Energy Transition and Industrial Policy

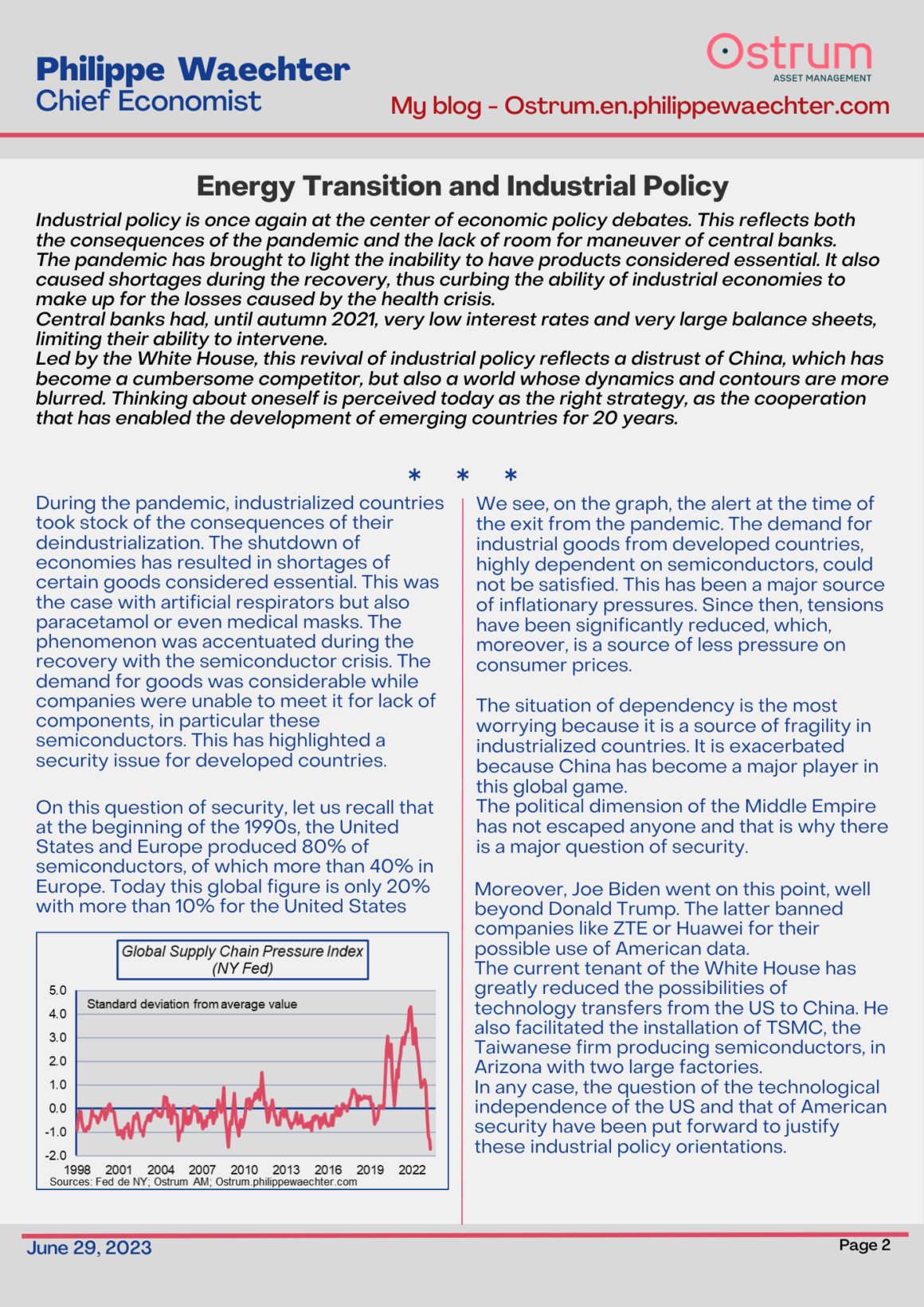

Industrial policy is once again at the center of economic policy debates. This reflects both the consequences of the pandemic and the lack of room for maneuver of central banks. The pandemic has brought to light the inability to have products considered essential. It also caused shortages during the recovery, thus curbing the ability of industrial economies to make up for the losses caused by the health crisis. Central banks had, until autumn 2021, very low interest rates and very large balance sheets, limiting their ability to intervene. Led by the White House, this revival of industrial policy reflects a distrust of China, which has become a cumbersome competitor, but also a world whose dynamics and contours are more blurred. Thinking about oneself is perceived today as the right strategy, as the cooperation that has enabled the development of emerging countries for 20 years.

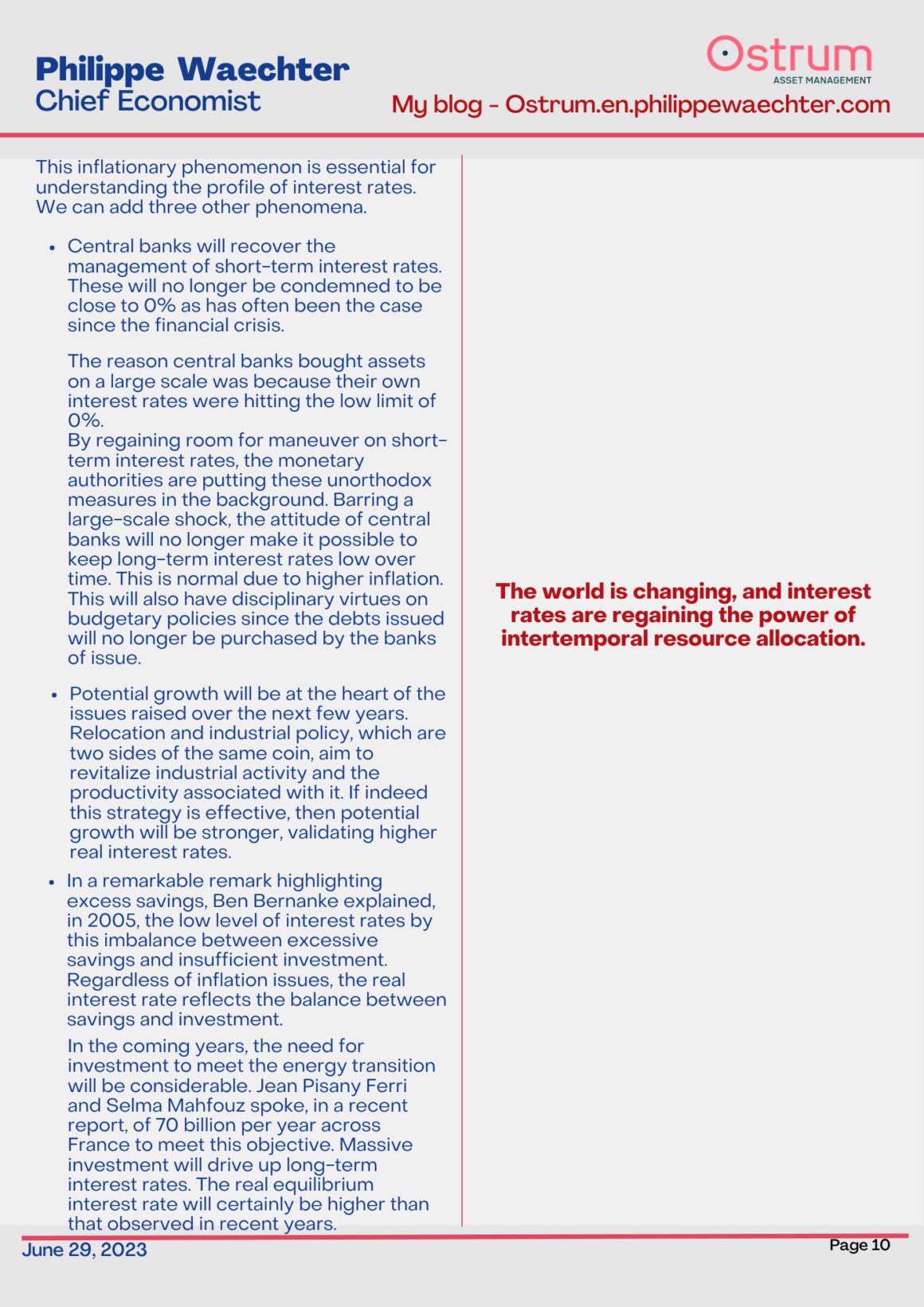

Inflation and interest rates over time

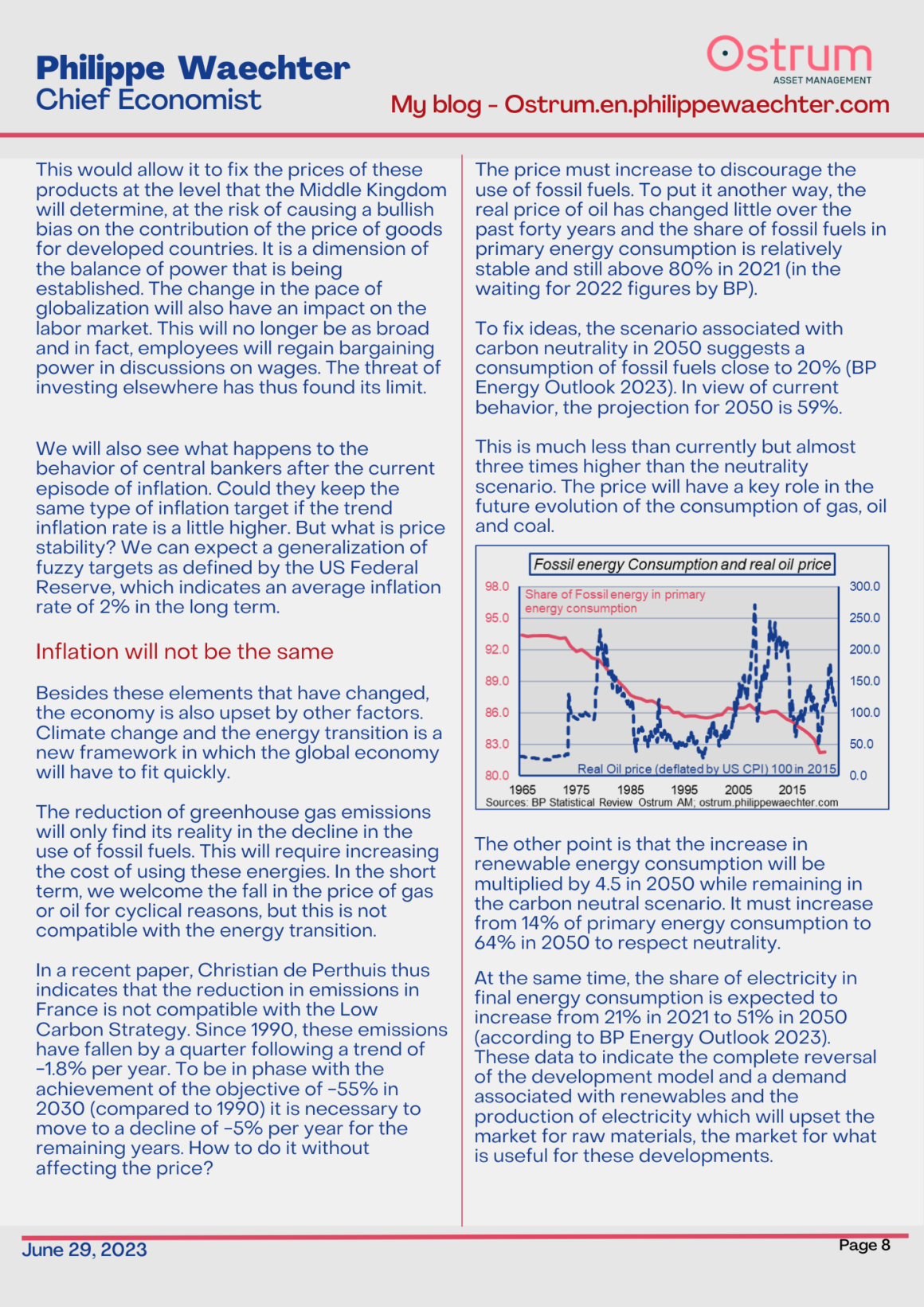

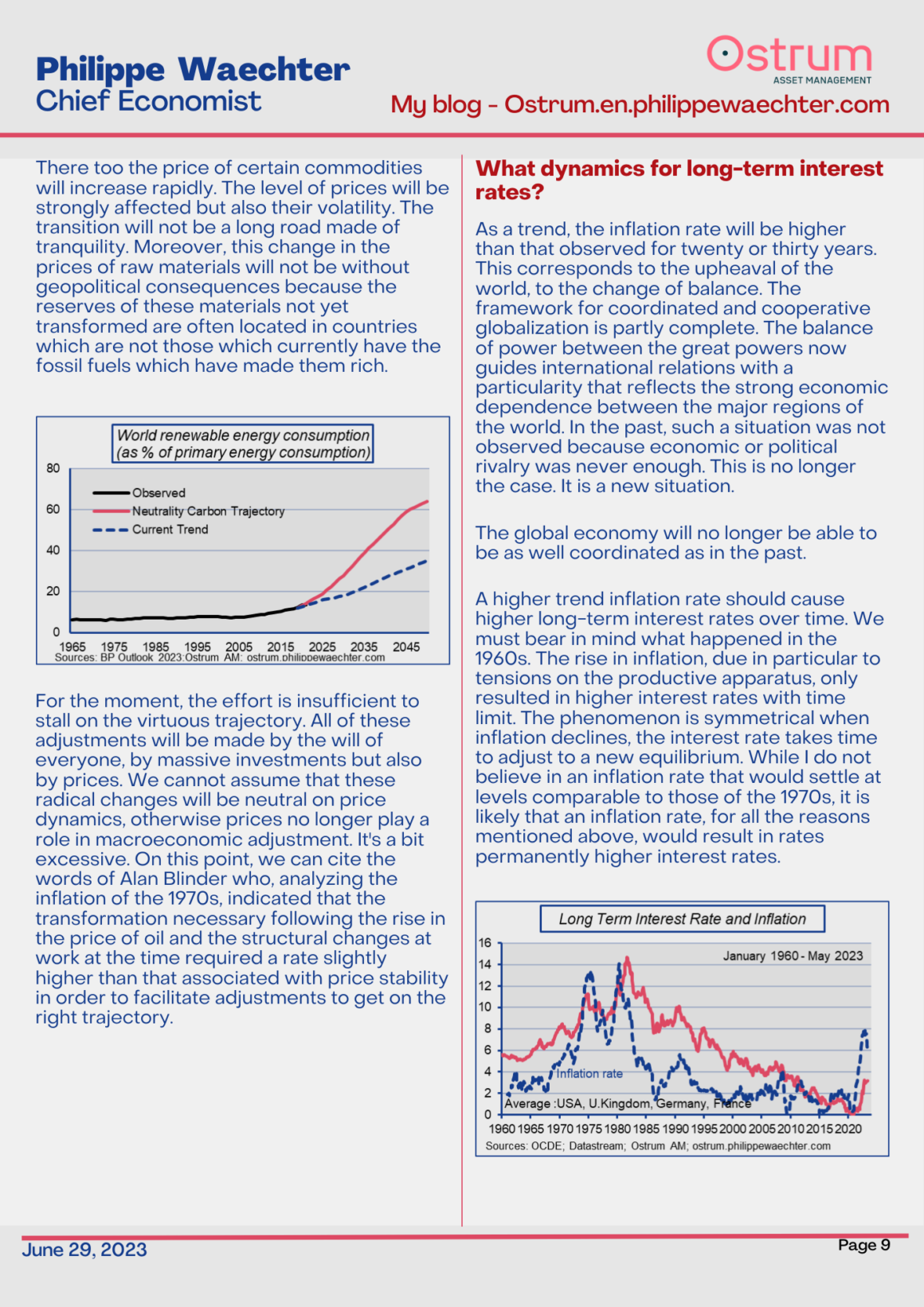

The world is changing and with it the modes of adjustment of the global economy. Inflation, which has been very low for thirty years, will register at a higher level over time. The economy is changing, it is no longer that of globalization at all costs, it is becoming that of relocation and energy transition. A higher rate of inflation will help this transformation. The higher inflation rate will restore the full role of the traditional modes of action of central banks and less appeal for asset purchases by the monetary authorities. The other point is that the investment needed for the energy transition will result in a higher demand for capital. This will result in higher long-term interest rates which will return to levels compatible with their role in allocating resources over time.

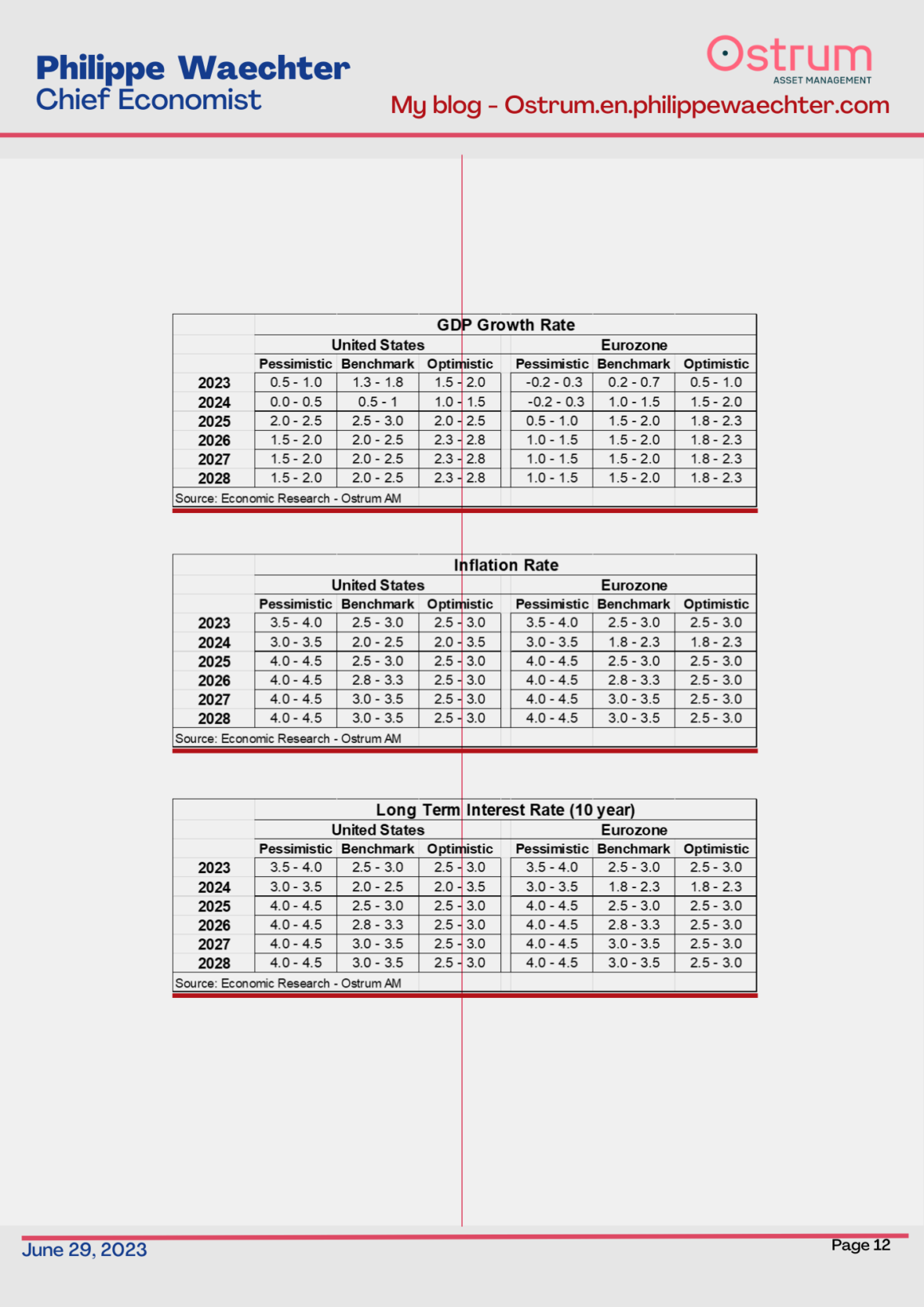

What medium-term projections?

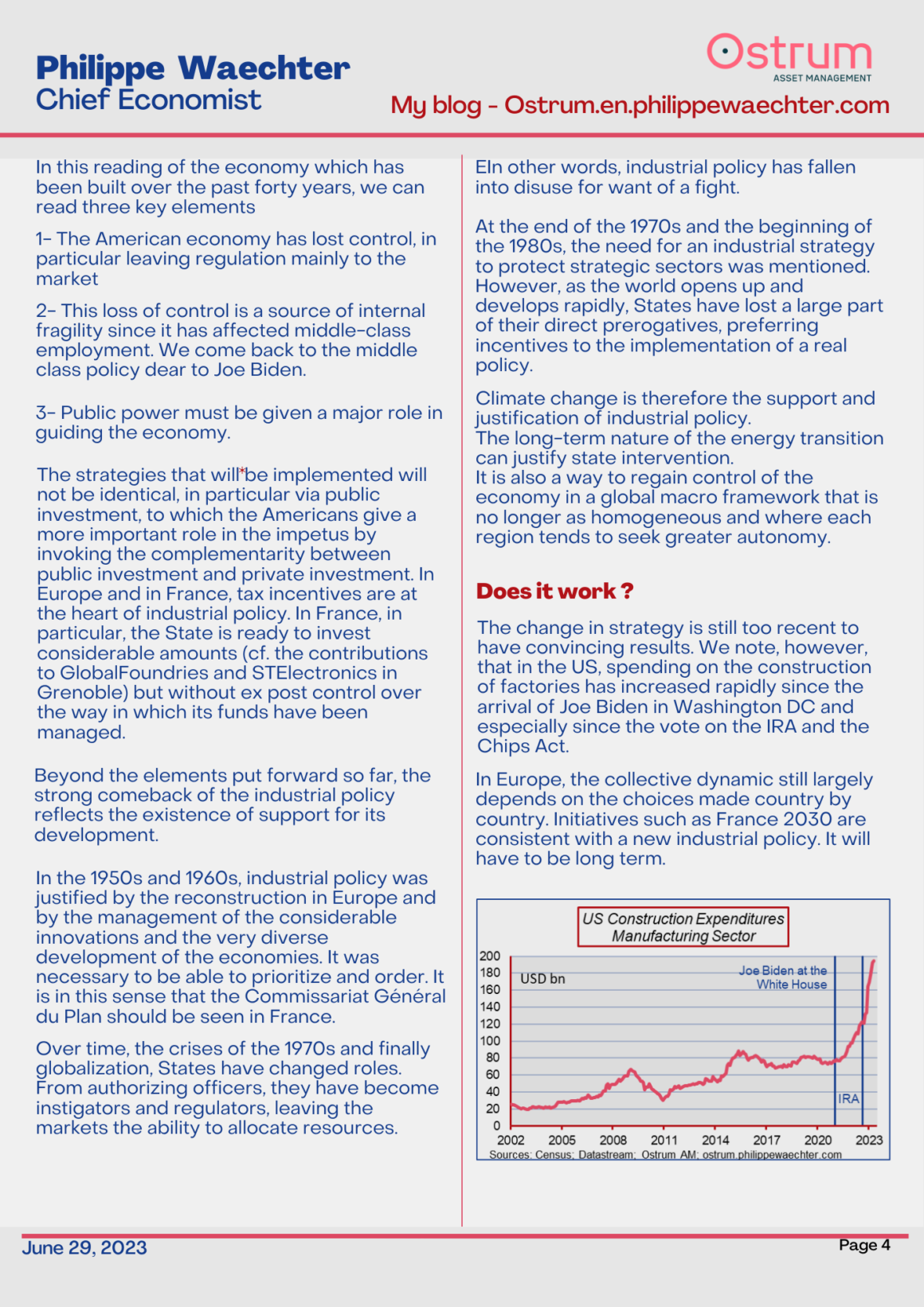

Three scenarios. In the reference scenario, the renewal of economic policy is in phase with the energy transition. In this case, the trend in activity remains robust. However, the upheaval caused by the transition translates into a higher trend inflation rate. We are moving away from the 2% which is the target of central banks. As a result, the strong investment need for the transition and higher inflation will translate into higher long-term interest rates over time.