The activity does not contract any more in March but the rebound appears limited and without ripple effect.

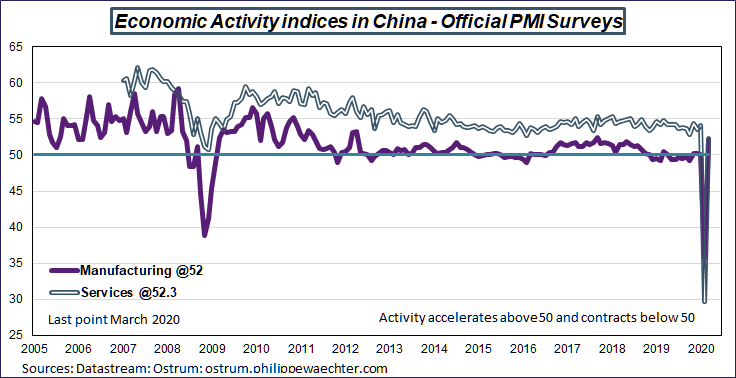

Chinese activity indices rebounded in March. The manufacturing sector index went from 35.7 in February to 52 in March and that of services from 29.6 to 52.3.

This suggests that activity has improved from the February low, but not that the pace has returned to what it was before. The activity is still below what it was at the end of 2019.

Several points to emphasize in the detail of the surveys:

All indicators are improving compared to February’s level, but many are still below the 50 threshold, suggesting that the improvement is not homogeneous and that the Chinese recovery is not as large as the synthetic indices suggest. The sample of companies surveyed in this official indicator is biased towards large public companies. This may explain the sharp rise in expectations about activity in coming months.

In the manufacturing sector, production and overall orders are improving (above 50), employment has stabilized but foreign orders are still deteriorating as are suppliers’ delivery time (the products needed for production do not arrive fast enough). Business expectations in the coming months are clearly improving.

In the services sector, only the index relating to business expectations is improving. All other indicators continue to contract.

More generally, signals from the Chinese economy indicate a long convergence to a normal situation. Demand will remain limited. Retail sales, which contracted by 20.5% year-on-year in February, have stabilized according to Chinese officials, the employment dynamic remains weak, foreign demand is contracting and questions arise about a resumption of the contamination.

Chinese momentum will remain subdued over the next few months despite political will.