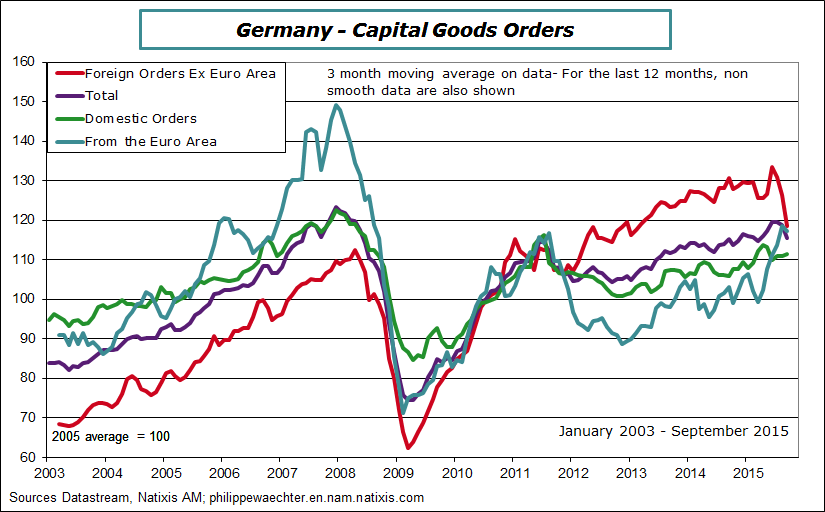

The main issue this week was the US employment figure as it may change the Fed’s mind on monetary policy. Nevertheless, employment is not the only aspect to mention to catch the US economy momentum. Another important issue, this week, is the rapid and deep drop of German industrial orders from outside the Euro Area. It’s a source of concern for the global investment dynamics. The last important point is the non-null probability of a rate lift-off at the Bank of England in 2016. Mark Carney has mentioned this possibility after the Monetary Policy Committee Meeting of the Bank. It’s not the first time that the BoE and Carney take this kind of commitment.

Eight points this week to follow the macroeconomic environment

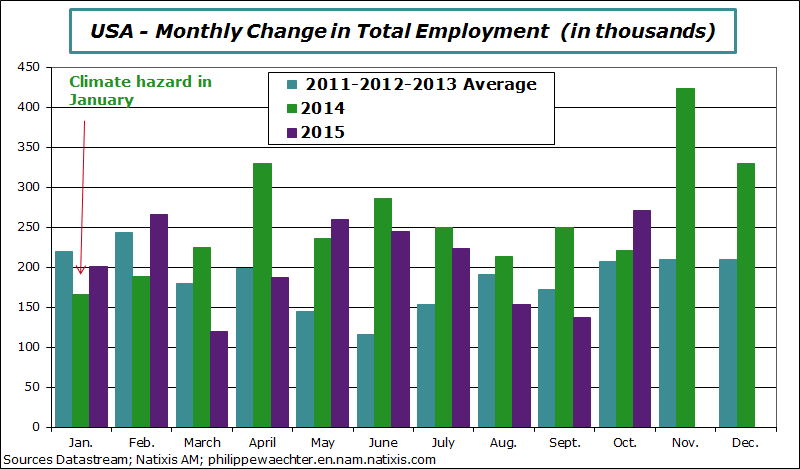

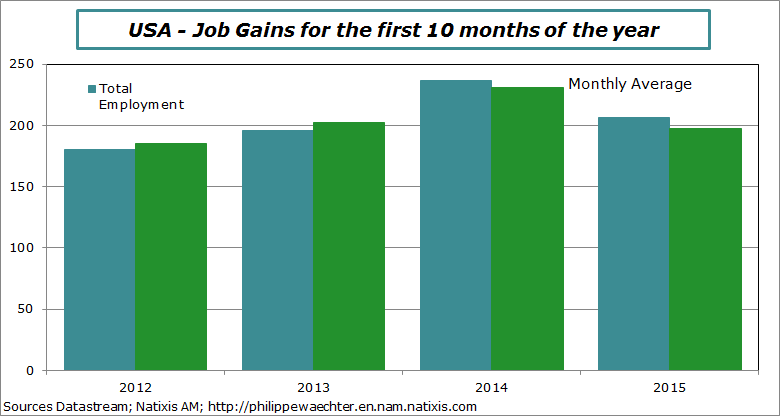

1 – There was impatience to get the number of jobs creation in October in the US as it could be a trigger for a Fed’s rate move at its December meeting.

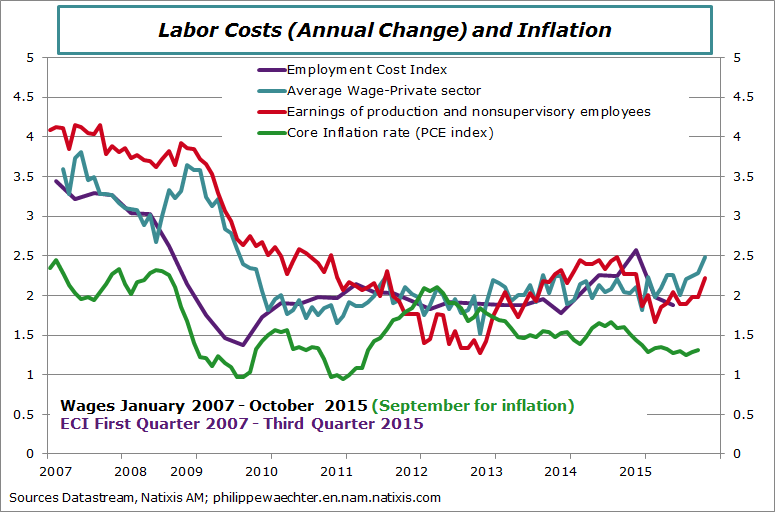

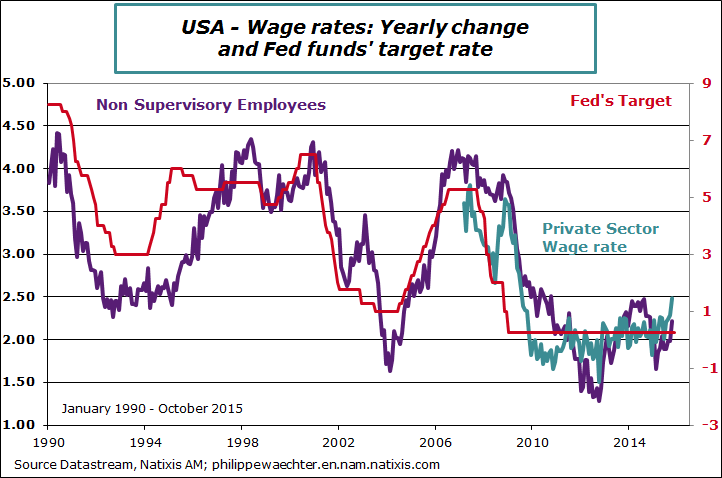

The number was strong at 271 000, way above expectations at 185 000. Nevertheless, the employment rate was almost unchanged for all classes of age and was unchanged for the 25-55 years of age. In other words, there were no supplementary pressures on the labor market even with employment surprising on the upside.

This figure comes after August and September during which the number of jobs creation was low. As a consequence, the average number of new jobs in the last 3 months is below the average of the 3 previous months: +187 000 in August, September and October versus 243 000 from May to July.

A single figure, as was the labor report, is nevertheless not sufficient to make the decision even if it is robust. There is a need for a confirmation at the beginning of December for the November labor report.

For a more complete report on the US job report see here

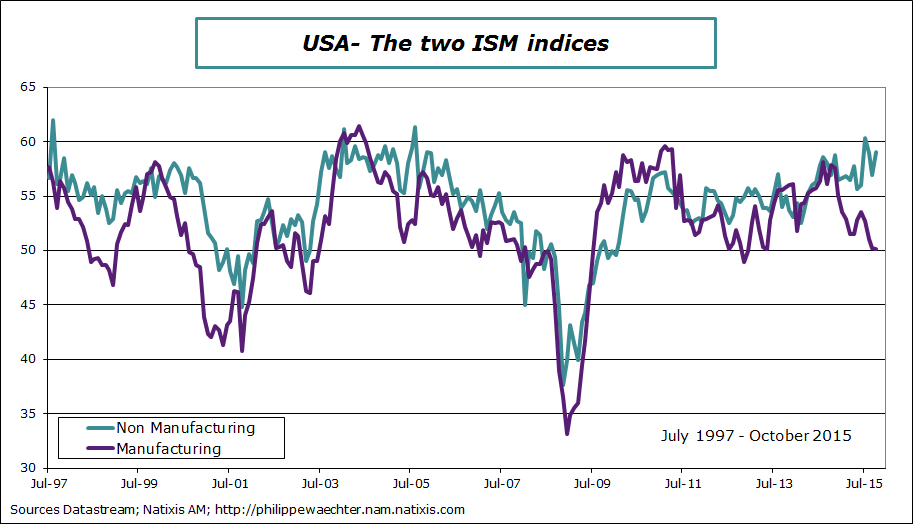

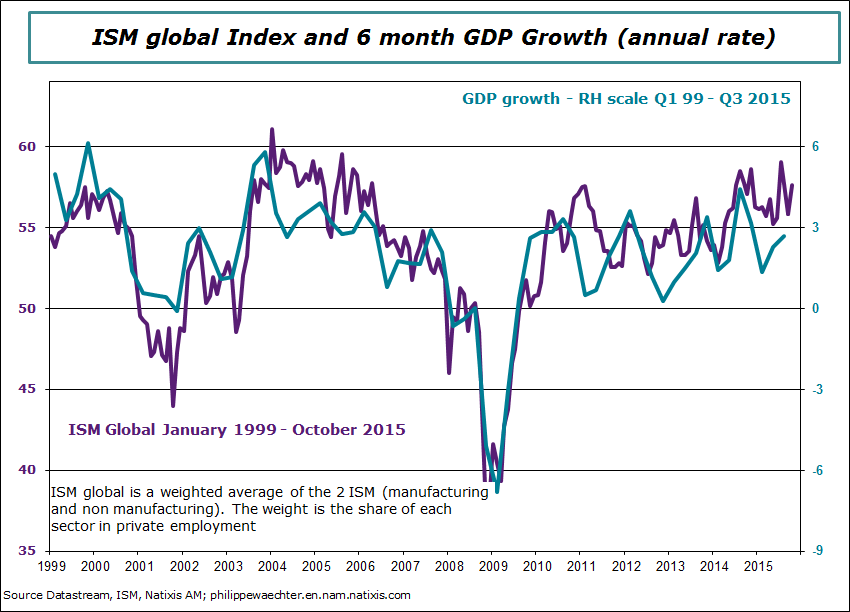

2 – Surveys on the US activity have very different profiles. The ISM for the manufacturing sector is trending downward with an index at only 50.1 in October. At the same time, the non-manufacturing ISM survey has an index close to its recent high at 59.05. The non-manufacturing series is available since July 1997. For the whole period, such a divergence between the two indices has never been seen. What is worrisome is the fact that usually, fluctuations on the manufacturing survey are prior those on the non-manufacturing. This could converge to weakness in the US economy

The US economy is supported by the sector of the services but with a low momentum on the manufacturing side. I have already mentioned this issue after looking at the production capacity utilization rate (see here)

If the job number was repeated in November, the Fed would be able to fulfil its commitment to change its strategy on the upside in 2015. But this would not tell something for 2016 as we know that Janet Yellen doesn’t have in mind a rapid increase of the Fed’s rate.

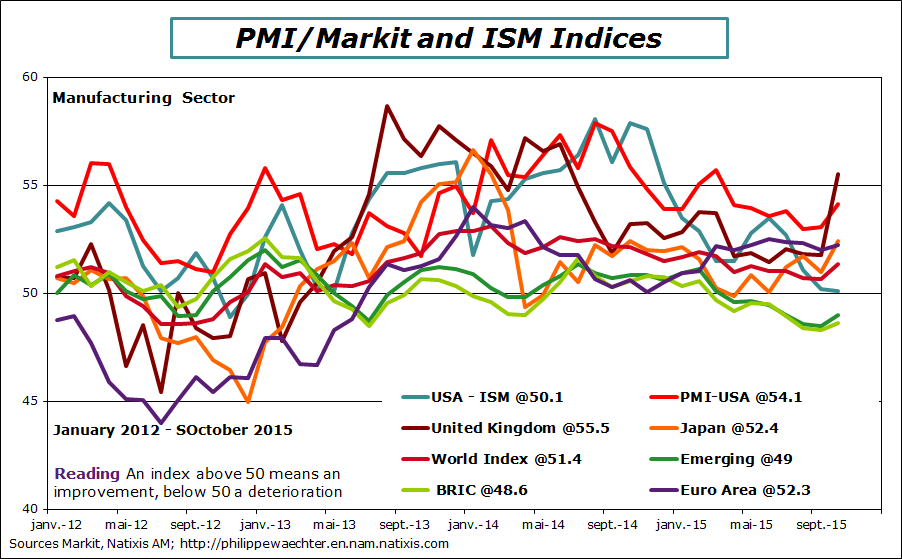

We notice that the UK index is improving rapidly while the CBI index was down. Usually the two indices have consistent profiles. There is something to understand better

Emerging countries indices are still low, below the threshold of 50. Russia is converging to 50 from the bottom, India is still above 50 but following a slow pace and Brazil is at its lowest level since March 2009. Recession in Brazil is far from being over.

At the same time, capital goods orders follow a stronger trajectory in the Eurozone during the third quarter: Could be good for investment.

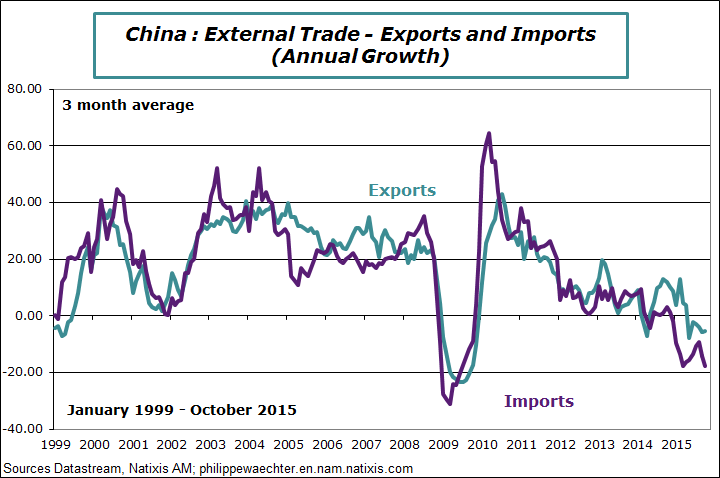

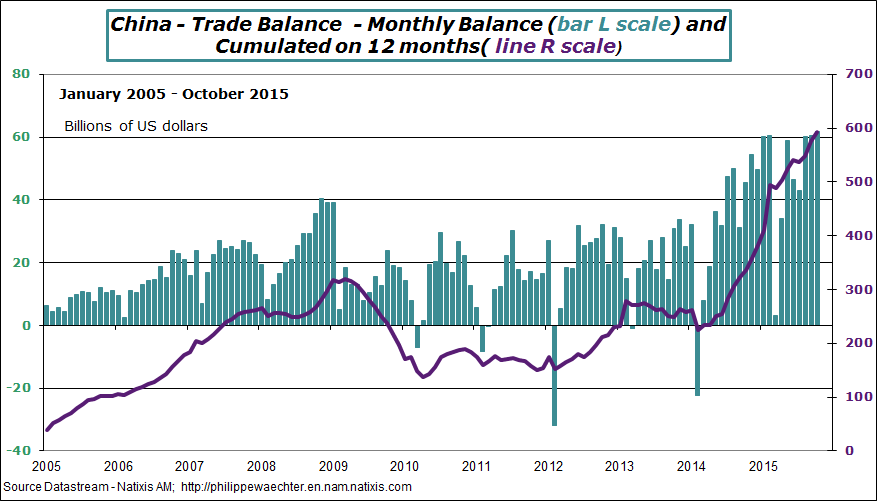

China perceives the impact it has had for years. It has fed exports from the rest of the world. But now as Chinese dynamics is lower, these countries (especially emerging) lack a source of growth and cannot import as such as they did in the past.

8 – Mark Carney said that the Bank of England interest rates could go up in 2016. It’s not the first commitment of this type from Carney but at each time in the recent past, the Bank was not able to fulfill it. Will it be the same in 2016? It’s a possibility which is associated with a loss of credibility.

For the coming week, the main publication will be GDP growth for the third quarter in the Euro Area. It will be next Friday. The French figure will be out at 0730. We don’t expect acceleration and the number will probably be circa 0.3-0.4%.

The other important publication will be retail sales figures for October in the US. It could highlight the real current momentum after two months in August and September with limited improvement. It will be Friday

In China, after the inflation rate for October (Tuesday) we will have data on retail sales, on investment and on industrial production. It will be on Wednesday

We will have jobs number in the United Kingdom on Wednesday, industrial production in France and Italy (Tuesday) and for the Euro Area on Thursday. The Inflation rate in France and Germany will be available on Thursday

Good week to everyone

This column was published first in French on Monday the 9th

Philippe Waechter's blog My french blog