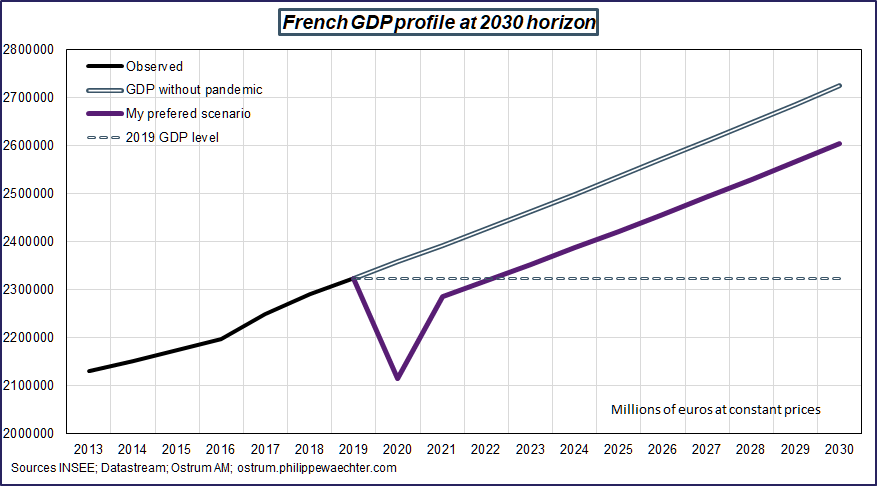

INSEE forecasts a GDP contraction of -9% in 2020, which would be consistent with the convergence to the 2019 GDP level as soon as 2022. This is the hypothesis I mentioned (here in French) at the beginning of July . INSEE still indicates that many uncertainties remain with the resurgence of the health risk while the catching up on the consumption of goods has taken place but not on services (tourism in particular).

The important thing to deal with it will be the behavior of the labor market. There were already 715,000 job cuts in the first half of the year. INSEE is optimistic about the second part of the year pending a stabilization in the number of jobs.

The government’s plan, notably by postponing the end date of short-time working scheme, will make it possible to limit the risks on the income of the French reducing the risk of catastrophe on the economy.

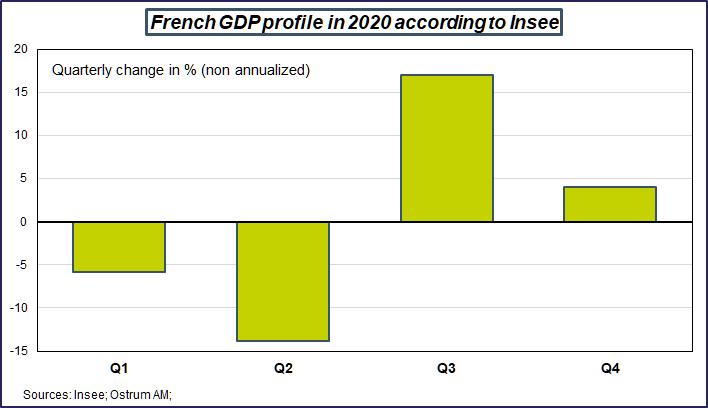

In its new economic report, INSEE confirmed its scenario of July 8 in which it indicated a significant catching up after the exit of the lockdown. The institute confirms its expectations of a 9% contraction for the whole year 2020 with the following profile: strong decline during the lockdown period then a significant rebound when the constraints were lifted before the return to a more moderate trend. This would translate into a contraction of -5.3% in the first quarter, -13.8% in the second before the recovery of 17% in the third and only +4% during the last three months of the year.

By incorporating the carry over at the end of 2020 for 2021 associated with the scenario mentioned above and a trend growth of 1.4% (average growth from 2013 to 2019), then the GDP would converge towards its level of 2019 during the year 2022.

Subsequently I maintained the hypothesis of a growth of 1.4% until 2030.

In details, the GDP profile reflects the catching-up in the consumption of goods after the end of the lockdown and associated with a rapid recovery of the industrial production. This is a usual situation emerging at the end of a recession. Consumers restrict themselves during the downturn in activity but spend again when the constraints recede. (For example, the purchase of a durable good (car for example) is postponed as long as the situation is constrained. Then the sales bounce back. In this car market and at this moment, the French government aid has clearly contributed to this rebound).

What is new in the pattern of the current crisis is the situation in services. Health constraints still weigh heavily and tourism, so important in France, does not have the usual pace.

The renewal of health risks and the end of the catching up in the goods sector create uncertainty at the risk of inhibiting behavior during the last quarter. This is what was expected.

For INSEE, this will result in a stabilization of employment in the second half of the year after a loss of 715,000 jobs over the first six months of the year. It is a rather proactive vision because of the great economic fear of the increased risk of companies’ bankruptcy.

This expectation on the employment profile will result in a temporary rise in the unemployment rate to 9.5%