The Federal Reserve, or US central bank, cut back its key rate for the third time this year at its October meeting, after previous moves in July and September. The federal funds rate now stands at 1.5-1.75%, which equates to the range in the dot plot after correction. The Fed also indicated that it does not plan to continue cutting interest rates in the near future.

The interesting aspect of the Fed’s decisions is that they are not dictated by US domestic trends. GDP grew 1.9% in the third quarter on an annualized basis, and 90% of this robust figure is driven by private domestic demand. So we are still seeing the paradoxical situation where the Fed’s decisions are not driven by the US domestic outlook, and we will need to keep an eye on this over the months ahead.

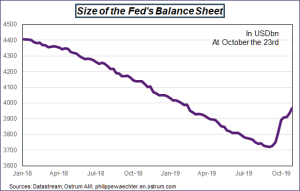

The other interesting aspect of Jay Powell’s press conference is that he only briefly touched on the situation and the glitches on the US money market, yetthis is a very worrying factor as the Fed has injected more than $200bn into its balance sheet to manage this crisis since mid-September. The Fed’s message is that it is not that important, but yet it has added $200bn to its balance sheet, given no explanations and pledged to continue hefty purchases until mid-2020 to ensure that the market remains liquid. This “move along, there’s nothing to see here” approach is disquieting, and we will really need to closely monitor this situation.

Christine Lagarde took over from Mario Draghi as ECB President on November 1, and there are two points worth noting on this change. Firstly, Christine Lagarde seems to be “Draghi-compatible”, and just like the former Italian ECB President, she has also made clear her aim of pursuing the development of the euro area by getting governments more involved and looking more to fiscal policy. She has taken a much more political stance than Draghi could right from this start, and this aspect will be both important and very interesting. The euro area lacks a political dimension, and Christine Lagarde could bring this to the table.

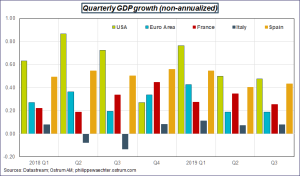

Third-quarter growth figures were issued for several euro area countries over the week. The non-annualized growth trend came out at 0.2% for the euro area as a whole, with 0.4% for Spain and 0.1% for Italy. The French growth figure came to 0.3%, in line with the two previous quarters.

This should lead to 1.2% growth for the euro area as a whole for the full year 2019, with a projected 1.3% for France, 0.2% in Italy and 2% in Spain, which has now made up its lag and is posting less vigorous growth.

Looking to the breakdown of figures for France, domestic demand plays a key role. Economic policy is designed to shore up domestic demand and offset any potential external shocks. It does not drive growth but it does rein in the risk of break points.

Looking to the US, growth we mentioned above for the country came to 1.9% in the third quarter and 0.5% on a non-annualized basis, which should lead to overall 2.3% growth for the full year.

The manufacturing ISM index in the US came out at 48.3 for October vs. 47.8 in September, marking the third month in a row below the 50 mark. Economic momentum is weaker, and out of the 18 manufacturing sectors assessed in the survey, only five stated that they are growing. Domestic demand is also weaker and less robust than a few months ago, so we are seeing the US economy change pace slightly.

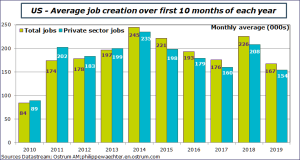

US job market figures were also released, but stats for October were fairly solid with the economy creating 128,000 new jobs, plus the 42,100 that could have been created without the General Motors strike. Average private sector monthly job creation figures YTD come to 154,000, which is a solid but not excessive figure, and fairly close to stats in 2017. The White House’s very aggressive fiscal policy in 2018 had driven figures up.

Jobless numbers came to 3.6%, which is very low and the employment rate has increased. The job market is dynamic, and the yoy wage rate increase is only 3%. Wage gains are decreasing each month following on from the high of 3.4% in February.

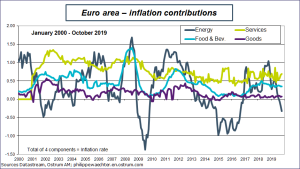

Inflation in the euro area came out at 0.7% in October vs. 0.8% in September, with this slowdown mainly triggered by energy’s negative -0.3% contribution in October. However, this tendency is set to turn around over the last two months of the year as oil prices collapsed at the end of 2018, so inflation is poised to increase slightly in November and December.

Looking to the week ahead, we note the global ISM index, which is the weighted average of composite indices for the manufacturing and non-manufacturing sectors in the US, and which usually fairly closely tracks GDP growth trends. September’s figure was particularly low and slightly above the 50 mark, which fits with sluggish growth of 1.5%, so October’s stats will be particularly important in judging the pace of US growth: if it is excessively weak, the Fed could well change its strategy to keep rates on hold that it set out at its latest meeting.

The Markit survey global manufacturing sector figure will also be announced on Monday, and this indicator has pointed to a contraction in world manufacturing since May. Chinese external trade balance figures for October will also be released on November 8, and the decline in imports points to weaker Chinese demand, while stagnating exports reflect lackluster world trade, particularly as it is dictated by US trade policy.

September’s German industrial orders will be issued on November6, and the pace is very much in line with OECD corporate investment figures. The slowdown trend witnessed since the start of the year is worrying for future global economic performances.

Have a good week

The post is available for download in PDF format