A major challenge for the European cycle will be the confrontation with Chinese products.

For what ?

1- China is redeploying its activity and will continue to use its exports as adjustment mechanisms due to sluggish domestic demand and overcapacity. Markets must be found for the manufactured products.

2- China’s reduced domestic demand stems from a combination of limited growth in household consumption, still-low real estate investment, and a transformation of industrial investment due to the maturity of the automotive sector. This sector, as in Europe and the United States, shapes industrial dynamics. With a production capacity of 60 million vehicles, China cannot exceed this target. Domestic growth will primarily come from its technology sector, which is a key focus of the five-year plan.

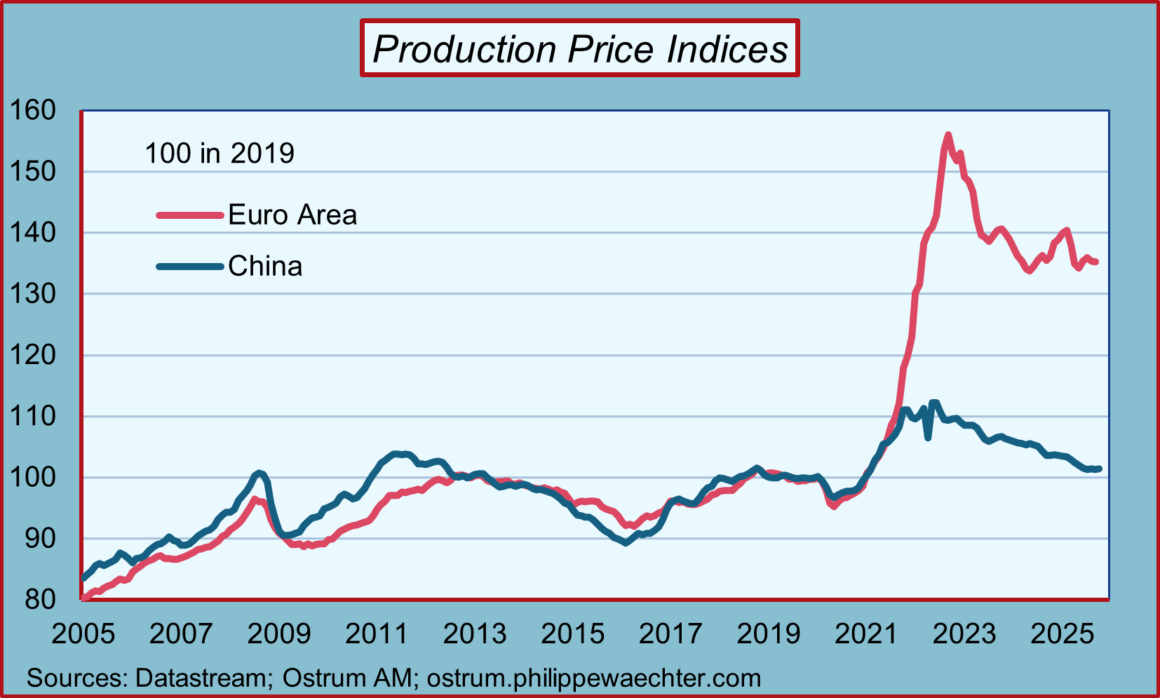

3- The consequence of this limited domestic demand is very low pressure on prices. The underlying inflation rate is close to 0% and producer prices fell by 2.1% in October.

Compared to the Eurozone, Chinese prices are very competitive. On a 2019 base of 100, the producer price index in China is 101.4, while in the Eurozone it was 135 in September.

4- Another point is the change in the direction of Chinese exports since the implementation of US tariffs. Of course, some of the flows pass through third countries to reach the United States, but there is also a redeployment of these flows, and the Eurozone is directly affected.

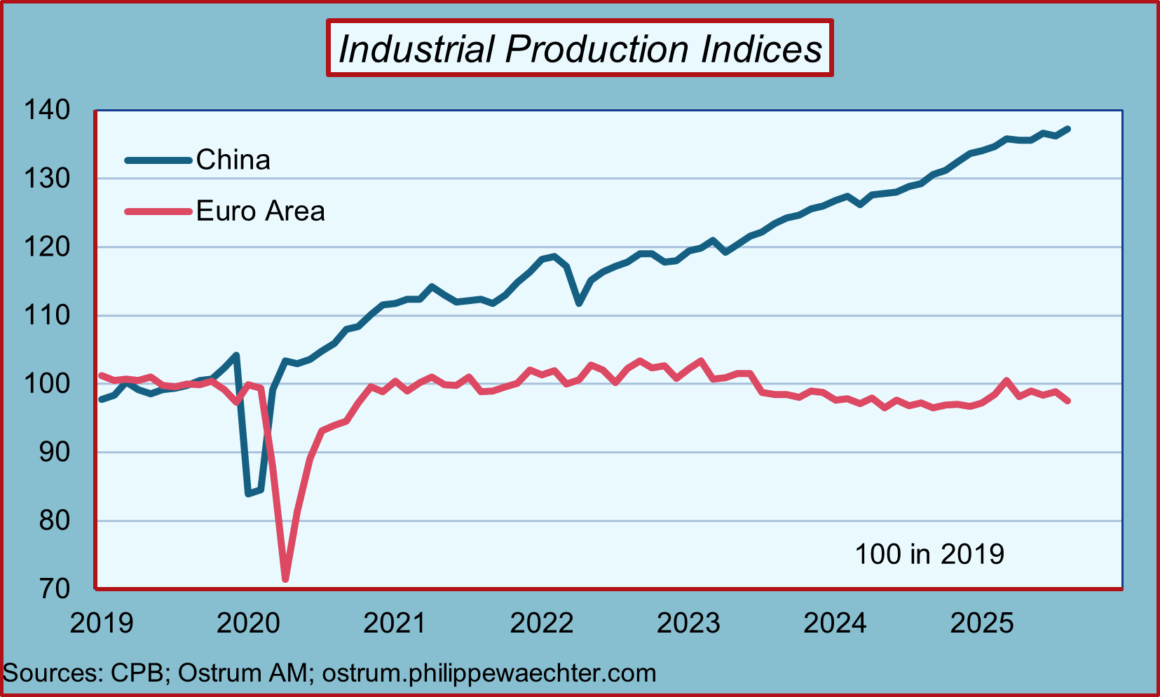

5- The Eurozone is also penalized by the lack of a rebound in its industrial production since the pandemic. This translates into less product renewal and more limited innovation. At the same time, the industrial production index in China has risen sharply.

Taking 2019, before the pandemic, as a reference, the Chinese index was at 137 in August compared to 97.5 in the Eurozone.

6-The Eurozone will have a positioning problem in relation to these cheap and innovative Chinese products.

7- In the long period preceding the pandemic, low Chinese prices had kept inflation very low for a very long time. Industrial decline was a trend. But after the pandemic, low Chinese prices will allow China to gain market share with more innovative products.

8- Therefore, the question is how the Eurozone, the European Union, the Commission, and governments should react. The underlying issue is our capacity to innovate in the future, and thus our collective well-being, but also the question of employment in the face of a rapidly aging population.

9- Should we become Trumpists and implement tariffs? The question is worth asking because the Chinese wave is definitely here.