar-denominated

GDP), yet it now equates to more than the entire euro area put together.

China has contributed a point of growth to the world economy every year over

the past at least ten years, so just under a third of world growth is

attributable to the country.

Substantial transfers of business drove this very

swift growth, as manufacturing activity fast stepped up the pace in China, but

this is now triggering potential doubts as to developed countries’ ability to

stage self-sustained growth, particularly during difficult times like the

current coronavirus outbreak.

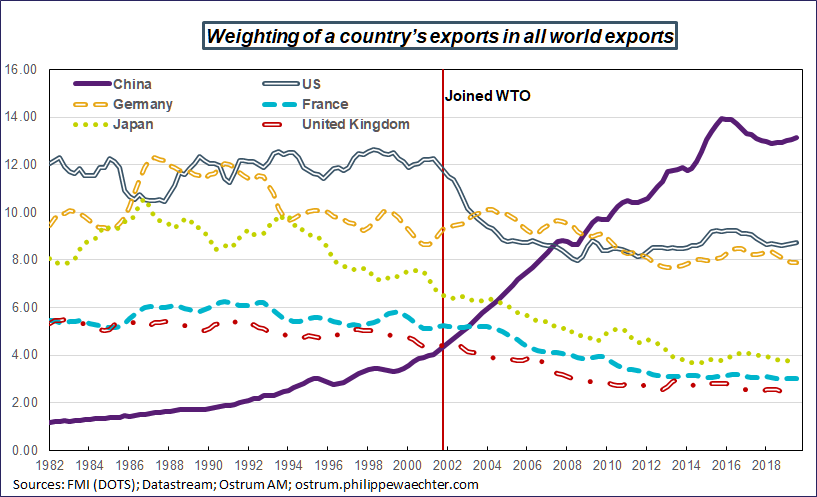

Another way of looking at this upheaval is to note that large manufacturing

countries have seen a dwindling role in world trade over the years, while China

is now the export champion, despite getting off to a very humble start: when it

joined the WTO, China’s exports as a percentage of world trade were lower than France’s

figures.

These factors show then that China played only a small role in world economic

momentum at the time of the SARS outbreak in 2002/2003. The country’s economic

activity at the time primarily addressed domestic demand that was growing fast,

so manufacturing in developed countries suffered little impact from this

epidemic. Any Chinese facilities that closed mostly affected Chinese

production, leaving only the health issue to be addressed.

However, the situation has entirely changed today. China now accounts for a

hefty chunk of the world economy. Imports into the country account for more

than 10% of total imports worldwide vs. 4% in 2001 and the United States’ 13%. This

figure conveys China’s clout in industrial countries’ economic activity.

China’s ties with the rest of the world have also increased as a result of technology

transfer on the one hand, and as on the other hand companies in developed

countries have sought to get involved in the economy’s growth, as its pace of

expansion was expected to sit above developed countries’ trends on a long-term

basis. China is a crucial part of the value chain for world products, and the

country is a major and sometimes indispensable contributor, whether in the

automotive industry, luxury goods, pharmaceuticals or electronics.

World economy could get by without China

during SARS outbreak in 2002, but not in 2020.

The champions of old now lag behind somewhat as a new balance has emerged, which is driven every bit as much by the Chinese economy as by the US. The United States’ dominant position has been disturbed, and this can explain the country’s stark reactions and its quest for isolationism, which has disrupted the world economy’s previous multilateralism seen over recent decades.

Three

indicators reflect these shifts.

Firstly, the weighting of China’s GDP as a proportion of world figures in

dollar terms, compared with the euro area and the US.

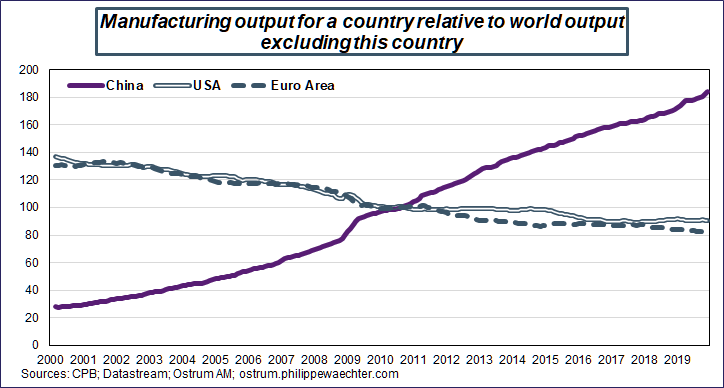

Secondly, trends in Chinese manufacturing output relative to the world

index excluding China. The comparison with the US and the euro area is

startling but not surprising.

Thirdly, Chinese exports as a proportion of world exports, and in this

arena, China is also taking over from developed countries, and outstripping the

winners of the past.

China’s GDP accounted for 4% of world GDP in 2001 (expressed in current dollar terms) when the country joined the WTO. Fast forward to 2019, and China now produces 16% of world wealth, so its weighting in the world economy has quadrupled in the space of 20 years. This figure reveals the hefty role China now plays in world growth trends.

The change is also impressive when we compare with other large countries: in 2000, China’s GDP was equivalent to less than 20% of the euro area’s figure, yet this proportion now stands at 106%, with the country overtaking the eurozone.

If we look to the US, China’s GDP equated to 11% of US GDP previously, but 66% in 2019 (in purchasing power parity terms, China has surpassed the US since 2014, but we feel it is more useful to look at trends in dollar terms).

This chart also reveals the shift in the euro area at the start of the 2010 decade when the fiscal and monetary authorities opted for recession rather than growth (see here for more details).

Growth in China was initially driven by greater manufacturing activity, with the initial logic based on twofold momentum on investment and exports, and a resulting impetus for manufacturing output.

I used data from the CPB to assess China’s specific trends as compared with the rest of the world and develop figures on world manufacturing output without China. I then compared the Chinese index to this index excluding China, as shown by the purple line on the chart, which denotes the ratio between the two indicators. The figure excluding China gained on average 1.15% per year between 2000 and 2019, while Chinese manufacturing activity jumped on average 11.3% each year, making for a spectacular difference.

I also conducted the same process for the US and the euro area, and in both cases, growth was much weaker than for output outside the US or euro area. So we can see that a large proportion of manufacturing was transferred to China.

The US and the euro area have no longer stood out as the world manufacturing leaders over the past 20 years.

Doubts over globalization due to coronavirus epidemic?

This also reflects the period of globalization, which has led to a transfer of manufacturing and the related productivity to emerging markets and particularly to China over the past 20 years.

The question of whether this process went too far or not is now emerging in light of the coronavirus outbreak. Yet the answer is significant: the manufacturing transfer can either point to the appeal of the Asian markets, or to the desire to transfer operations to produce at a lower cost and then send manufactured items back to developed markets.

In the first option, this behavior ends up being self-fulfilling, as the market looks robust over the long term, which encourages companies to set up there, and this in turn enhances this trend and increases the appeal of investing in the region. Any mishaps are then seen as temporary events that can happen on any market and do send companies fleeing from the market. In the second explanation, if production is first relocated, then perhaps bringing production back again could be an attractive possibility. So crux of the matter here is the conditions for these relocations. If there are fewer incentives than before, then nothing could prompt companies to return to developed countries.

With the current crisis, we swing back and forward between these two potential views.

The third indicator is exports. China now accounts for a considerable portion of trade, and this reflects the economy’s strength and its ability to fully take on this role afforded by globalization. The weighting of each developed country has decreased, particularly since the start of the 2000s, and the winners of old now lag far behind China’s performances. So China’s sway can now be measured by its ability to provide goods that other countries can no longer produce. This marks a major watershed in manufacturing, where momentum originated in Europe and continued in the US, but China is now taking over this role as the rest of the world depends on its output.

China is now at the heart of manufacturing momentum,

which had developed in Europe before transferring to the US.

China now dictates the trends for all others.

This is a massive change.

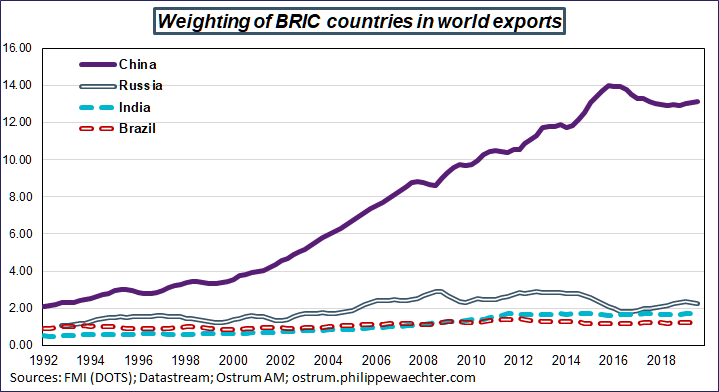

Looking further onto the international arena, there are often questions on other large countries, such as the BRIC, but there can be no comparison. The chart shows the weighting of exports for each of the BRIC countries as a proportion of world exports. Onlookers may be amazed at India, Brazil or Russia, but their growth cannot compare with China.