As expected, the Federal Reserve has decided to start the process of reducing the size of its balance sheet. It will start next month in October. Details of the operation were presented in June and are available on a post send earlier today.

During her press conference, Janet Yellen has clearly announced the hierarchy between the two instruments the Fed can use to manage its monetary policy. The main instrument remains the fed fund interest rate. In “normal” time, this is the instrument that must be used by the FOMC to manage its monetary policy. The purchases of assets could become again an instrument for the Fed if the situation is exceptional. The interest rate is the rule and the assets’ purchase is the exception. But it was a relevant question as the current level of the fed fund is too low to have a strong impact on the economic activity in the case of a negative shock. A quantitative adjustment could be necessary. Janet Yellen sees a kind of complementarity between the two and the two instruments must remain in the central banker toolbox.

The other remark is on the efficiency of the quantitative easing operations. The Fed’s president found them efficient as they boosted growth in recent past. She said that experiences in the US or in the Euro Area have shown that the QE have improved the growth trajectory. She doesn’t expect from the QE a strong and long lived impact on inflation. That’s a difference with Mario Draghi who is ready to increase the size of the ECB purchases if inflation doesn’t converge to 2% rapidly.

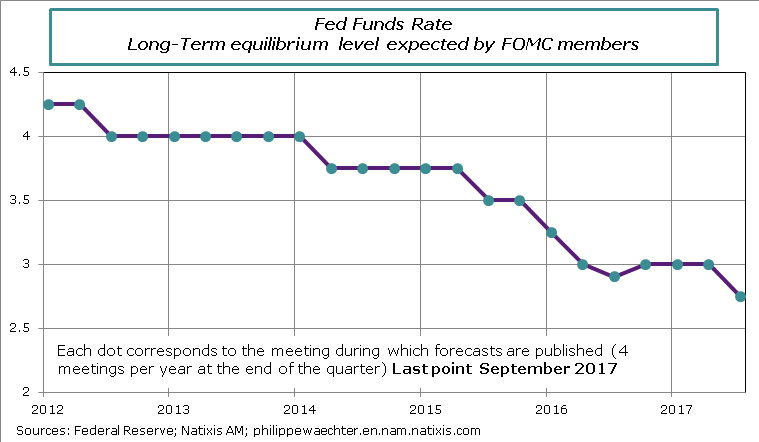

The Fed’s members expect one more rate increase in 2017 (Rate at 1.375% midpoint of target range at the end of 2017), three increase in 2018 (2.125%), two increase in 2019 (2.625%) and one in 2020 (2.875%).

The explanation is that the trajectory of the US economy is robust and the monetary policy must be adapted to this environment. In the Fed’s forecasts, the unemployment rate is marginally above 4% and the inflation rate is close to 2%. The normalization is the rule even if the growth prospects are not strong (1.8% expected for 2020).

On inflation Janet Yellen said that doesn’t really understand the recent drop of the inflation rate. She thinks it is a temporary effect and that price increase will go back to 2%.

The press release had a paragraph on the climate events. It is said that there are impacts on the short term but that the US economy long term trajectory will not be modified.

The Fed is confident in the state of the economy. That’s the main reason for starting to shrink the size of its balance sheet and that’s also a good reason to increase rates in the future. It’s a new step for the Fed as it shows that the crisis is over in the US.

Nevertheless the Fed is not optimistic. It median projection for the fed fund interest rate in the long term is declining again. It was stabilized at 3% and is now at 2.75%. This reflects the absence of productivity gains and the demographic shock the US will have in the long term. Therefore the monetary policy normalization is just to say that former problems may be solved but new ones are on the table. In 2012, the long term projection was at 4.25% It was a reference to pre-crisis level. Currently no one expect this level of rate and the Fed is like other economists. The crisis is over but some other new problems are on the table. No reason to be optimistic.

Philippe Waechter's blog My french blog