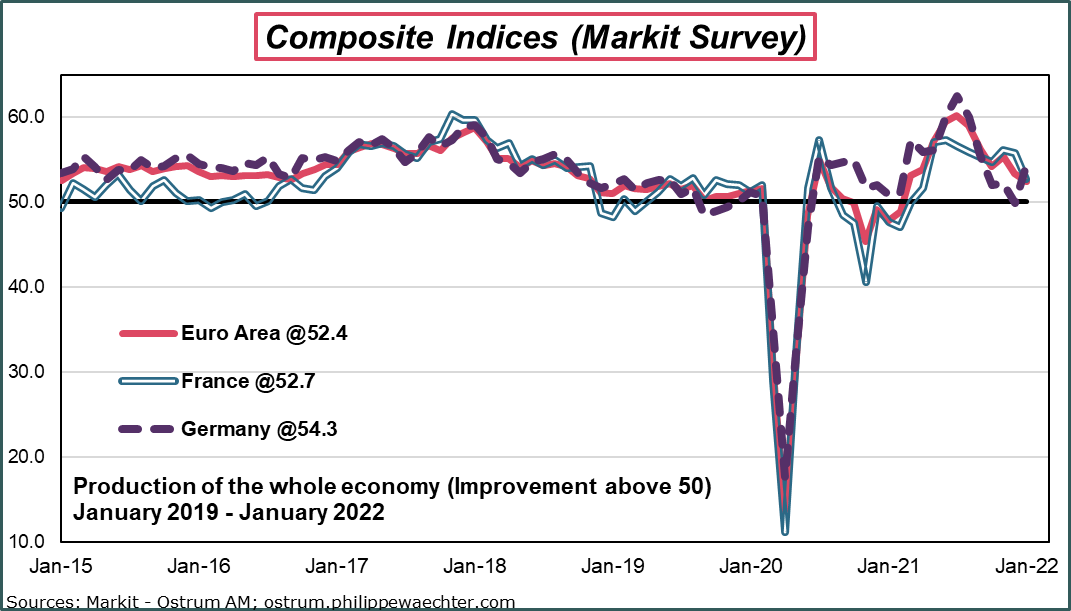

The Markit index for the entire economy of the Euro zone dipped in January 2022. It stood at 52.4, losing almost one point compared to December. Economic activity continues to grow but at a slower pace.

In France and Germany the paces are opposite. The German index rebounds while the French index retreats rapidly.

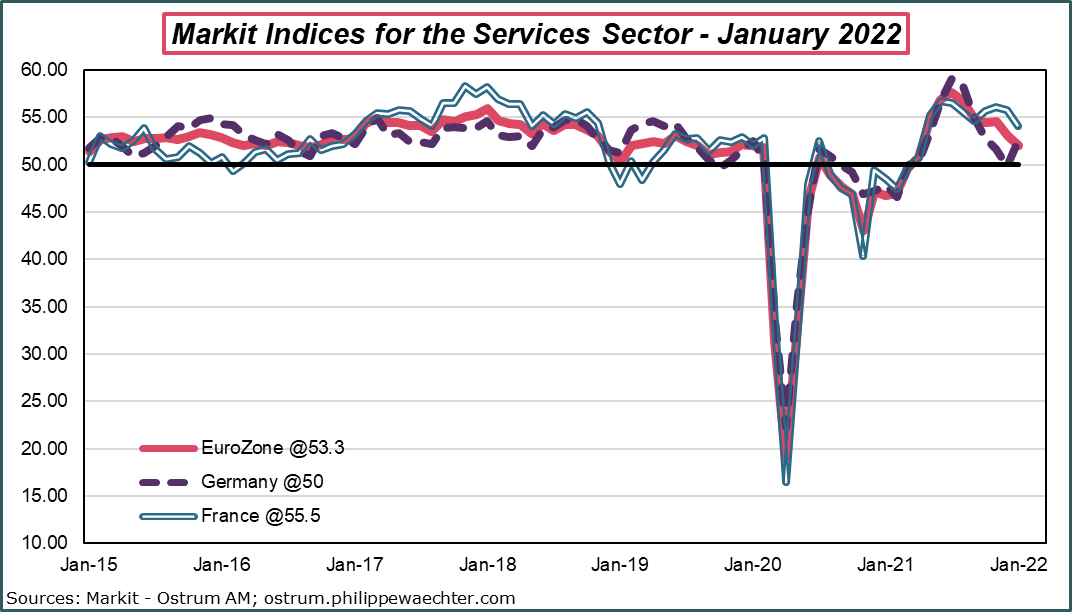

This divergence between France and Germany results mainly from the health, Omicron, effect (and the impact on catering, transport, etc.). German services were heavily penalized at the end of last year, while France suffered in January. This effect is certainly not specific to France and explains the decline in the composite index for the Euro zone.

We can hope that this impact does not go too far beyond the month of January.

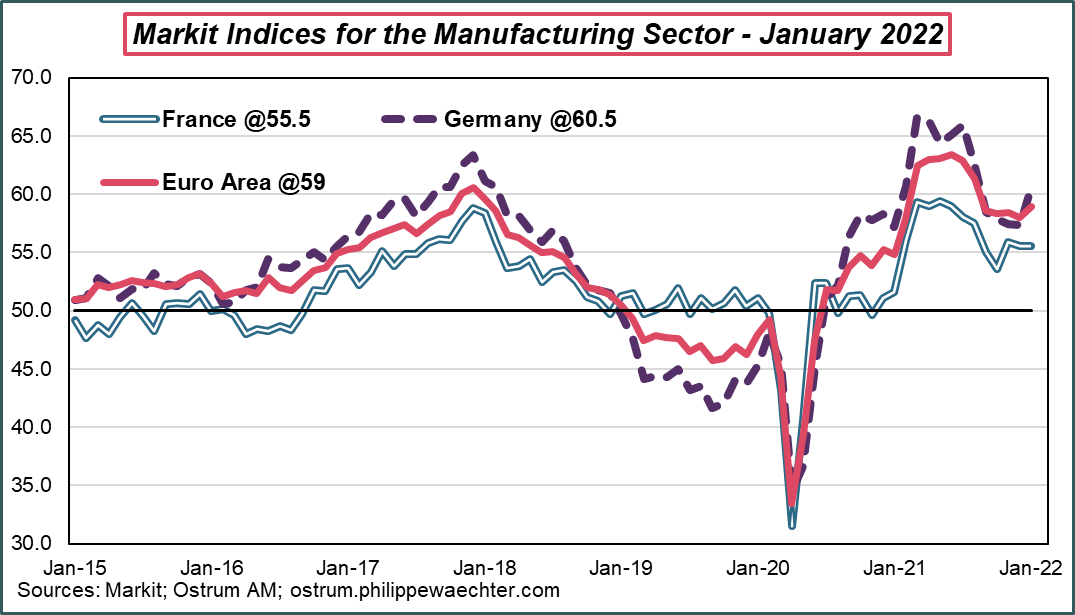

The manufacturing sector remains very robust. The Euro zone index is at 59 against 58 in December. The German indicator is also increasing rapidly to 60.5 while the French index is stable at 55.5.

The inflation issue

Inflationary pressures started last spring, and companies in the manufacturing sector were on the front line. They experienced a rapid increase in their orders with stocks that were insufficient to be able to respond spontaneously to this new demand. This had resulted in tensions of all kinds and a rise in inflation.

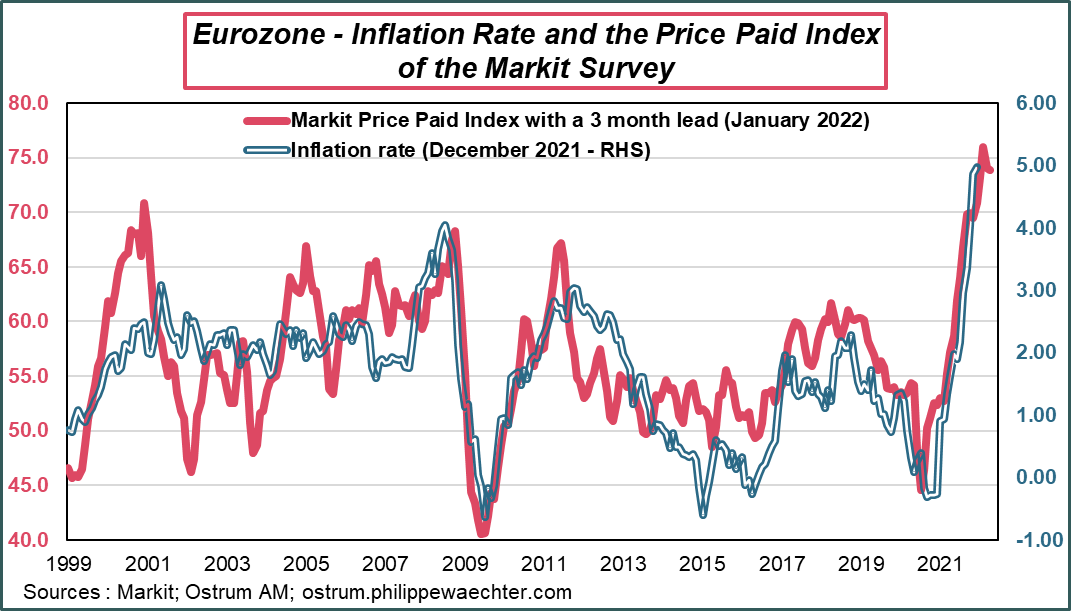

The graph linking the prices paid by companies and inflation shows a consistent interaction. For a very long time the relationship between the two indicators has worked well.

In the increase in prices paid, there are two dimensions: one linked to the price of energy since the contribution of energy to the inflation rate explains half of the inflation in the Euro zone in December 2021. Business leaders suffer from this situation.

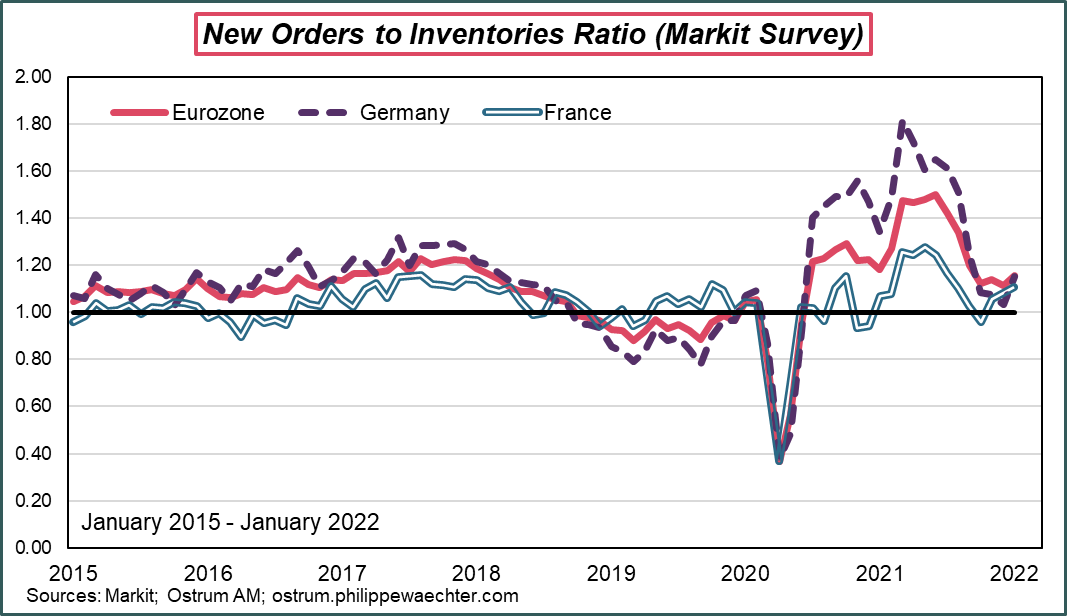

There is a second dimension which reflects the effect of the demand shock on the supply. There had been a sharp rise in the ratio of new orders to inventories. This reflected the imbalance within the companies. These indices are normalizing in the Euro zone but also in Germany and France. Orders remain strong but inventories have increased.

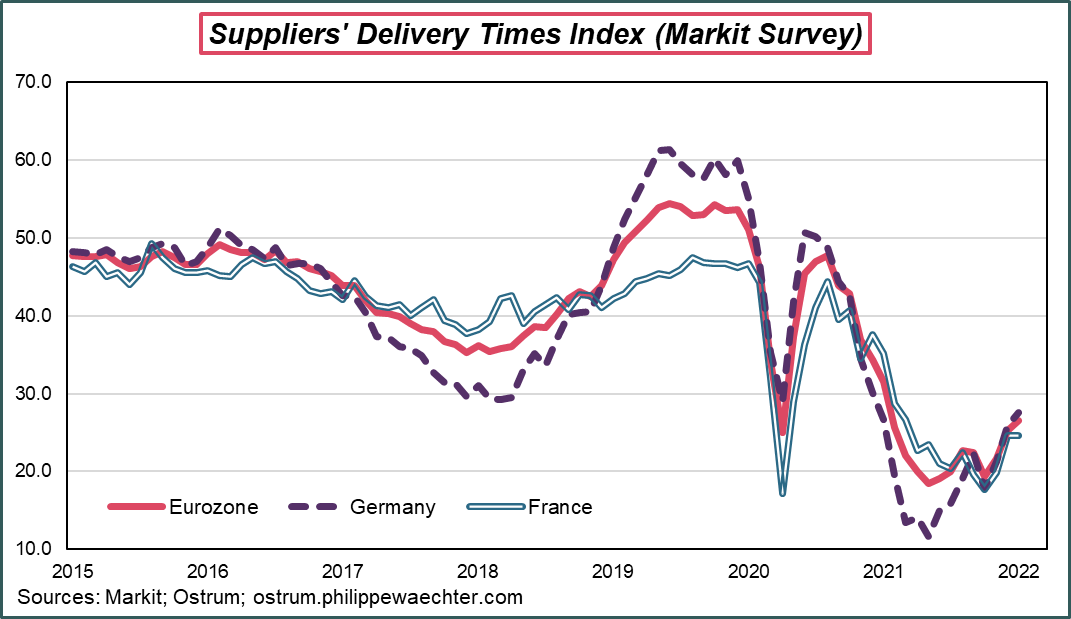

The other interesting indicator is that of delivery times. At the time of the demand shock, lead times had clearly lengthened, particularly in Germany. The movement is being reversed. The delays remain long but they are reduced. This is a good signal for rebalancing the internal situation of companies.

The peak in inflation linked to the demand shock has probably passed and this is a good signal about the robustness and responsiveness of companies and to avoid too great a macroeconomic imbalance over time.