My point of attention: Europe is on the road to decarbonizing its electricity production

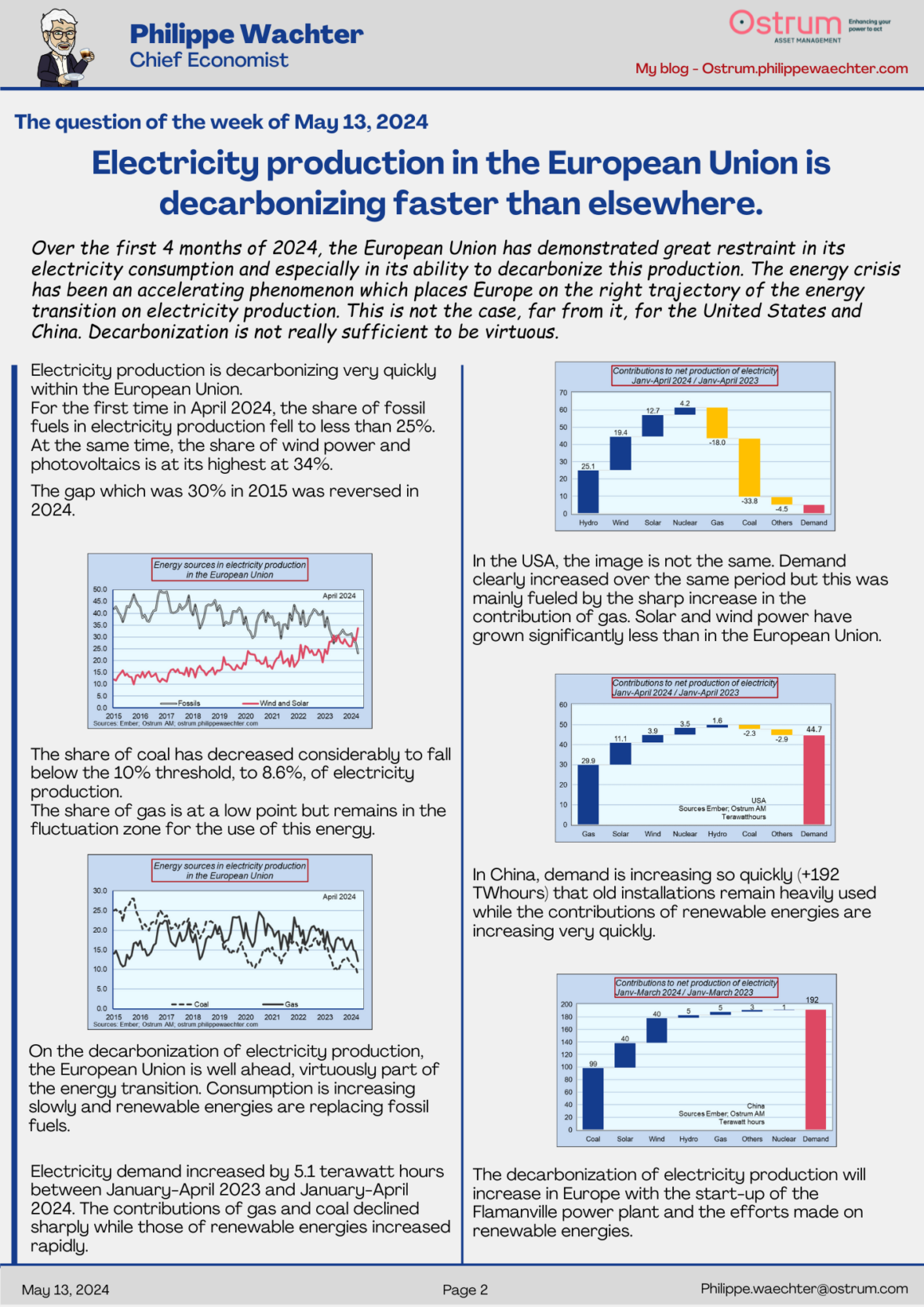

My expectations this week: the US inflation rate for the month of April

7 themes this week

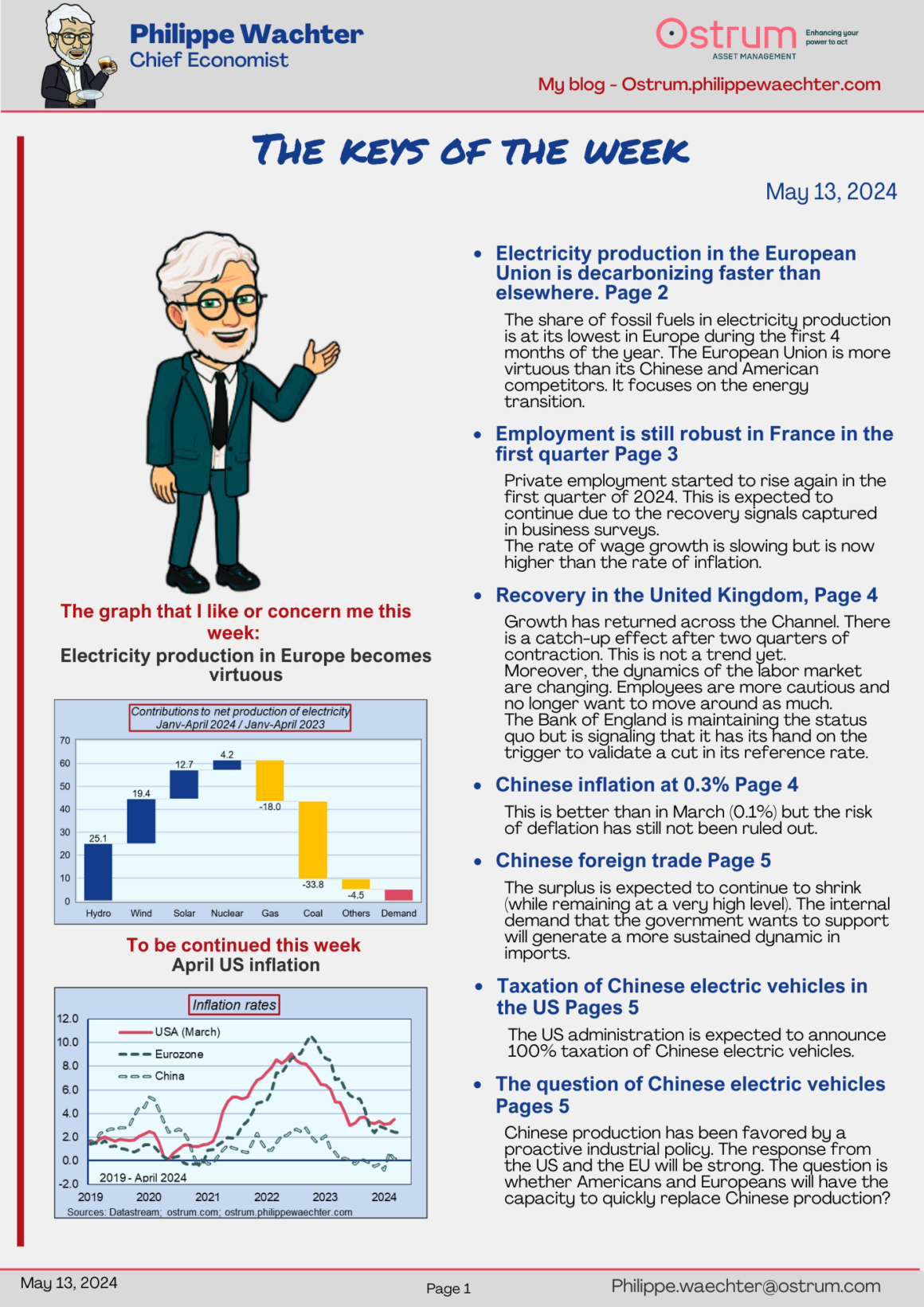

=> Electricity production in the European Union is decarbonizing faster than elsewhere. Page 2

The share of fossil fuels in electricity production is at its lowest in Europe during the first 4 months of the year. The European Union is more virtuous than its Chinese and American competitors. It focuses on the energy transition.

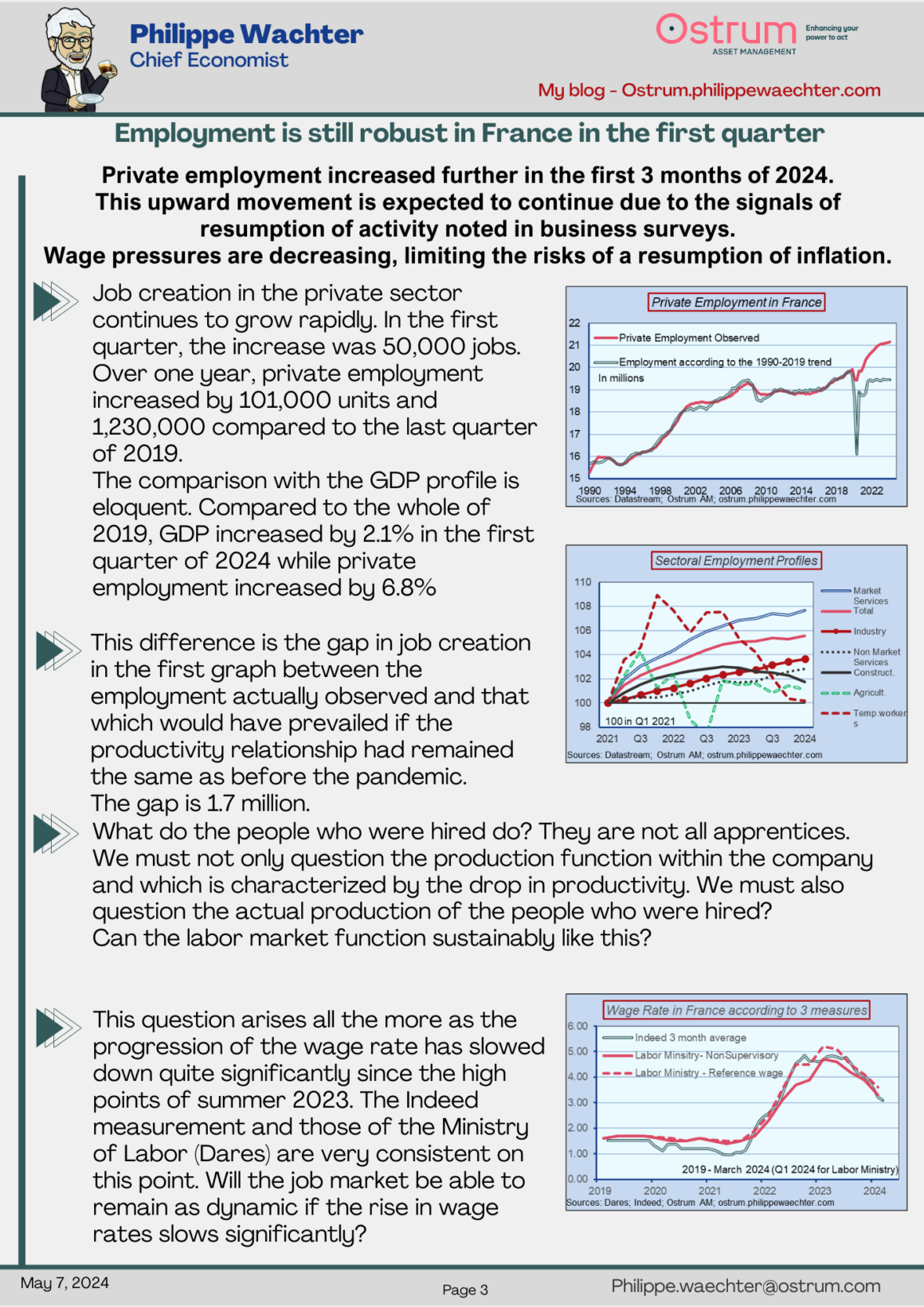

=> Employment is still robust in France in the first quarter Page 3

Private employment started to rise again in the first quarter of 2024. This should continue due to the recovery signals captured in business surveys. The rate of wage growth is slowing but is now higher than the rate of inflation.

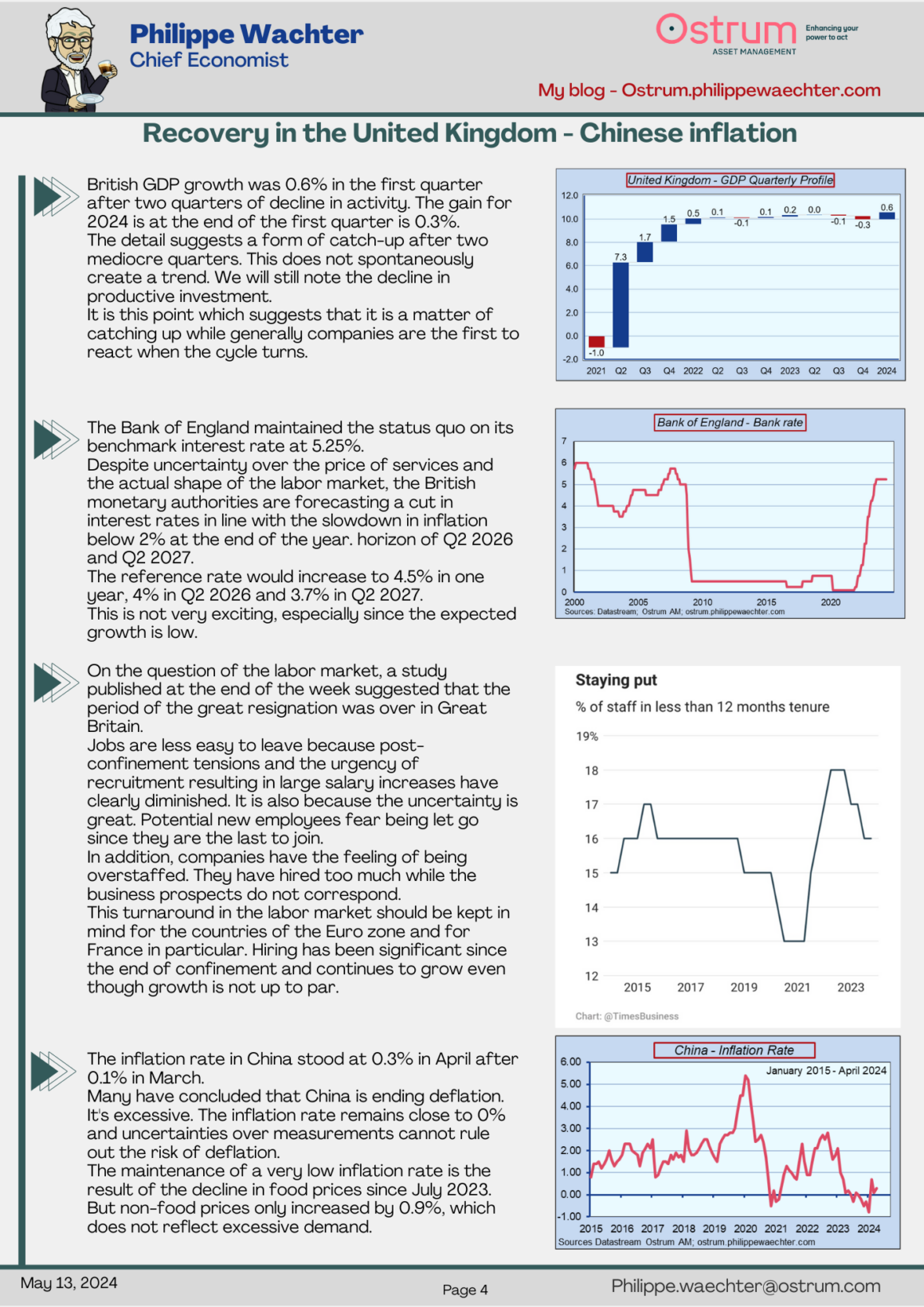

=> Recovery in the United Kingdom, Page 4

Growth has returned across the Channel. There is a catch-up effect after two quarters of contraction. This is not a trend yet. Moreover, the dynamics of the labor market are changing. Employees are more cautious and no longer want to move around as much. The Bank of England is maintaining the status quo but is signaling that it has its hand on the trigger to validate a cut in its reference rate.

=> Chinese inflation at 0.3% Page 4

This is better than in March (0.1%) but the risk of deflation is still not ruled out.

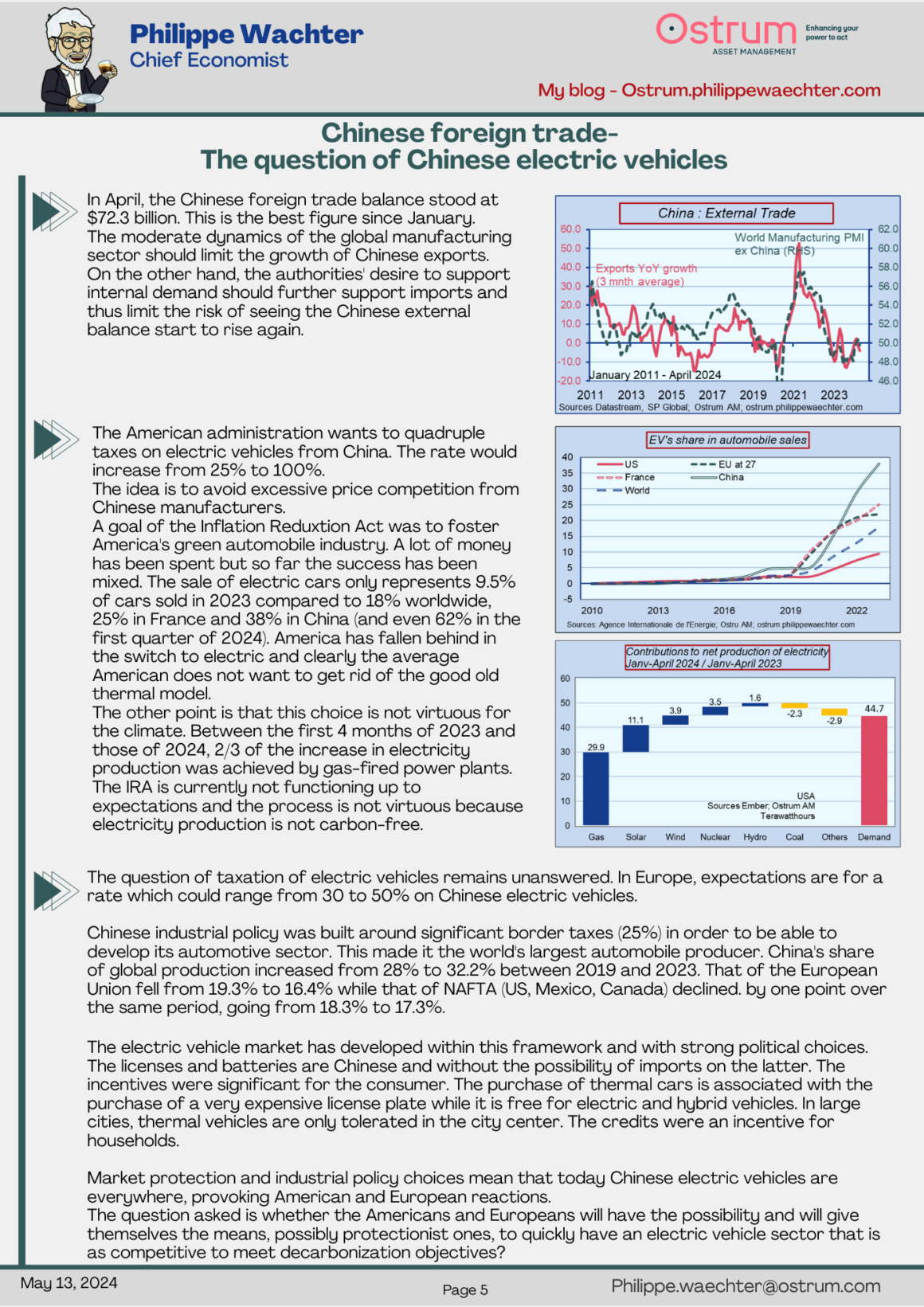

=> Chinese foreign trade Page 5

The surplus should continue to shrink (while remaining at a very high level). The internal demand that the government wants to support will generate a more sustained dynamic in imports.

=> Taxation of Chinese electric vehicles in the US Pages 5

The American administration should announce 100% taxation of Chinese electric vehicles.

=> The question of Chinese electric vehicles Pages 5

Chinese production has been favored by a proactive industrial policy. The response from the US and the EU will be strong. The question is whether Americans and Europeans will have the capacity to quickly replace Chinese production?