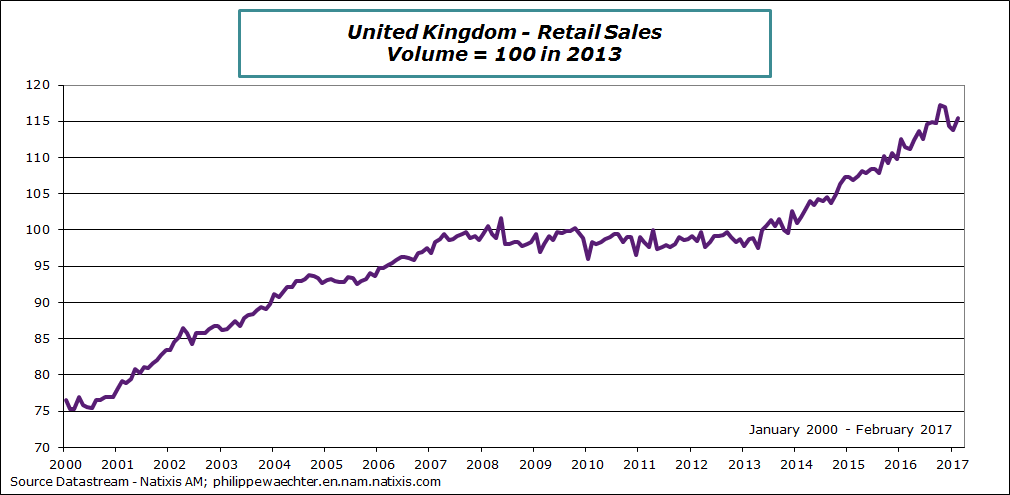

The rapid improvement of retail sales in February (+1.5%) has to be interpreted with care. The retail sales momentum has deeply changed in recent months. After a strong recovery since the end of 2013, its profile has dramatically changed last fall. Since the peak of October 2016 the trend is still robust but downside oriented. Households continue to spend as far as inflation is not too high.

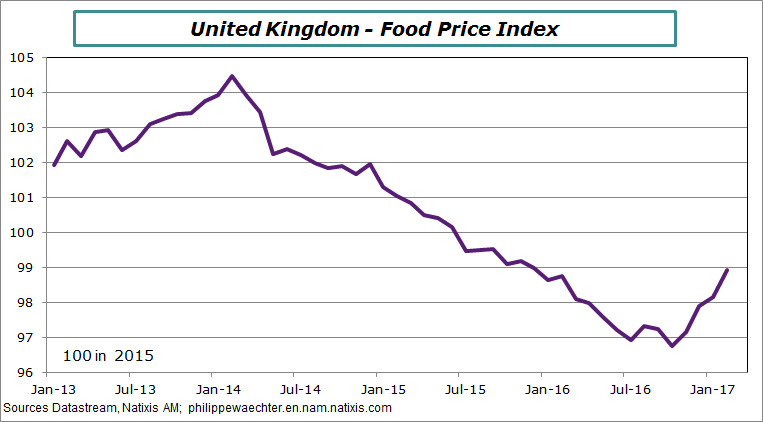

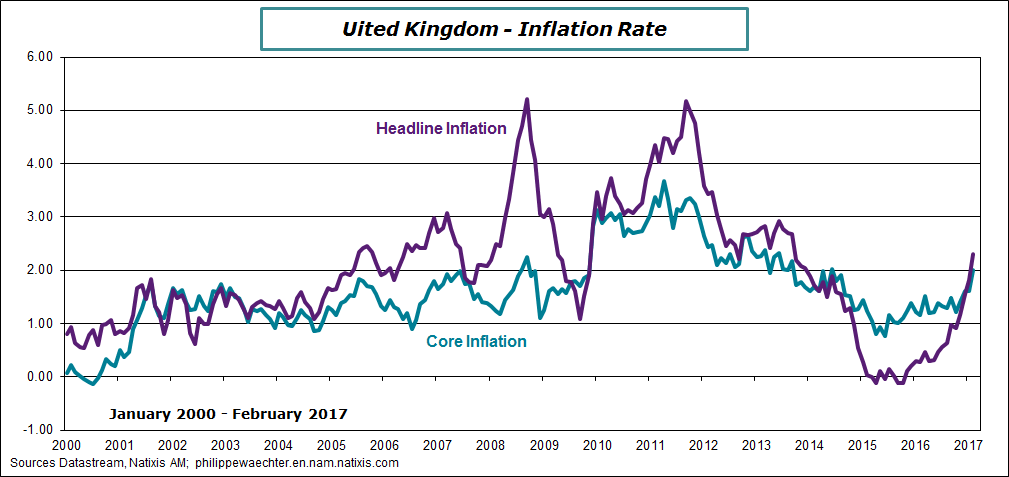

In the United Kingdom, inflation is back. The core inflation rate was at 2% in February. Its highest level since June 2014. The interesting point is the food price index trajectory. From the end of 2013 to October 2016, it was decreasing. But since October it recovers rapidly. In October the yearly change for food price was -2.4%, in February it is +0.17%. What is impressive is the upturn since last fall and what is important is the acceleration. This is linked with the sterling depreciation.

Before the acceleration of inflation and the slowdown of their purchasing power , households have increased rapidly their expenditures. But now higher inflation will limit their capacity to spend.

Households have been rational in their behavior. Higher prices in the future translate in higher purchases now to take advantage of prices that are still low. With higher inflation prospects, the outlook for households demand will lose momentum. It will weigh on the UK economic outlook.

In case of an exit of the French currency from the Eurozone, we can expect at least the same thing.

Philippe Waechter's blog My french blog