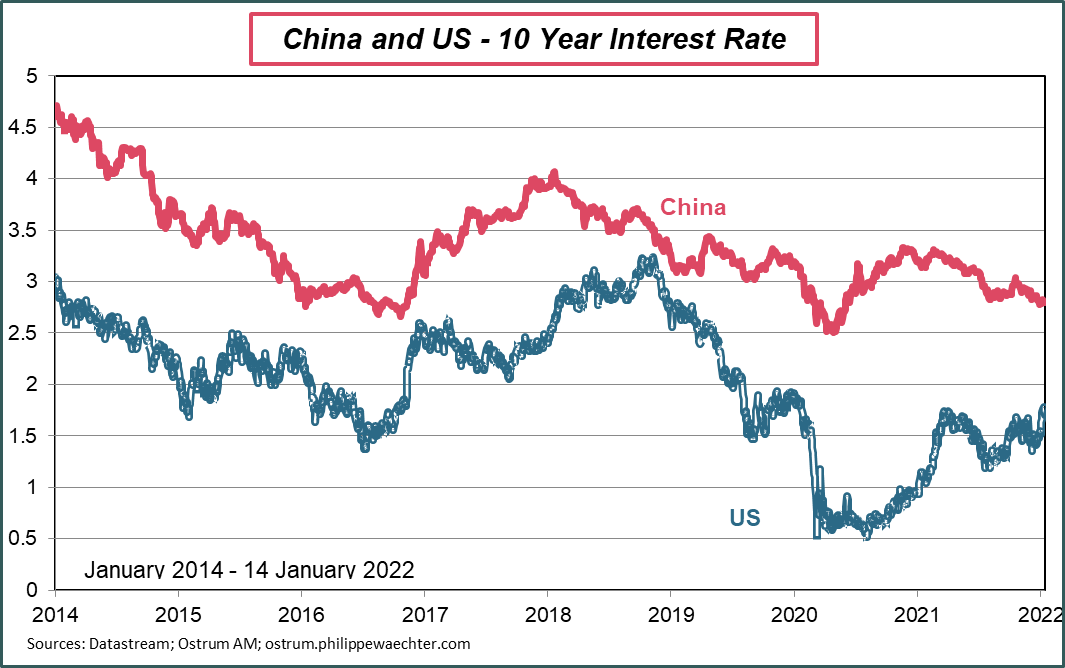

The slowdown in growth and the very low inflation in China will lead to the implementation of a very accommodating monetary policy. This has already started and will continue throughout the year due to somewhat long response times. This monetary orientation will be in opposition to that led by Washington. This cycle opposition between the two largest economies in the world will cause new tensions and volatility on currencies and commodity prices.

Chinese growth is slowing

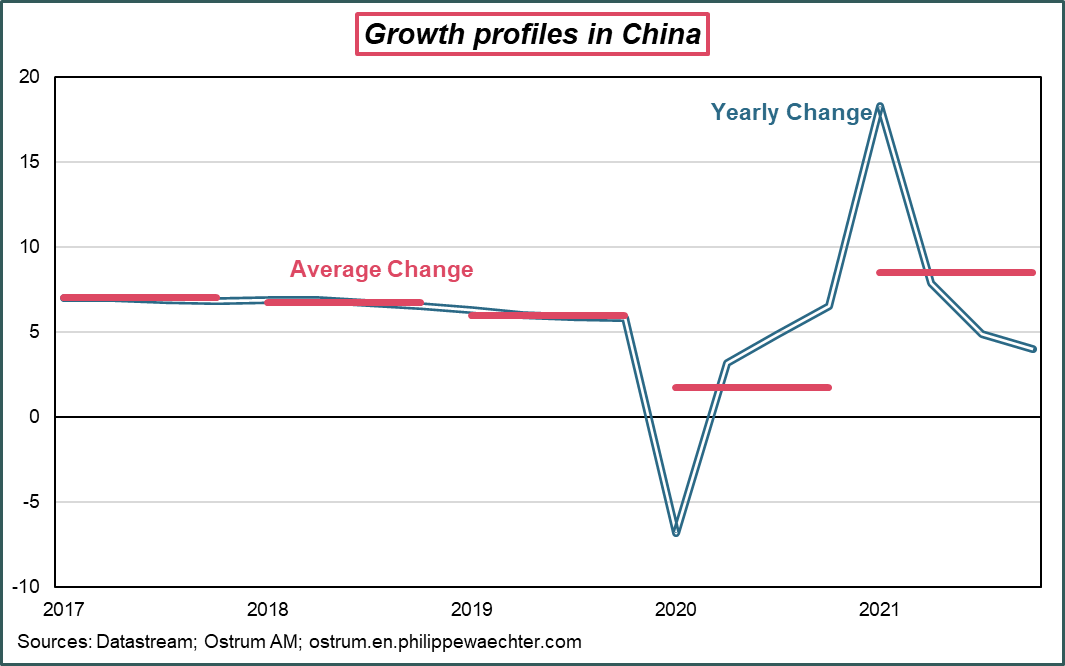

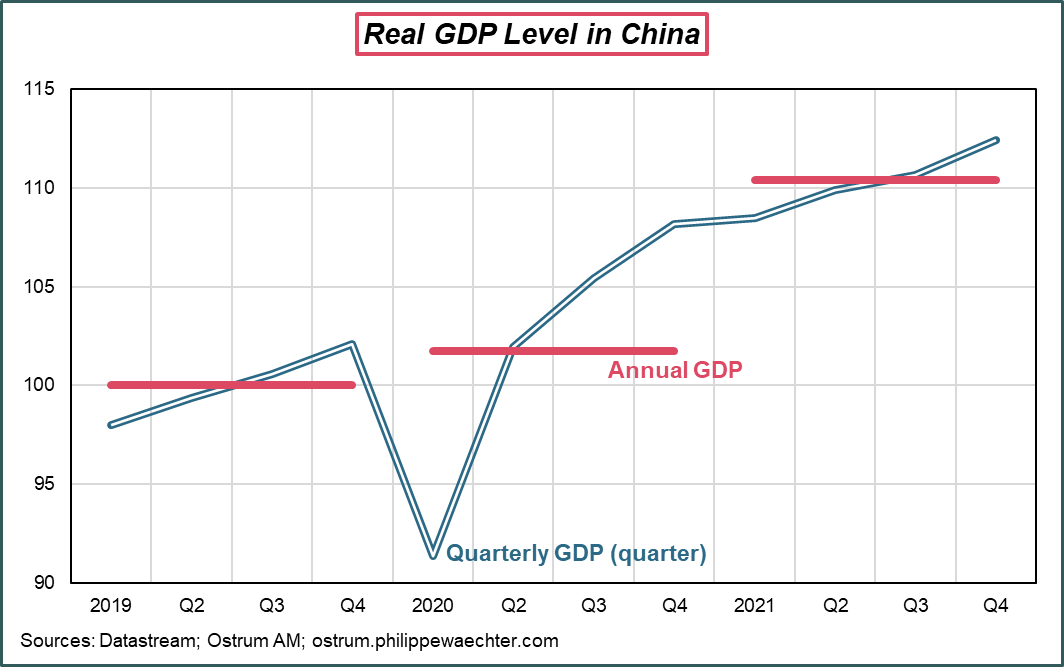

Activity in China increased by 4% over one year in the 4th quarter of 2021. We can see on the first graph the particular pace of Chinese GDP with a marked dip in the first quarter of 2020 during the lockdown then the recovery to almost 20% over one year at the beginning of 2021 and finally the slowdown at the end of 2021.

The annual average figure is 8.1% and reflects the catch-up effect after the very weak expansion of 2020.

For 2022, the carry over growth at the end of 2021 stands at 1.9%. This is a bit stronger than expected and reflects the revisions that have been made to China’s GDP profile.

In detail, consumption is a source of fragility for the Chinese economy. They only believe by 1.7% in December over one year. This is the lowest figure since August 2020.

Inflation is reduced

Chinese domestic demand appears to be sluggish.

The slowdown in inflation illustrates this lack of robustness in domestic demand (third graph). While consumer prices in the US and in the Euro zone were clearly on the rise in 2021, those recorded in China fell sharply to 0.9% on average over the year.

Divergent monetary policies

China’s central bank has begun to apprehend of this fragility of internal demand.

It had lowered the reserve requirement rate in December and this morning reduced the rate on 1-year loans. This monetary policy aims to support internal activity in order to maintain a robust growth rate. It must therefore quickly reverse the dynamic and that is why one must expect a very accommodating monetary policy in 2022 in the Middle Kingdom.

The objective of Chinese monetary policy is at three levels: to ensure price stability but also the stability of the renminbi while contributing to growth.

A more accommodating monetary policy in China translates into an improvement in activity with a fairly long delay of around one year.

This is also reflected, and always with fairly long delays, in slightly more marked upward pressure on prices, but a currency that depreciates since this reinforces the recovery in activity. The impact is rather positive on the price of raw materials due to the structure of Chinese production.

This dynamic of the Chinese economy and its monetary policy should be compared with what is happening in the USA where the central bank is seeking to normalize its strategy since economic activity is returning to a more “normal” pace. As early as March this year, it could raise its benchmark interest rate and subsequently reduce the size of its balance sheet.

Such an action by the Fed would deteriorate financial conditions on a global scale by causing a reduction in private liquidity and encouraging a rise in the dollar. The impact would then be a fragility of the dynamics of asset prices and an inflection in the dynamics of capital flows.

The PBoC with its more accommodating monetary policy wants to revive the internal dynamics of China with a risk of depreciation of the renminbi and an upward pressure on the price of raw materials. The Fed’s tougher tone will weigh on the global economic cycle, favor the rise in the greenback and the inflection in the price of commodities on the downside. It is this new opposition that will animate the year 2022. The political dimension of this confrontation will not fail to fascinate us.