It was initially published in French here

Different elements must be noticed this week to understand the macroeconomic outlook

The first element is Janet Yellen’s speech. She talked one week after the press conference following the last Fed’s monetary committee. In her discussion of the US monetary policy, everyone was able to find what he wanted to find. Pros and cons of a rate hike have arguments in her speech to feed their own perception. The situation remains highly uncertain on monetary policy side

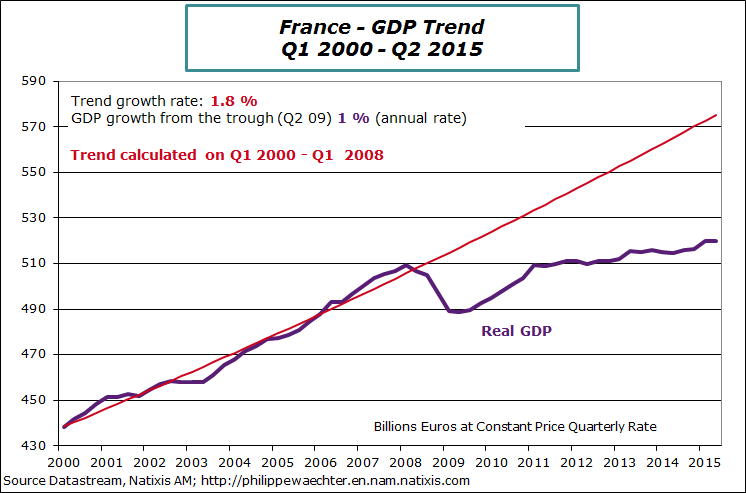

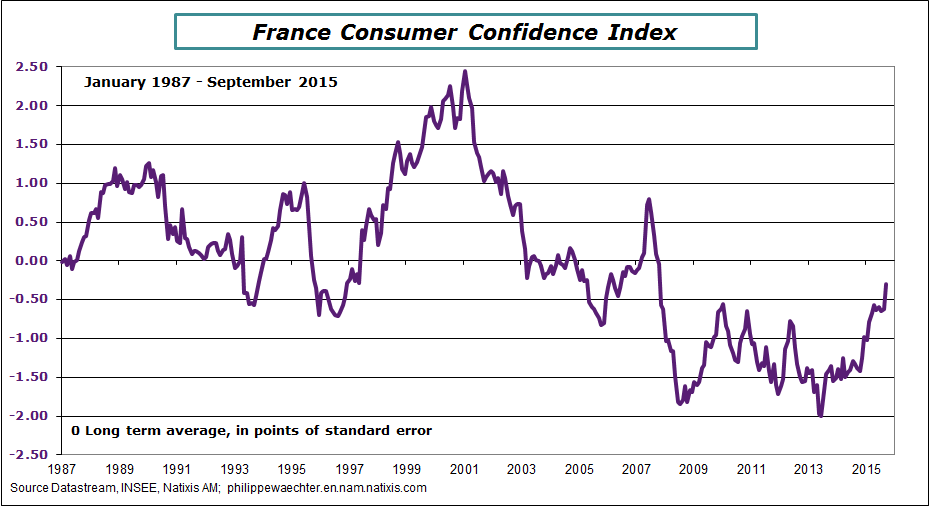

The second point is related to the French economy. With the second GDP estimate for the second quarter, we have details on behaviors. Before that, we note that the French profile is marginally stronger. The first quarter GDP growth is still at 0.7% (non-annualized rate) and the second at 0% but the carry over growth for 2015 is higher at 0.87% versus 0.83%. To converge to 1% which is the government target, a mere 0.18% is needed in each of the two remaining quarters of this year. Before the new estimate it was 0.25%.

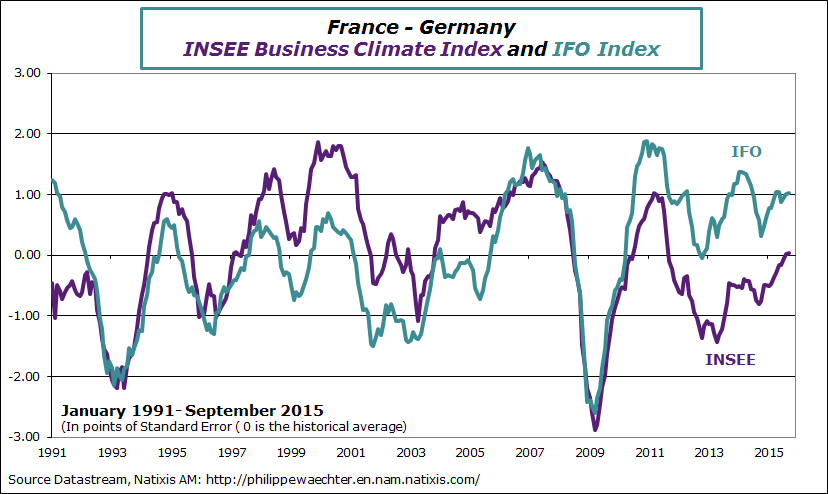

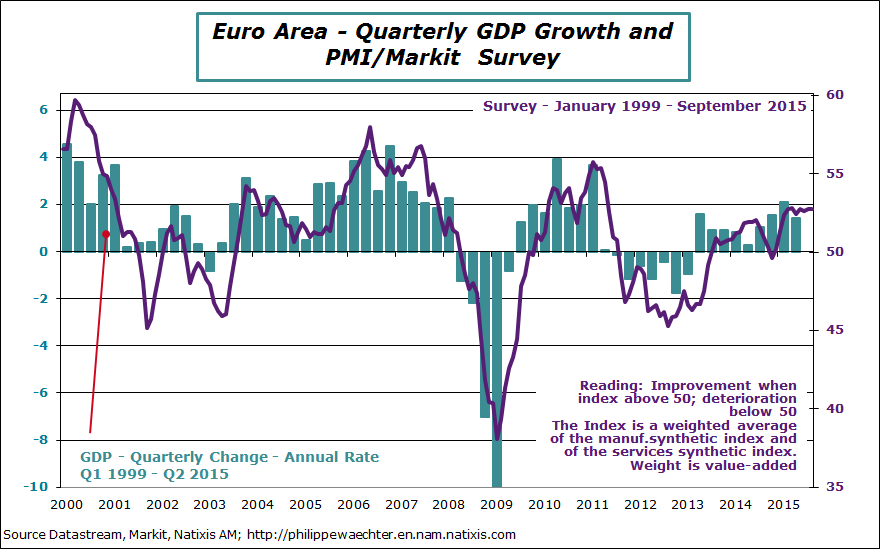

In the Euro Area, the Markit synthetic index for the whole economy is stable in September. Since last February it is at the same level. It reflects positive growth (the index is in a range 52.4 – 52.8) but no acceleration. The target is to have a consistent business cycle within the Euro Area; in that case it would lead to a real acceleration. This is the ECB target but it is not the case yet. The current heterogeneity is a drag for stronger growth.

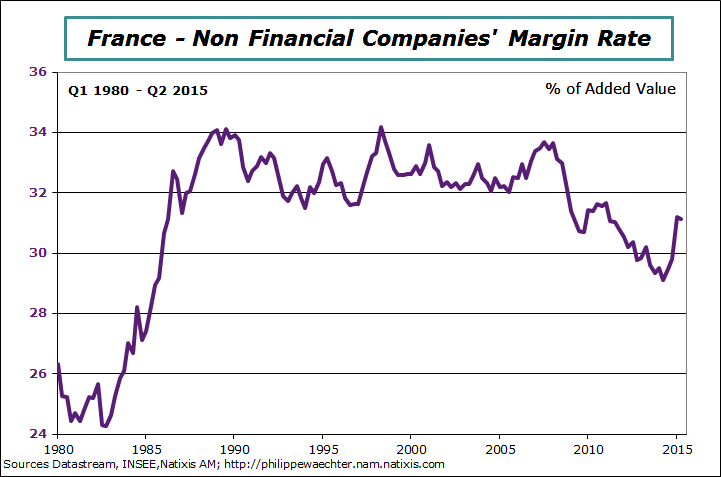

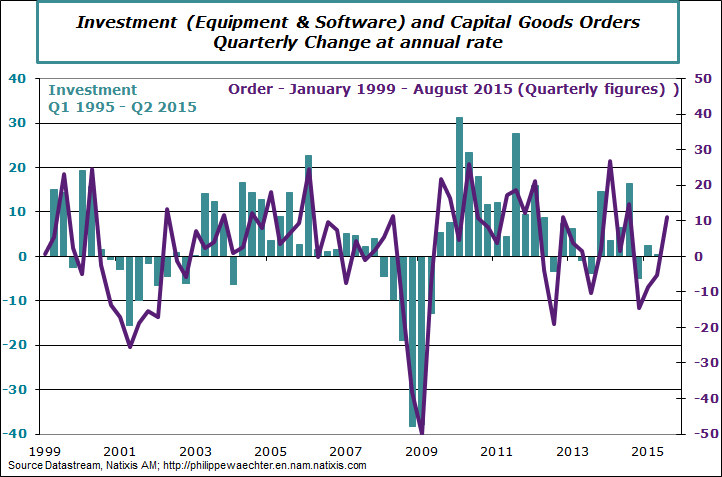

During the third quarter we expect a strong rebound of companies’ investment after the acceleration in capital goods orders in July and August.

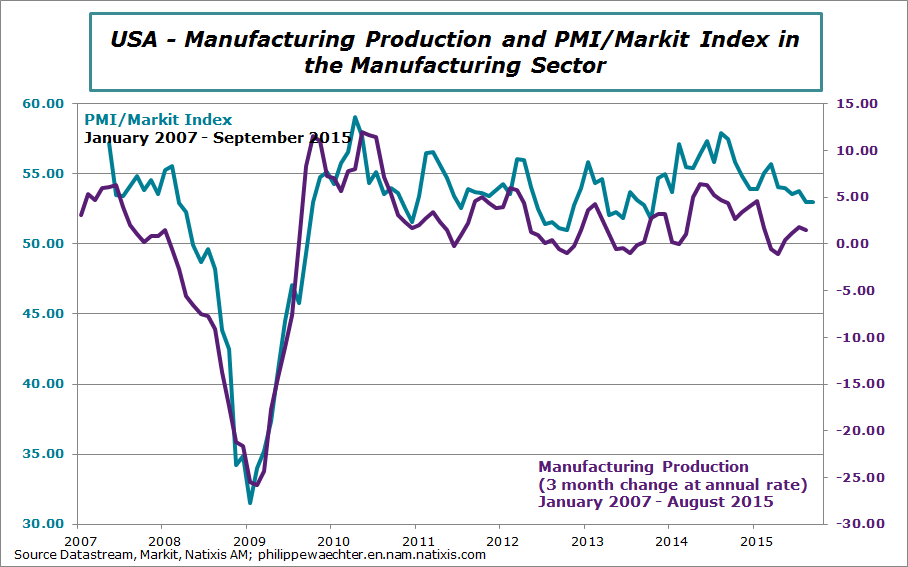

For the week to come, the main publication will be the ISM and Markit surveys for the manufacturing sector (Thursday) and the employment report in the USA (Friday). On Wednesday, inflation for September in the Euro Area will be release. The number will probably be negative.

Philippe Waechter's blog My french blog