After the deep drop in the ISM surveys for August (see here and here) we have had two new important data.

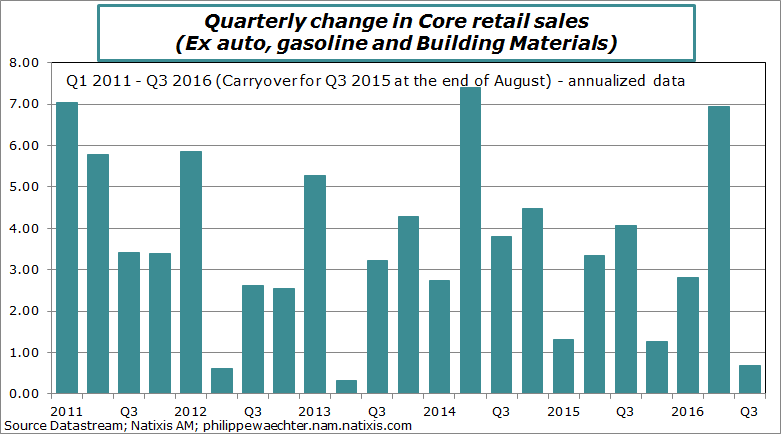

Retail sales were down by -0.3% in August after +0.06% in July and core retail sales were down -0.1% in July AND in August. Therefore carry over growth for Q3 at the end of August was 1.8%% at annual rate (after 6% in Q2) for retail sales and 0.7% for core sales after in Q2. Q2 data were exceptional and not the beginning of a strong trend.

The risk is a low contribution of households’ consumption to GDP quarterly growth. Households’ expenditures were a strong support for GDP in the second quarter. This will probably not be the case for Q3. This means a probable downgrade of growth for 2016. We were at 1.4% for the whole year, it will probably be lower.

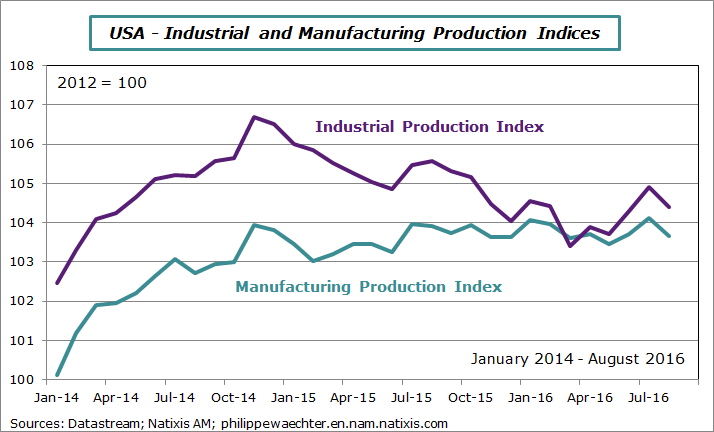

After a rebound in July (+0.6%), the industrial production index was down in August (-0.5%). For the manufacturing index data were -0.4% and +0.4% for August and July. Therefore carry over growth for Q3 at the end of August is a modest +2.3% (at annual rate) for the industrial index (after -0.6% in Q2) and for the manufacturing index data were +0.7% and -1% respectively. The momentum is still low. The YoY comparison shows that the industrial index is down by -0.7% and the manufacturing index is up by just 0.1%.

After the ISM, employment it is now retail sales that follow a weak trend while the industrial production index is neutral. Where is the risk of an overheating economy mentioned recently by Eric Rosengren from the Boston Fed. It was a cool summer in the US and the Fed has absolutely no reason to change its monetary policy at its next week meeting

Philippe Waechter's blog My french blog