German growth, US Industrial Production, UK retail sales, Chinese external trade and industrial production, US Jolts, Retail sales and inflation rate in the US

Highlights

German GDP annual growth for 2019 (jan.15)

The annual GDP growth for 2019 will be release this week. It is expected to be 0.6% after 1.5% in 2018. It is way below the historical growth average of 1.36% since 1991. The 0.6% is consistent with a 0.2% growth during the last three months of the year. Therefore the carryover is expected to be close to 0.1%. This low starting point will limit the German growth performance for 2020.

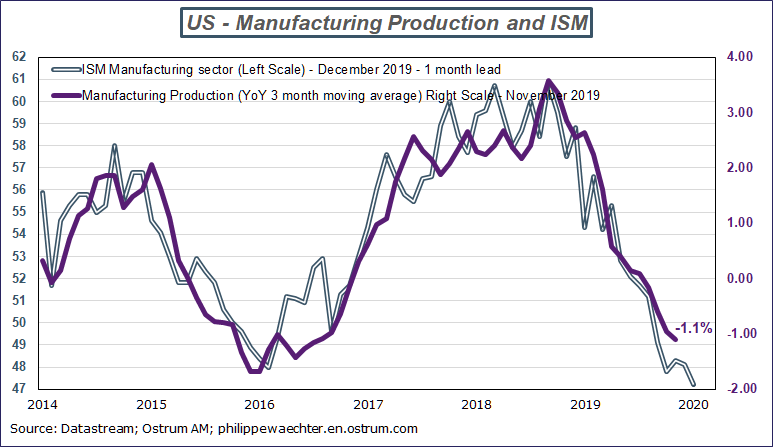

The US industrial production for December (jan.17)

The US manufacturing production index has a profile consistent with the ISM synthetic index for the manufacturing sector. This latter dropped to 47.2 in December. This should pull down the YoY change in the industrial production. The NY Fed and the Phyli Fed indices on economic activity in January will also be released.

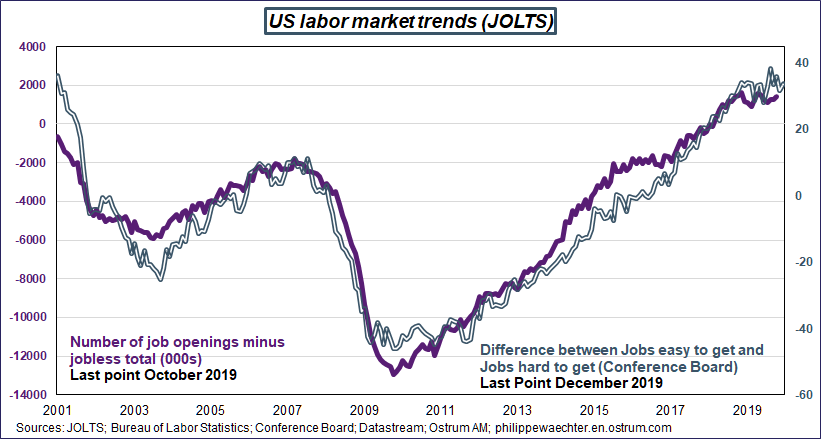

Jolts number for November (Jan.17)

After the December report on the labor market which showed a kind of neutral signal, it will be interesting to look at the Jolts which reflects flows on the US labor market. The dynamics has changed since the beginning of the year, we expect a confirmation.

External trade in China for December (jan.14)

Exports’ dynamics has been negative since last September. They have a profile consistent with the global business cycle measured through the ISM index for the manufacturing sector. The drop in the ISM is not good news for the Chinese external trade even if the surplus remains very large due to the deep drop in Chinese imports.

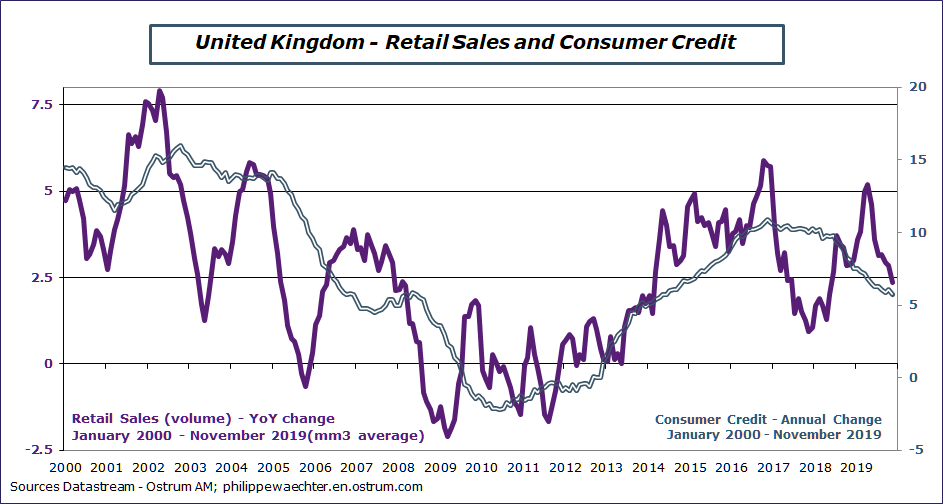

UK retail sales for December (jan.17)

The recent picture is weak on retail sales side in the UK. An improvement can be expected after the general elections result. Brexit will take place n January the 31st. This reduces uncertainty. But it may be short lived as new issues will arrive such as details of the final deal with the European Union. Boris Johnson wants an agreement before the end of 2020. It should be hard to have a compact with the EU at this date. CPI for December (15)

Retail sales (jan.16) and CPI (jan 14) for December in the US

The inflation rate will be higher than in November. The main reason is a higher oil price in December. On retail sales, we can expect a small reversal after November’s weakness. Nevertheless, the expenditures’ momentum is now lower.

Other statistics: Industrial production for November in the UK (13) and in China for December (17); NFIB for December in the US (14); US housing starts for December (17), Consumer confidence in the US Michigan index (17)

What to keep in mind from last week ?

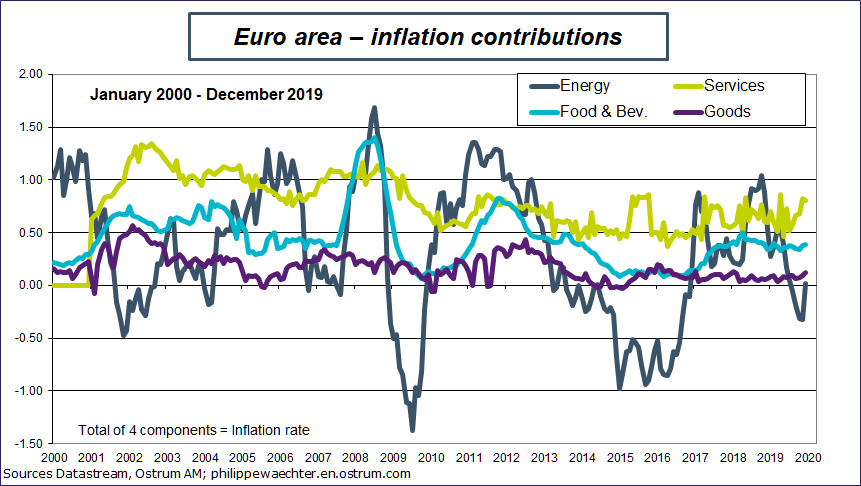

Rebound of the Eurozone Inflation rate in December

The inflation rate jumped from 1% in November to 1.3% in December. This reflects only a higher contribution of the energy sector. Its contribution was negative in November at -0.3% and was 0% in December. At the end of 2018, the oil price dropped dramatically. It had a coherent behavior with what happened on the stock market. The price is more stable this year and the acceleration in the inflation rate is due to what happened last year rather than new conditions this year. The impact on monetary policy expectations are null. The core inflation rate was stable at 1.3%. We expect it to converge to its recent average which is close to 1%.

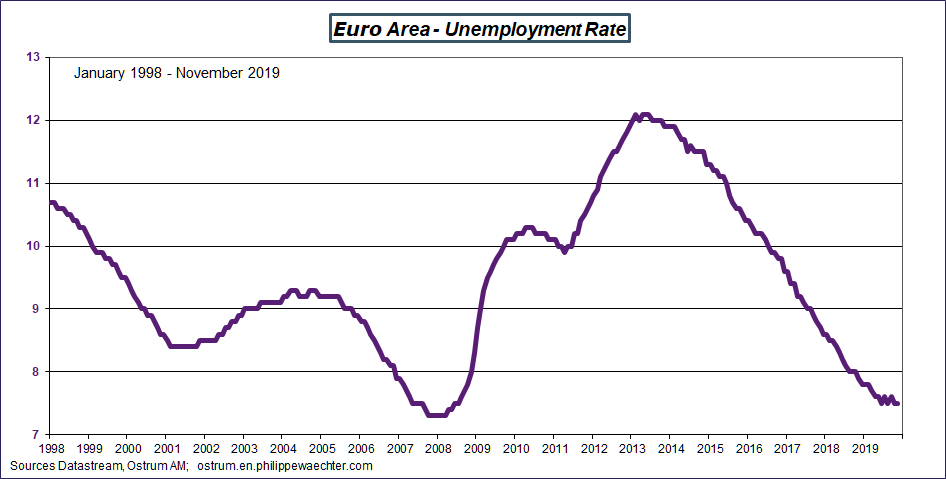

The unemployment rate was stable at 7.5% in November in the Eurozone

That’s an interesting question. As we see it on the graph, the unemployment rate is close to its lowest level at 7.3%. This may correspond to full employment as the eurozone has never been lower in the past. One natural question: would it be necessary to have a pro-cyclical fiscal policy as the eurozone is already at full employment ? The answer is a definite yes as 7.5% is clearly too high to be satisfying. Southern countries (Greece (16.8%), Spain (14.1%), France (8.4%) and Italy (9.7%)) must improve the efficiency of their labor market to converge to lower unemployment rate.

The US labor report will not force the Federal Reserve to change its monetary policy on the upside

The number of jobs creation was at 145 000 versus an average of 176 000 for the whole year. The main adjustment was on the manufacturing sector (strong change during the last three months with the GM strike in October). The unemployment rate remains at 3.5% and YoY changes in wages dropped dramatically. It was below 3% (at 2.9%) for the private sector as a whole. The graph suggests that nothing will happen rapidly on the Fed’s side.

The Chinese inflation rate was stable in December at 4.5%

The food price contribution was marginally lower but still very high. The trade agreement between China and the US will relax the food constraint on China. The inflation rate will revert.

Industrial production indices was up in November in France, Italy and Spain with positive surprises for the three countries

The global activity was up in December in the US and in the Eurozone

In December, the global indices for the ISM survey in the US and the Markit survey in the Eurozone were up compared to November. None of them shows the possibility of a recession in the short term. They both have the same characteristics; the manufacturing sector in in recession (47.2 in the US and 46.3 for the Euro Area) but a rebound was seen on the non manufacturing sector. Nevertheless, the momentum of both index is limited. The US index is consistent with a 2% growth and the euro area with a 1% growth.

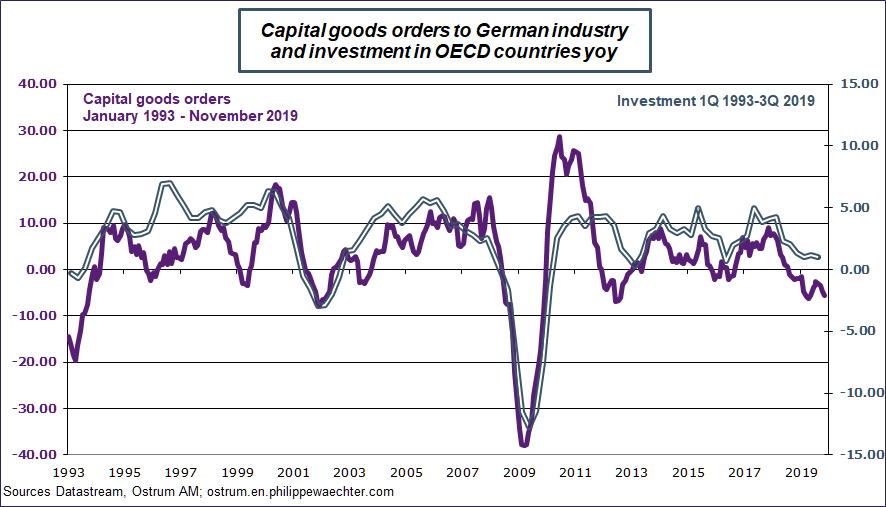

The capital goods orders in Germany are consistent with a drop in OECD investment.

Capital goods dropped in November. It was down -5.5% on a year. The geographical distribution shows that domestic orders crashed at -7.7% as were non euro orders at -8.6%. It was partially compensated by the 4% growth coming from the Euro Area.

What bother me is that these orders are closely linked with the OECD corporate investment. We can expect that this companies’ investment may drop around 0% at the end of 2019 or the beginning of 2020. This is clearly not a source of impulse for the business cycle.

The good news for the global business cycle comes from the stability in the oil price. The risk of an oil shock falters and the risk of a weaker consumption profile in coming months appears limited.

The oil price was down at 65 dollars versus 69 last week.

The escalation of tensions between Iran and the US was more limited than expected at the end of last week. They both realized that an escalation was a mistake. Nevertheless it doesn’t mean that risks are over, but the risk of a war is much lower this week.

The analysis on the French households’ confidence index shows a slight drop but no break. See here

The document can downloaded