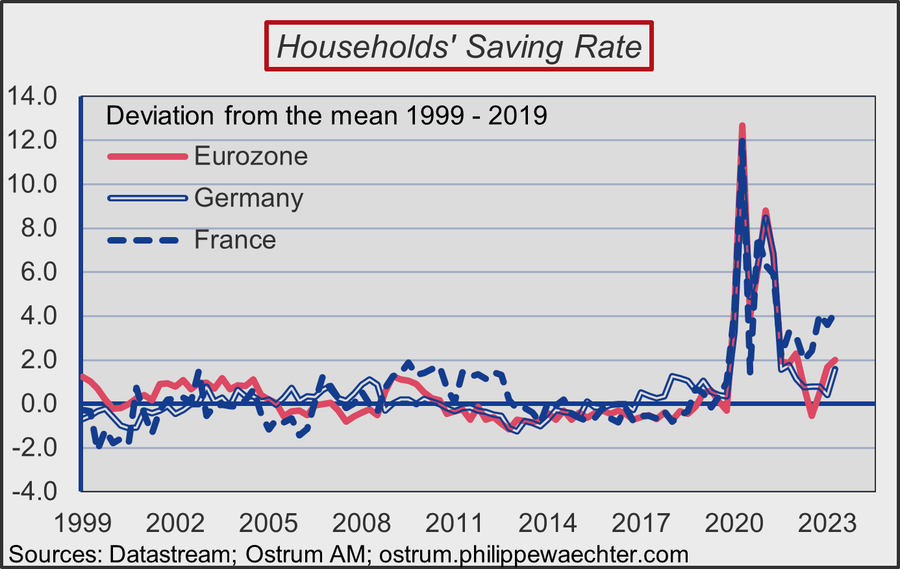

In the Eurozone, higher inflation has caused income sharing in favor of savings. Since the start of the pandemic and throughout the period of high inflation, the savings rate has been higher than its 1999-2019 average.

The objective is to preserve the value of savings, so that they do not depreciate.

Over this reference period, 1999-2019, the savings rate is stable in the Euro zone, Germany and France and fluctuations are limited, reflecting uncertainties over the cycle.

The cyclical shocks, over the period, do not cause breaks but rather persistent dynamics a little above or a little below the average savings rate.

This was the case in France, from the time of the financial crisis until the end of the long recession in the Eurozone. The increase in the unemployment rate is an additional source of savings over the period 1999 – 2019.

If the increase in the savings rate is conditioned by the high inflation rate, then the decline in price increase should result in a sharing of household income more in favor of consumption.

This would then support the economic cycle of the Euro zone in general and of France in particular where the savings rate is currently particularly high.

The savings rate will not spontaneously return to its long-term average because the economic climate appears more risky, particularly in the labor market.

In other words, the fall in inflation will favor consumption to the detriment of savings but the greater uncertainties over employment will not allow rapid and immediate convergence towards the long-term average. The effect will be positive for growth.

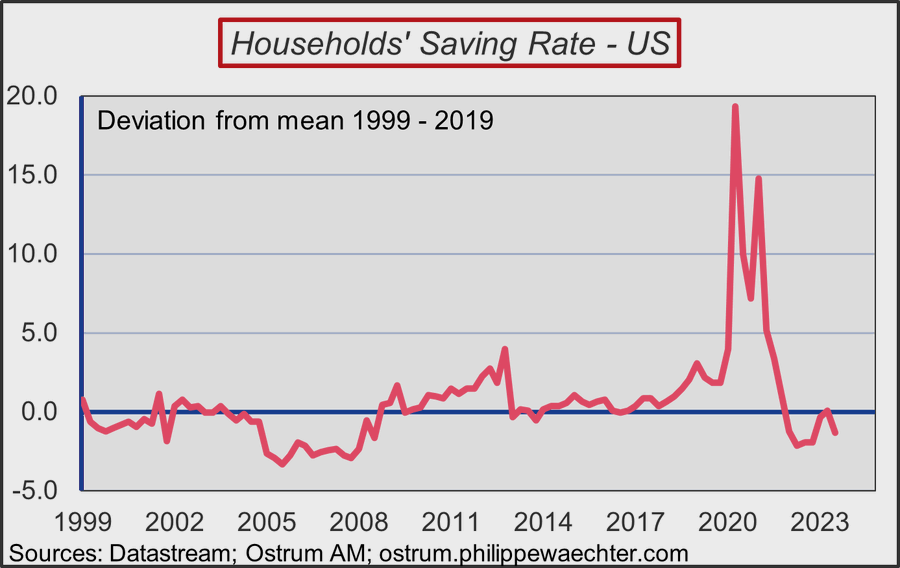

In the US, the movement risks being the opposite. During the period of inflation, households favored consumption over savings. The normalization of inflation should result in a rise in the savings rate, a little less consumption and less explosive GDP growth.