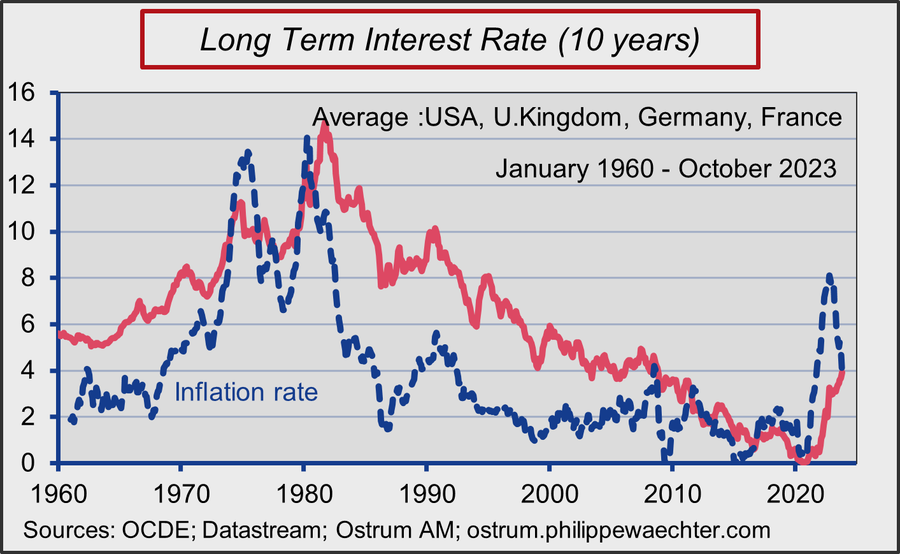

New regime change on the debt market, inflation and long-term interest rates are now on an equal footing.

A little over two years ago, investors had to successively face a much higher inflation rate then a spectacular rise in long-term interest rates.

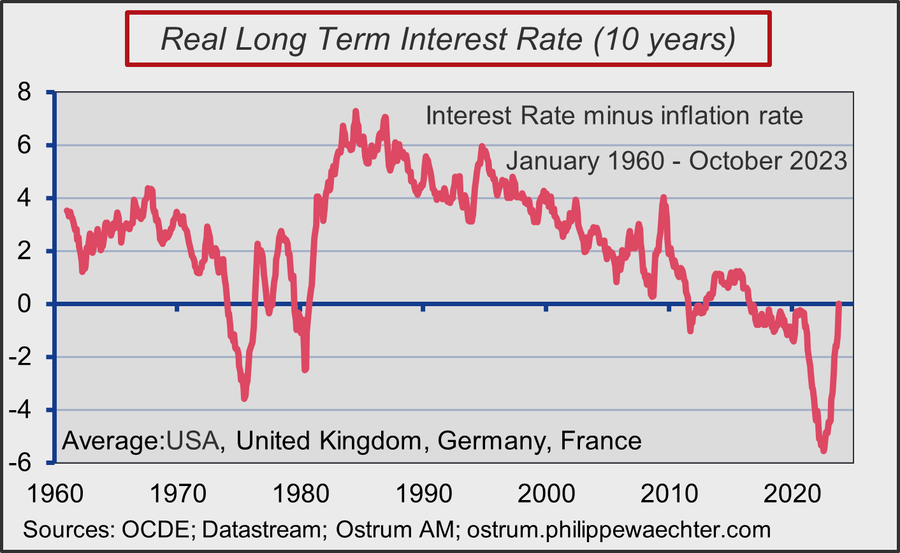

The movement has been such that the real interest rate, measured as the difference between the nominal interest rate and the inflation rate, has never been so negative, even when in the 1970’s when the rate of inflation was double that seen since 2021. (according to the metric I use, the average G4 inflation rate was 10.1% between January 1974 and December 1982 and 5.7% from May 2021 to October 2023)

In October 2023, this real interest rate is 0%. The average interest rate for G4 countries is equal to the average inflation rate for these same countries.

Three remarks

1- The real interest rate will become permanently positive with the further slowdown in the inflation rate. Central banks will not immediately give the signal to cut rates because uncertainty remains.

2- A rise in inflation, like the second leg of inflation in the 1970’s, can only be anticipated if we experience a new energy crisis. At the time, the power crisis in Iran had precipitated the second oil crisis. Such a crisis is always possible given the conflict between Hamas and Israel, but it is not our reference scenario.

3- There is therefore a new configuration emerging on the debt market.

Over time, the real interest rate will be positive.

This is a radical change in regime. In the 1980’s, such a situation, with very high real rates, was not associated with a depression in growth, quite the contrary.

The era that is opening could translate into new opportunities in the world of energy transition.

These high interest rates over time will also reflect a slightly higher trend inflation rate than in the past and central banks which will not intervene in the form of quantitative easing for the long term necessary for the energy transition. They will also reflect a more divided and more uncertain world.

A new world is dawning.