In April, there are still a lot of questions related to the strength of the global economic activity for the coming months.

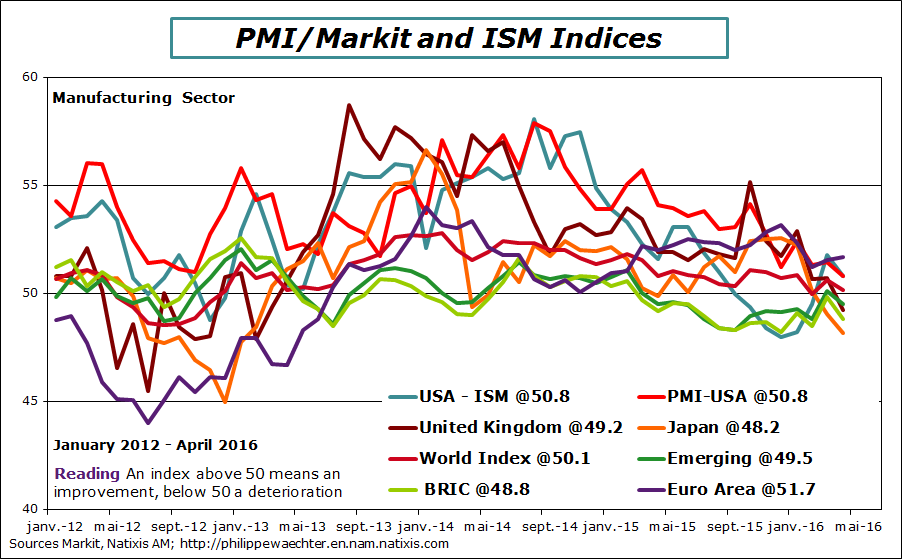

Companies’ surveys in April from ISM and Markit do not show an improvement in the manufacturing sector. Nevertheless the momentum is stronger in the non manufacturing sector. The first point is worrisome as a slow dynamics in the manufacturing sector will lead to a poor performance in world trade. We cannot expect an impulse from this sector and therefore no spillover can be anticipated to the non manufacturing sector. The main source of improvement in the economic momentum always comes from a change in the manufacturing sector profile. This is not the case yet.

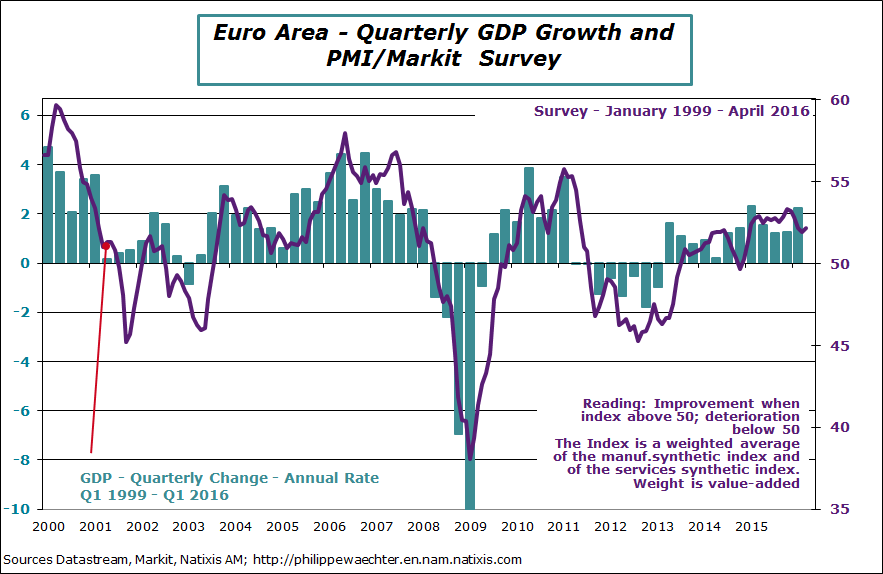

In the manufacturing sector, the Euro Area is the only country which shows a marginal stronger momentum in April. Its index is at 51.7 after 51.6 in March and an average of 51.7 during the first quarter. Nevertheless it is not a good performance.

For the world economy the index converges to 50 at 50.1 after 50.6in March and an average at 50.5 during the first quarter.

In the United Kingdom the index dropped below the threshold of 50. It can be linked with the uncertainty associated with the referendum on Brexit (June 23rd). In Japan, the index is below 50 for the second month in a row. There is a need to strengthen the Japanese economy but it’s probably not with a more accommodative monetary policy. The Abe administration must find other means.

The US indices are at the same level at 50.8. For the ISM it’s weaker than the 51.8 seen in March. The recovery is losing steam.

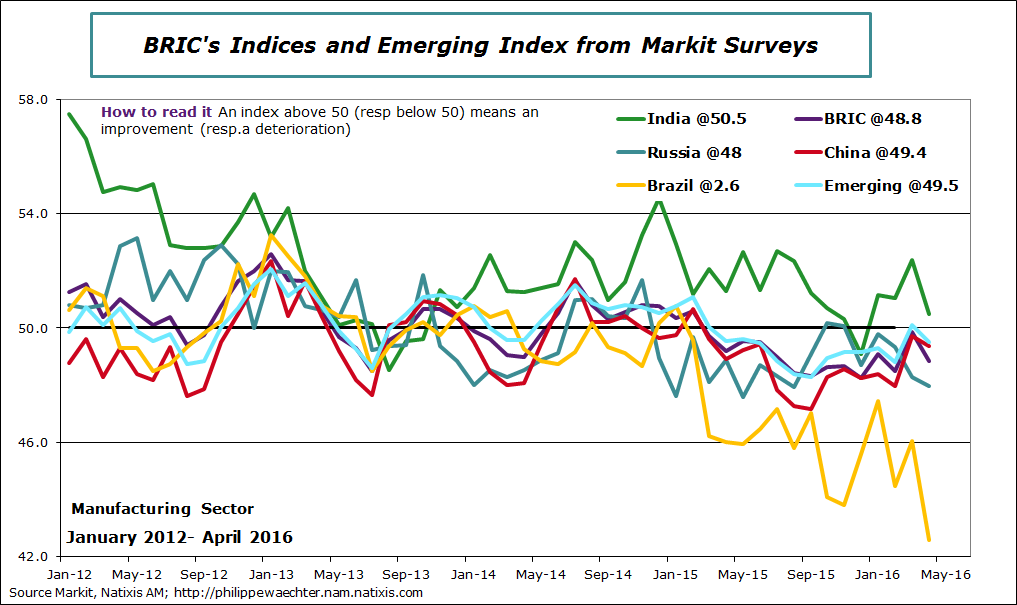

In emerging countries, indices are back to below the 50 threshold. The impulse will not come from emerging countries in the short run.

In the press recently there were many articles on a possible mini-cycle led by China and the US. If it exists it seems to be short-lived as there is absolutely no impulse in the manufacturing sector.

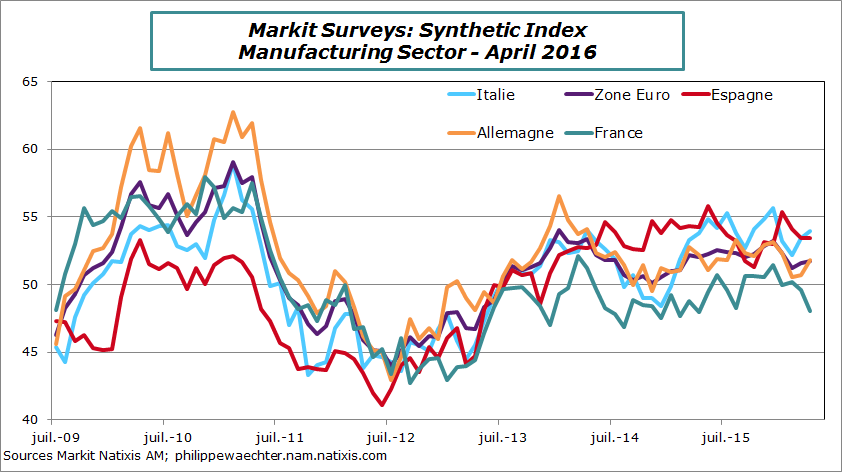

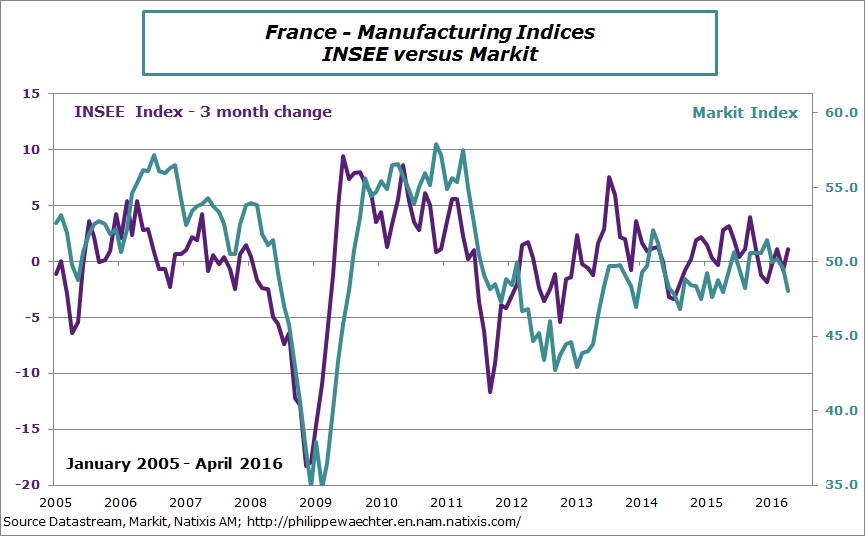

In developed countries, the situation is a little stronger in the Euro Area but profiles are very heterogeneous. Italy and Spain are still strong, the German index recovers but the French index dropped dramatically below the 50 threshold. But there is a gap for France in the manufacturing sector between the INSEE survey which is quite optimistic and Markit which is really pessimistic. The difference may come from the reduced sample in the Markit survey creating bias in the result.

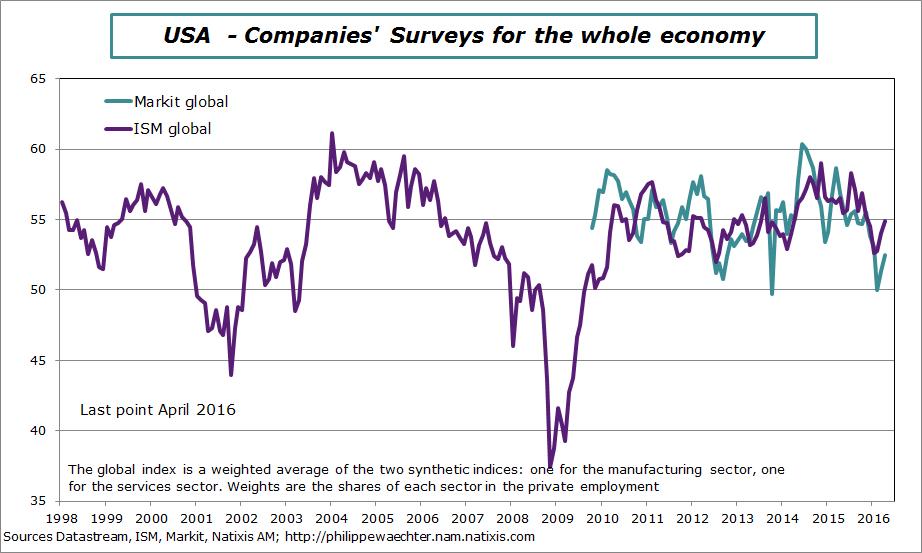

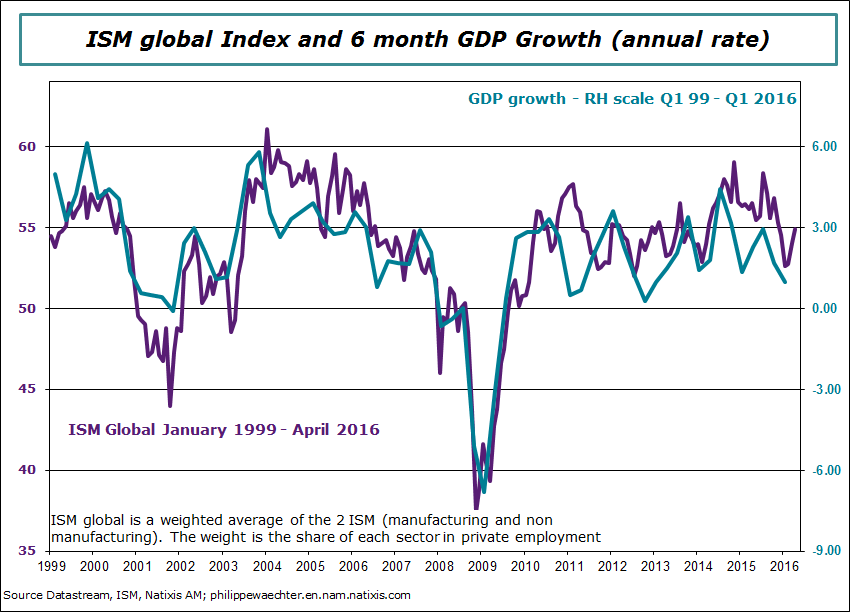

This fragility in the manufacturing sector is compensated, in the US and in the Euro Area, by stronger momentum in the service sector. After two months with a weak index, the ISM global is back to 55. It’s still below what was seen on average in 2015 but there is no downside break in the US economic momentum. That’s positive.

It’s good news for the Q2 GDP growth. As we see it on the graph, there will be a rebound; the question is to know if it will be consistent with what was seen in recent past or not (see here)

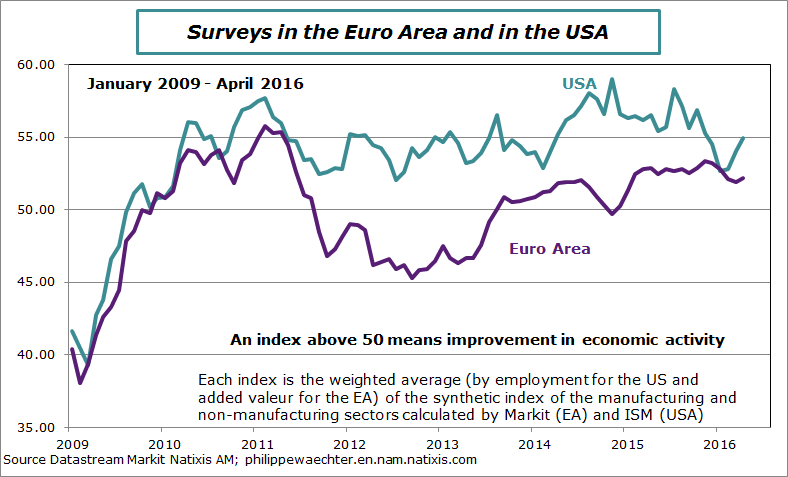

The comparison between the US and the Euro Area is still at the advantage of the American economy. The rebound is shy in the Euro Area and with the strong GDP growth number for the first quarter this moderate index in April probably means a lower number for the Q2.

For emerging countries, the picture is bleak. The Indian index dropped in April and the Brazilian index was at its lowest level since the 2009 crisis. Chinese and Russian indices dropped marginally. The impulse for a recovery will not come from emerging countries. The main question is about Brazil and its future profile!!!

Philippe Waechter's blog My french blog