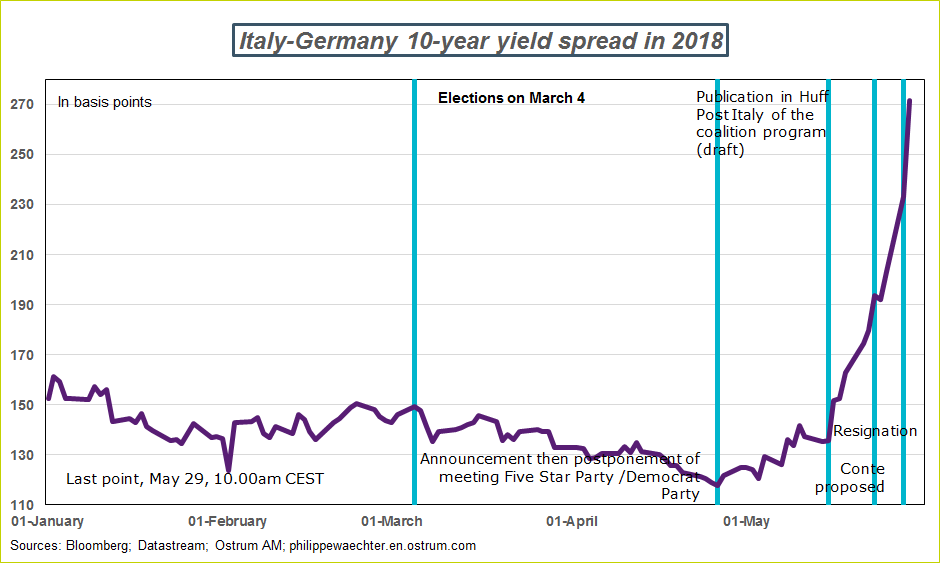

The adjustment on the upside is not over on Italian rates. The 10 year bond’s rate is converging to 3%. The spread with the German 10-year rate is now circa 270 bp. This also reflects a safe heaven effect for German bonds.

With a rate at 3% % while the inflation is at 0.5% (in April), the real rate is way too high in Italy compared to real growth prospects. But such a level on the real rate (2.5%) would be just above the average seen since the beginning of the Euro Area (2.2%). It’s too high when the GDP trend is close to 1%. This has deterred investment and it will continue limiting the capacity to grow. We have to expect a slowdown in the economic activity in coming months. It will come from the real rate level but also from the uncertainty in the Italian economy. An austerity program that can be expected from a transition government is not good news for Italy but also for the rest of the Eurozone.

Philippe Waechter's blog My french blog