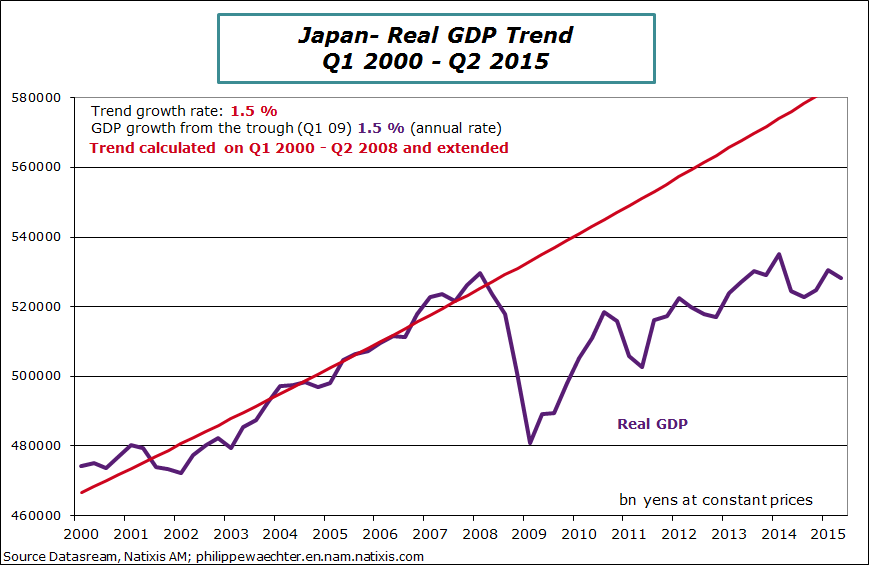

The Japanese GDP has retreated during the second quarter. It was down by -1.6% (annual rate) after +4.5% during the first three months of the year. Compared to last year, economic activity is up at 0.7% and carry over growth is at 0.4% for 2015 (carry over is the average growth for 2015 if GDP remains at Q2 level for the rest of the year).

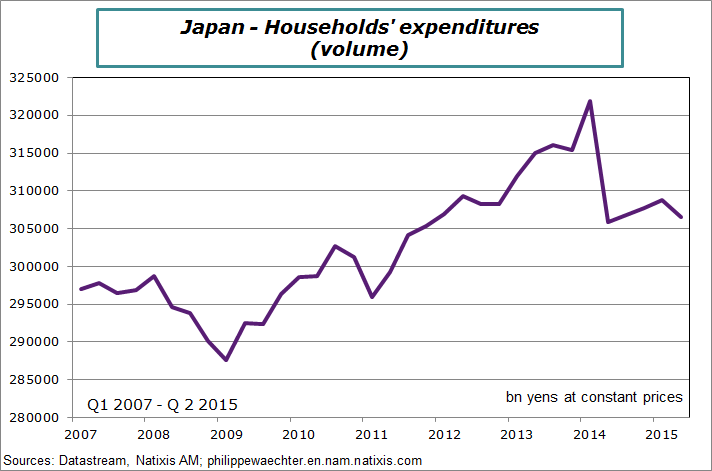

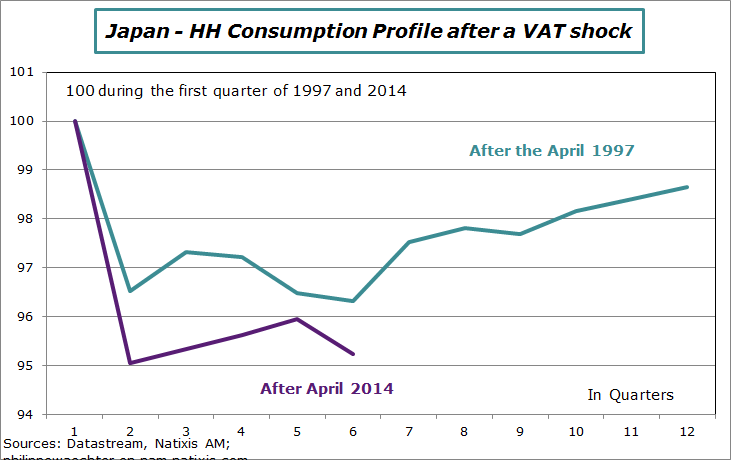

The GDP profile is shown on the graph. I have added a trend calculated from 2000 to 2008 (in red). The main point to notice is the fact that the GDP in Q2 is at the same level than during the last quarter of 2013. The Japanese economy stagnates even with a very accommodative monetary policy. But fiscal policy has been brutal with the VAT rate hike (3 points) on April 2014. The impact is persistent and has dramatically changed the upward trend of the Japanese economy.

Annex

The other components of demand are not able to compensate the weak consumption profile. That’s why it’s not easy for Japan to converge to an upward growth trend.