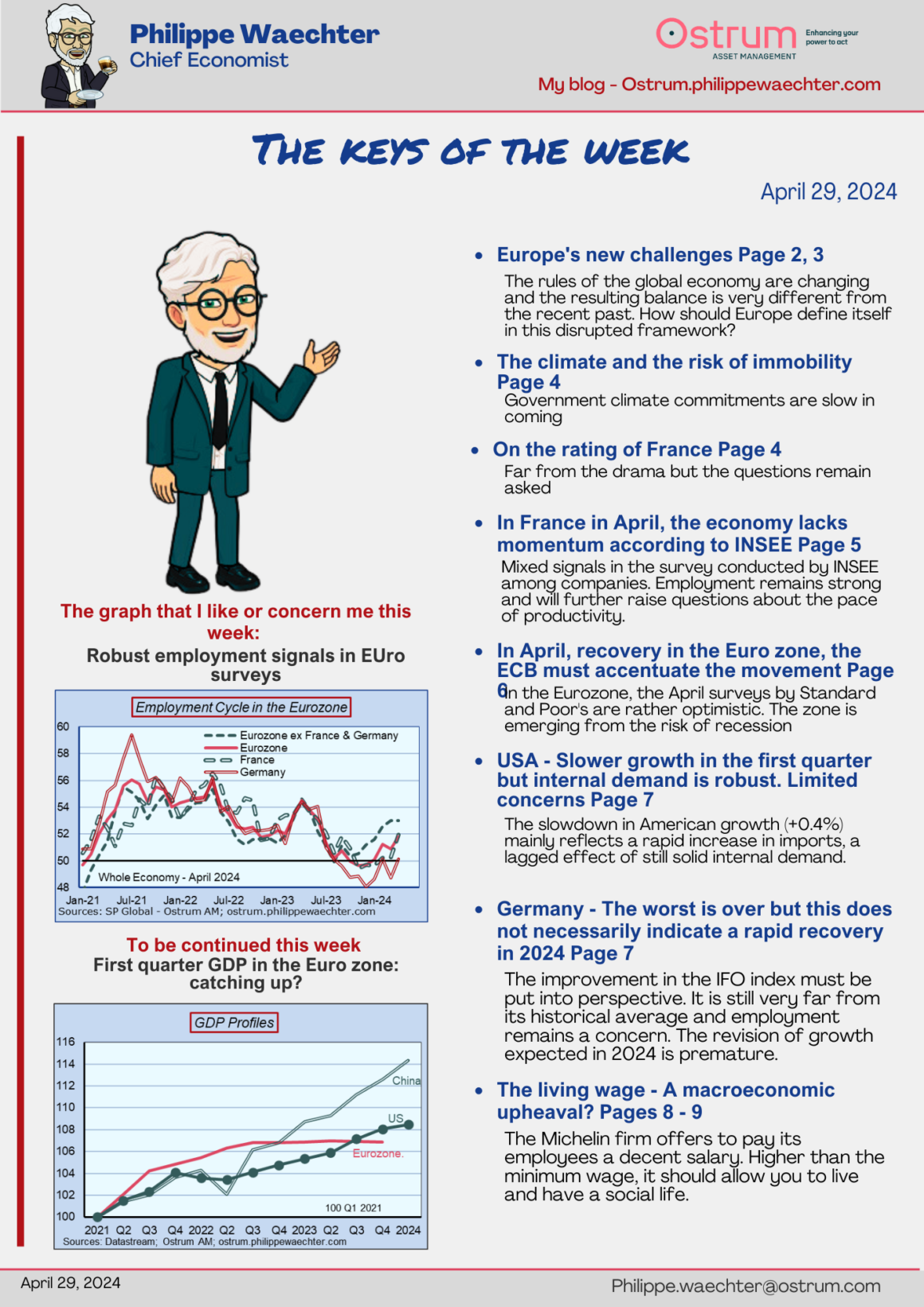

My point of attention: Employment indicators in European surveys are improving everywhere

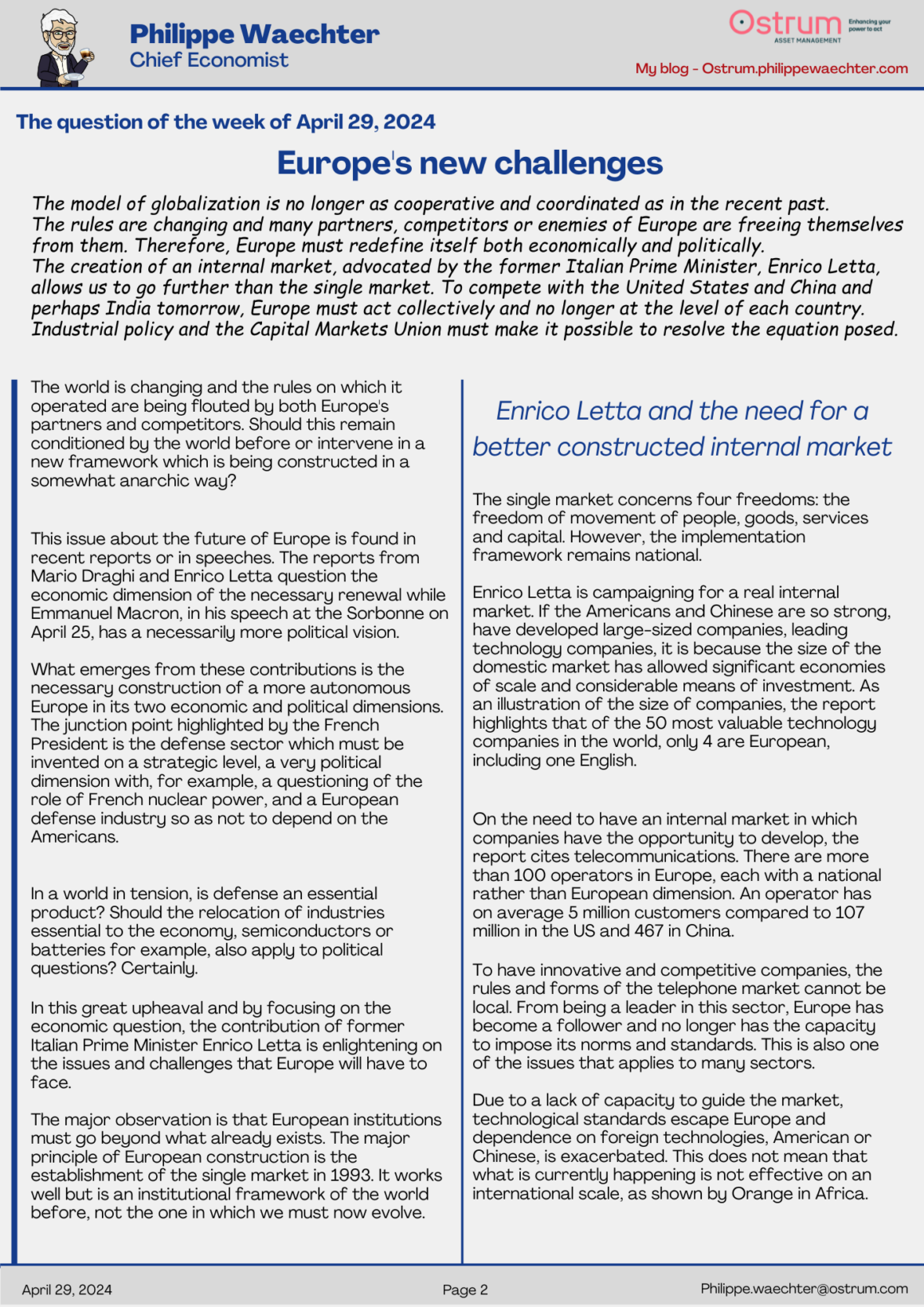

My expectation this week: growth figures for the first quarter in the Euro zone – A figure that is too low would greatly penalize the average growth rate of the whole year.

=> Europe’s new challenges Page 2, 3

The rules of the global economy are changing and the resulting balance is very different from the recent past. How should Europe define itself in this disrupted framework?

=>The climate and the risk of inaction Page 4

The government’s commitments on the climate are slow in coming

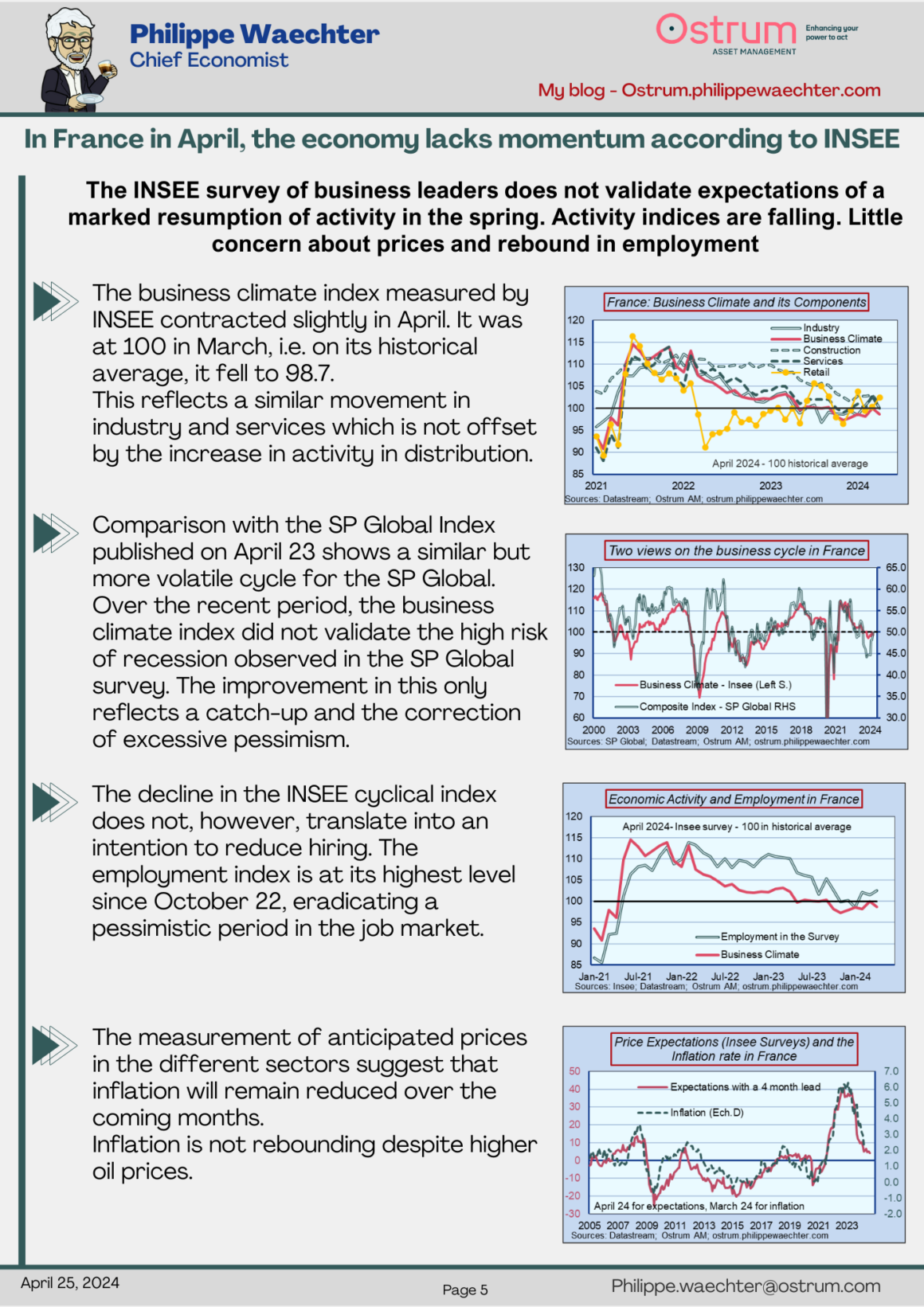

=>On the rating of France Page 4

Far from the drama but the questions remain asked

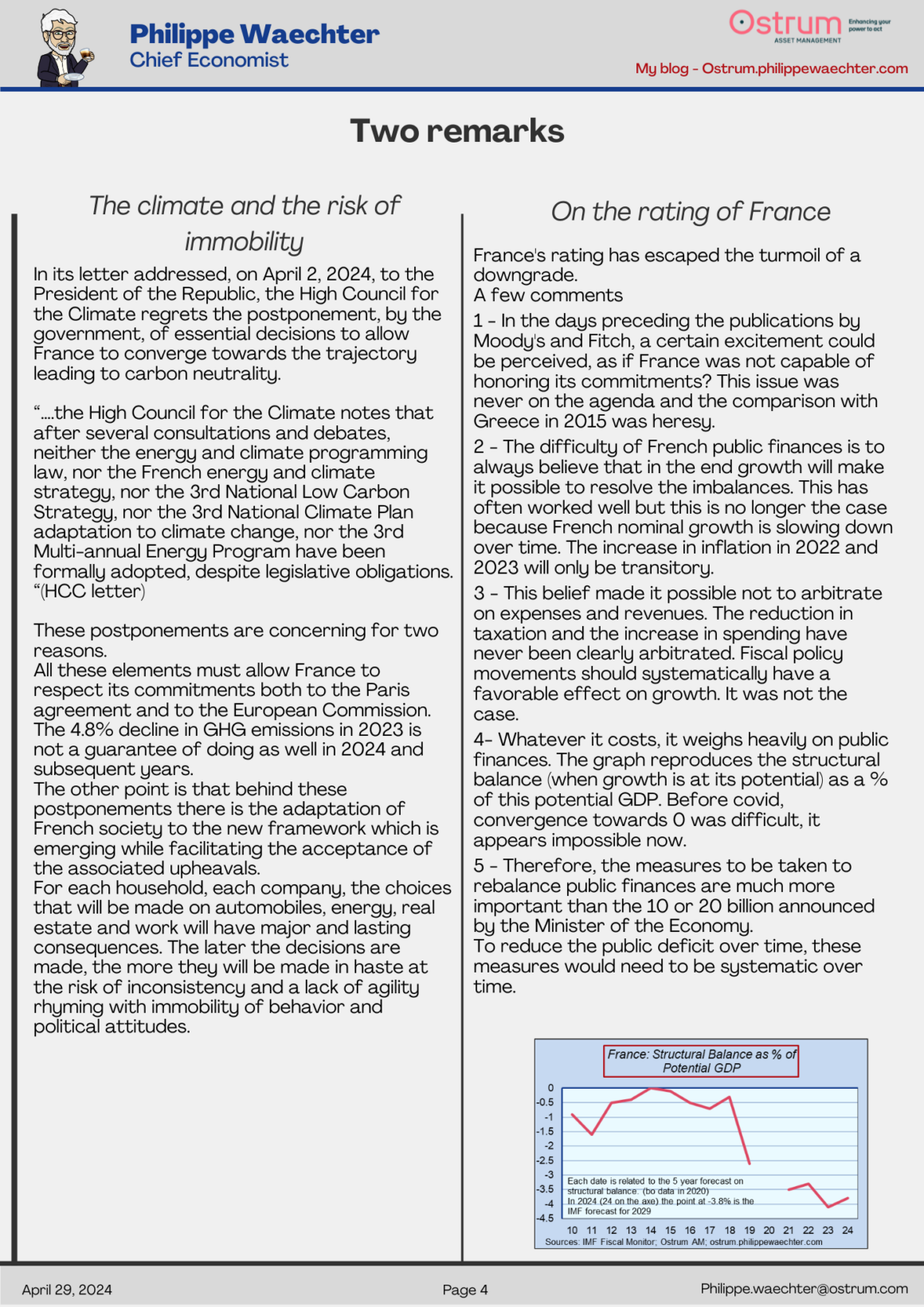

=>In France in April, the economy lacks momentum according to INSEE Page 5 Mixed signals in the survey conducted by INSEE among businesses. Employment remains strong and will further raise questions about the pace of productivity.

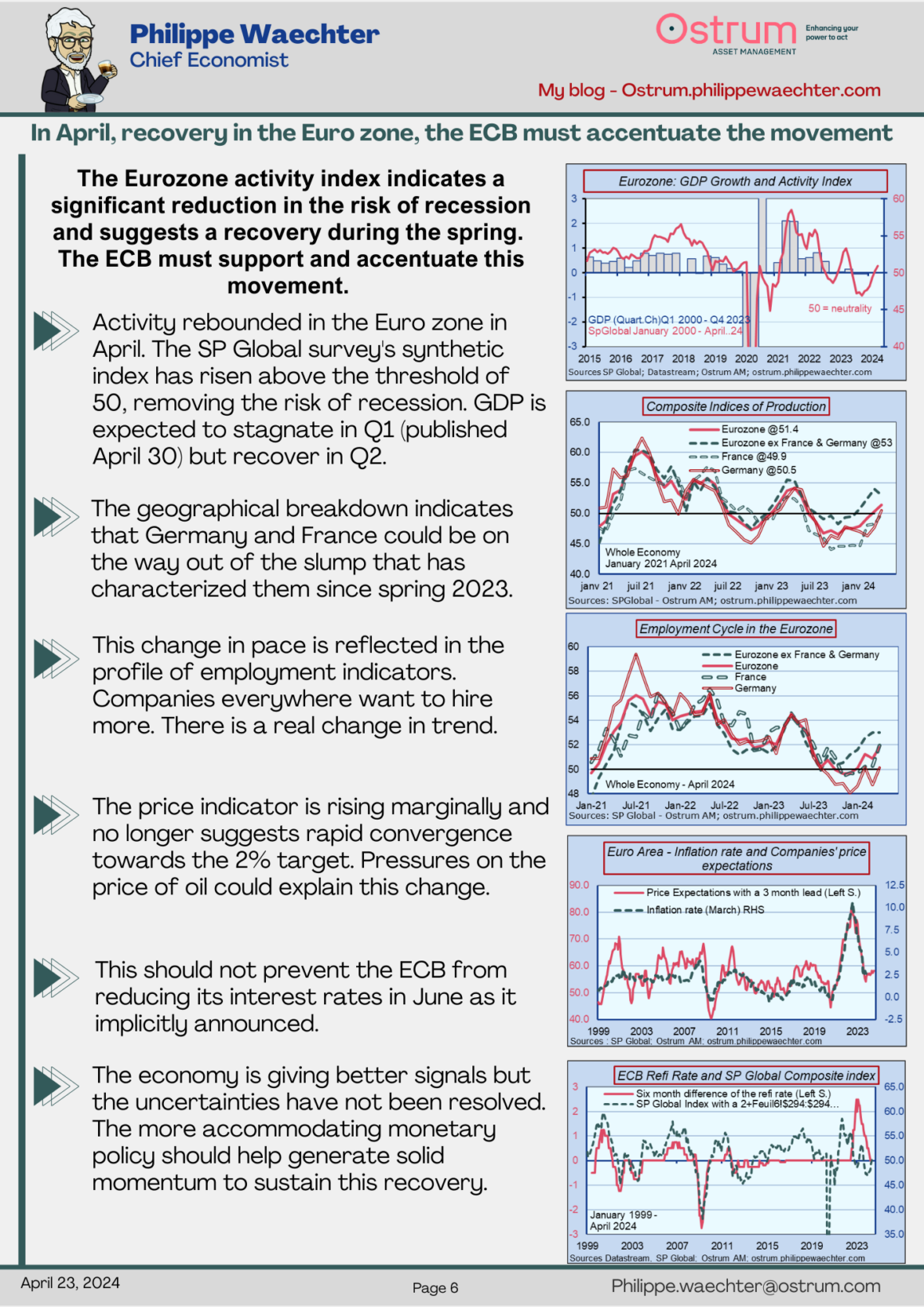

=>In April, recovery in the Euro zone, the ECB must accentuate the movement Page 6

In the Euro zone, the April surveys by Standard and Poor’s are rather optimistic. The zone is emerging from the risk of recession

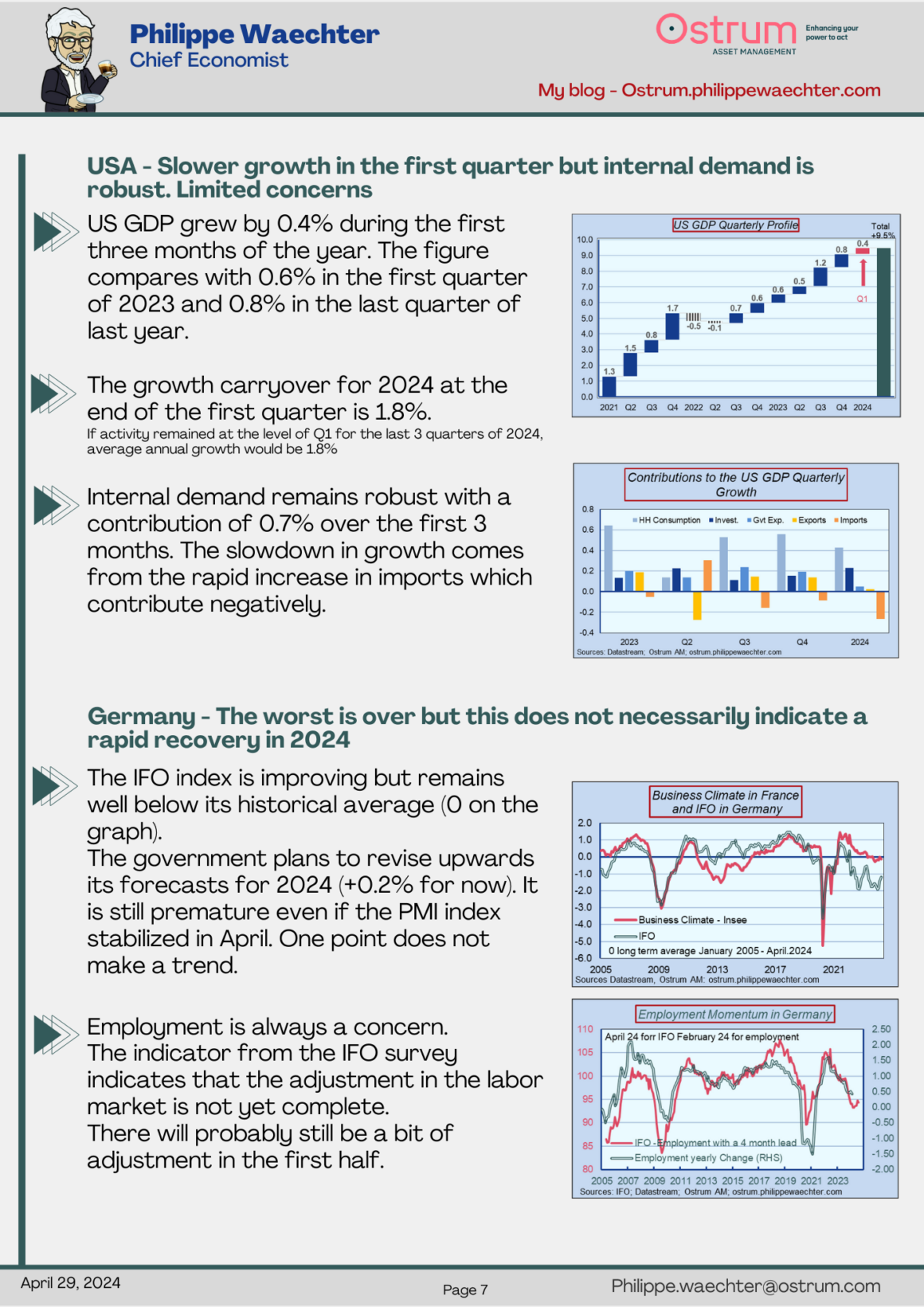

=>USA – Slower growth in the first quarter but internal demand is robust. Limited concerns Page 7

The slowdown in American growth (+0.4%) mainly reflects a rapid increase in imports, a lagged effect of still solid internal demand.

=>Germany – The worst is over but this does not necessarily indicate a rapid recovery in 2024 Page 7

The improvement in the IFO index must be put into perspective. It is still very far from its historical average and employment remains a concern. The revision of growth expected in 2024 is premature.

=>The living wage – A macroeconomic upheaval? Pages 8 – 9

The Michelin firm offers to pay its employees a decent salary. Higher than the minimum wage, it should allow you to live and have a social life.