Written with Aline Goupil Raguénès

Last week, during her speech at the Congress, Janet Yellen, the president of the Federal Reserve, highlighted the importance of inflation expectations stability. Stability is key in the design and calibration of monetary policy.

Nevertheless, when we look precisely at these expectations, there are doubts on their stability in the current period.

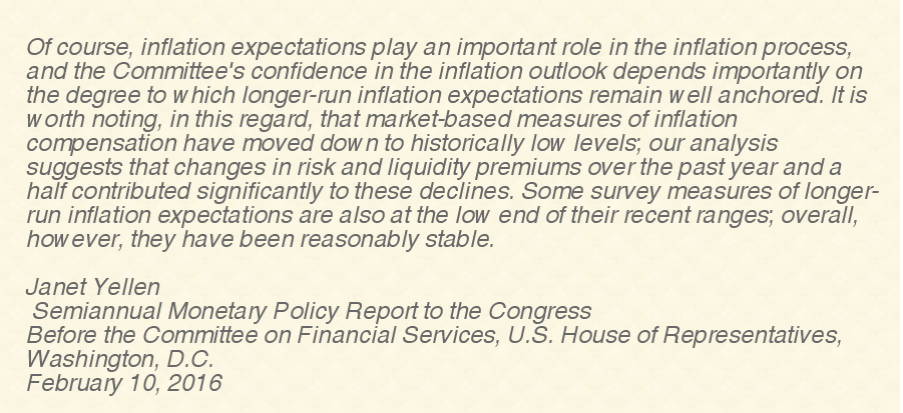

First, market expectations are trending downward. The graph below shows the 5 year in 5 year inflation break even. Except in 2008/2009, which was a very special period, recent points are at an historical low level. The indicator’s profile was relatively stable even when the oil price was very expensive in July 2008 and from 2011 to mid-2014.. The current level is at its lowest since the beginning of the series and I’m not sure that its profile is consistent with stable expectations.

We could consider that lower expectations are associated with some kind of animal spirits on financial markets. But the profile for households is almost the same.

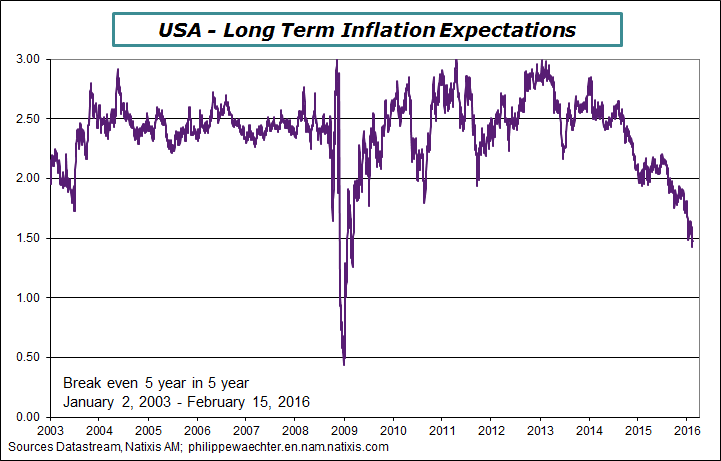

The graph below show the median inflation expectations at a 5 year horizon. It comes from the University of Michigan monthly survey. We see that from 1995 to 2015 households’ expectations have been stable. The two red lines show the average +/- a standard error. Expectations were between these two lines on average. Even during periods with a very expensive oil price ($140 in July 2008, 110 from 2011 to mid-2014), expectations were stable.

Since the end of 2015, inflation expectations are below the lower red line. In February 2016 the level of expectations is at its historical low. There is no nominal illusion and expectations on wages must also remain at a low level.

We cannot exclude that in the future there will be higher and probably temporary acceleration in the inflation rate. But if we consider that expectations five a good signal, the trend for the inflation rate will remain low. So there will be no reason for the Fed to change its monetary policy. Clearly for March, the position is that the Fed will not change its interest rate.

Philippe Waechter's blog My french blog