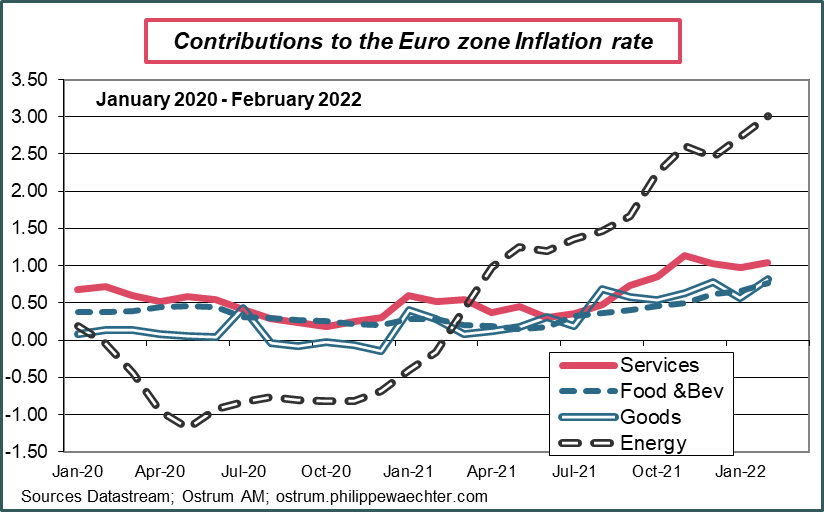

The inflation rate in the Euro zone stood at 5.8% in February 2022 against 5.1% in January.

The underlying inflation rate stood at 2.7% against 2.3% the previous month.

The inflation overhang for 2022 at the end of February is already 3.6% (if the price index remained at February’s level throughout 2022, the average inflation rate for 2022 would be of 3.6%). In 2021, the average inflation rate was 2.6%.

For the core inflation rate, the overhang is 2.6% against 1.5% in 2021.

To converge to the inflation rate expected at 3.5% by us or by the European Commission in its latest forecasts, the trend will have to be reversed quickly.

The main source of concern for the coming months comes from raw materials. Since the beginning of Russia’s aggression in Ukraine, the price of oil has increased, as has the price of gas. This means that the contribution of energy, which already explains more than half of inflation in the euro zone, will increase further.

Oil prices (Brent) are already at $110 a barrel as large users are reluctant to buy Russian oil. We can then make the following simple calculation: if the price of a barrel remains at 110 dollars on average in March 2022, then its variation over one year will increase from 51% in February to 61% in March. With the euro at 1.11 against the dollar in March, the rise in the price of a barrel in euros would rise from 61% to 79%.

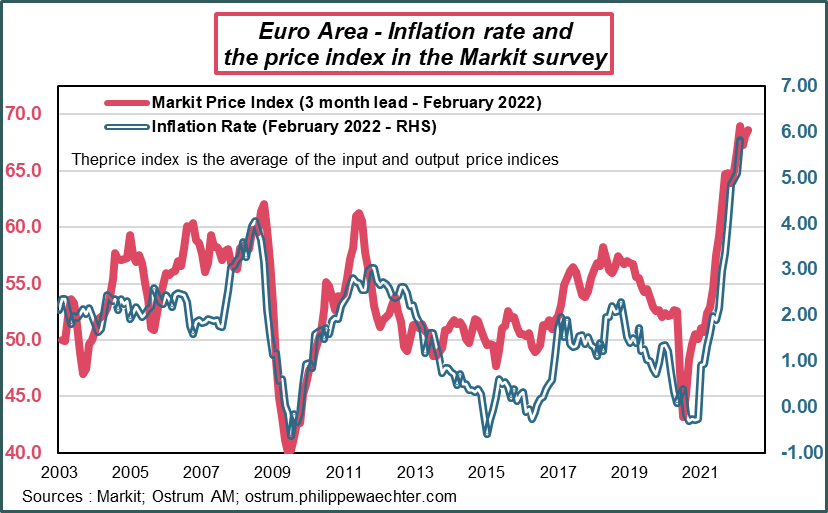

The contribution of energy will increase further. When we look at data from companies (Markit survey), we do not see any trend reversal in February. In other words, companies that will bear the brunt of the rise in commodity prices will adjust their prices upwards.

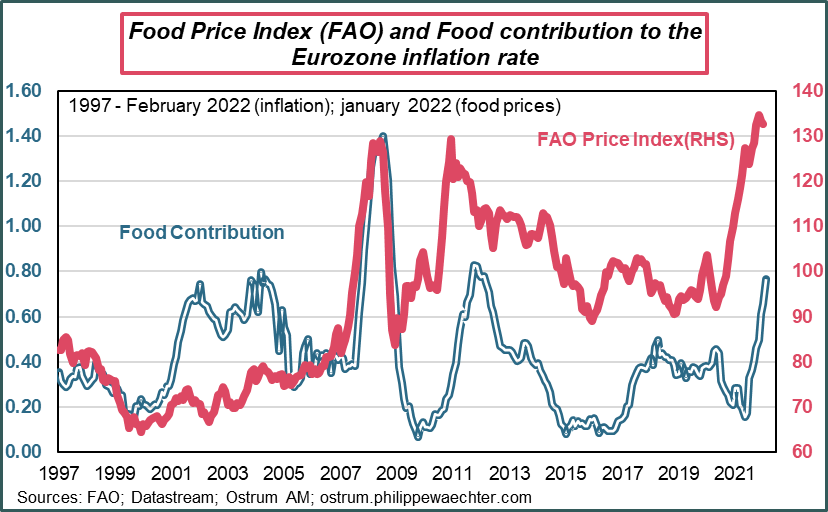

We also see a very sharp rise in cereals since the start of the attack. The prices of wheat, barley or sunflower, cereals for which Ukraine is a significant producer, are rising very rapidly.

In the FAO index presented until January (the February figure will be released tomorrow) cereals and oil are already at a historically high level. These upward pressures will intensify in March. The contribution of food will continue to grow markedly.

The acceleration of inflation is not over. The surge in commodity prices will increase the inflation rate in the Euro zone over the next few weeks. Internal prices (underlying inflation) will not compensate for these developments. The price of goods will take into account the price increases of raw materials and adjust.

Purchasing power will decrease for consumers, penalizing household consumption. Growth forecasts will have to be revised significantly downwards if Russia’s aggression against Ukraine continues.

The ECB is stuck. In this context, an increase in interest rates could have a recessionary character because macroeconomic uncertainty is already penalizing activity. At the same time, employees will ask for compensation on their purchasing power and increase the risk of a price/wage loop that the central bank does not like because to make it disappear, it would be necessary either to stop upward pressure on raw materials (rapid end to the aggression) or a recession which would weigh on the labor market and on employment. There is no good short-term solution.

The purchasing power will shrink.