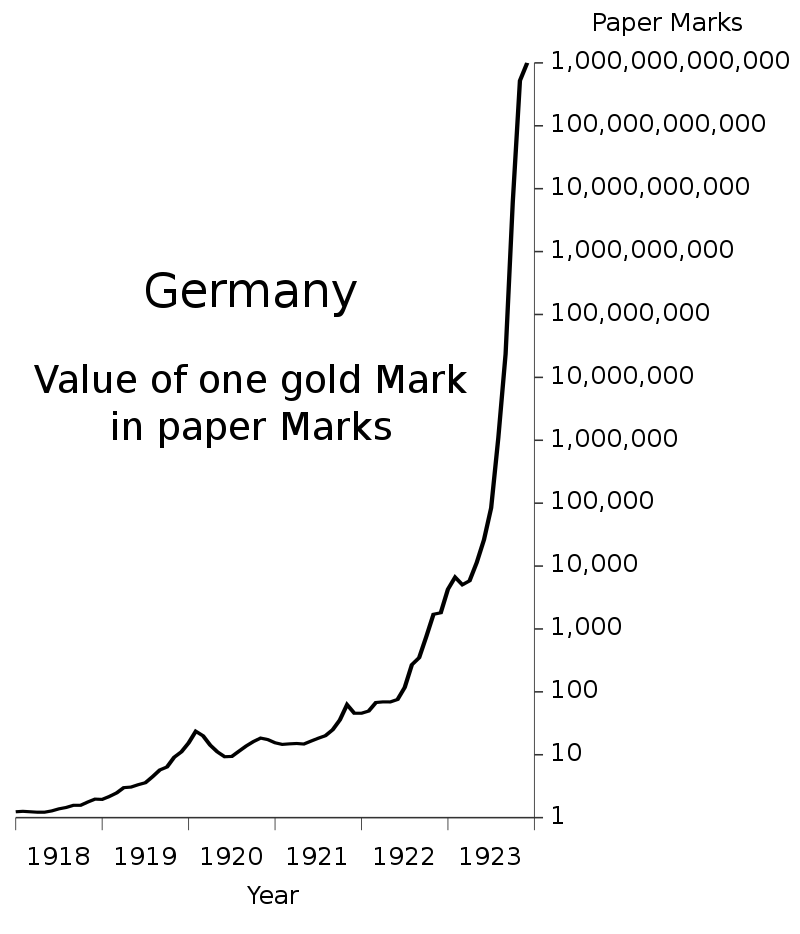

This morning while looking at an app on my phone, it says that in 1923, a century ago, a loaf of bread in Germany sold for 140 billion marks.

This episode of hyperinflation is the visible part of the chaos that reigned across the Rhine at the time, but it allows us to understand the reluctance of our German neighbors to accept high inflation.

The rapid and profound decline of the paper Mark (see graph) is another way of understanding the figure of 140 billion.

Germany emerged defeated from the First World War and its production facilities had largely lost efficiency. Consequently, after the Treaty of Versailles which condemned it to pay a heavy price, the German model was disoriented. The economy is no longer able to provide the necessary jobs and income.

The Germans are stunned and losing their bearings. The revolution of 1919 and the movements that followed shook up society and the Weimar government that was established afterwards was too weak and lacked credibility.

The rest of the world, observing the difficulties of German society, no longer gives Germany the support and credit it needs to obtain loans. The currency is collapsing against the dollar.

The government is increasing its spending to support activity. It is financed directly from the central bank, leading very quickly, given the scale of the movement, to a loss of confidence in the currency. The dynamics were so strong that the mechanics quickly got out of control. The currency then depreciates very quickly since no one wants to hold it anymore.

The end of hyperinflation was first and foremost the establishment of credible commitments, internally and externally, from the government and the return of confidence from the rest of the world. Price stabilization then proceeded very quickly.

These mechanisms of loss of credibility of institutions are always found in periods of hyperinflation which is ultimately not a monetary phenomenon.

Sometimes current inflation has been associated with hyperinflation!!!! This is nonsense. We are just experiencing an episode of higher inflation but the institutions are robust and are not weakened even if they can be shaken up