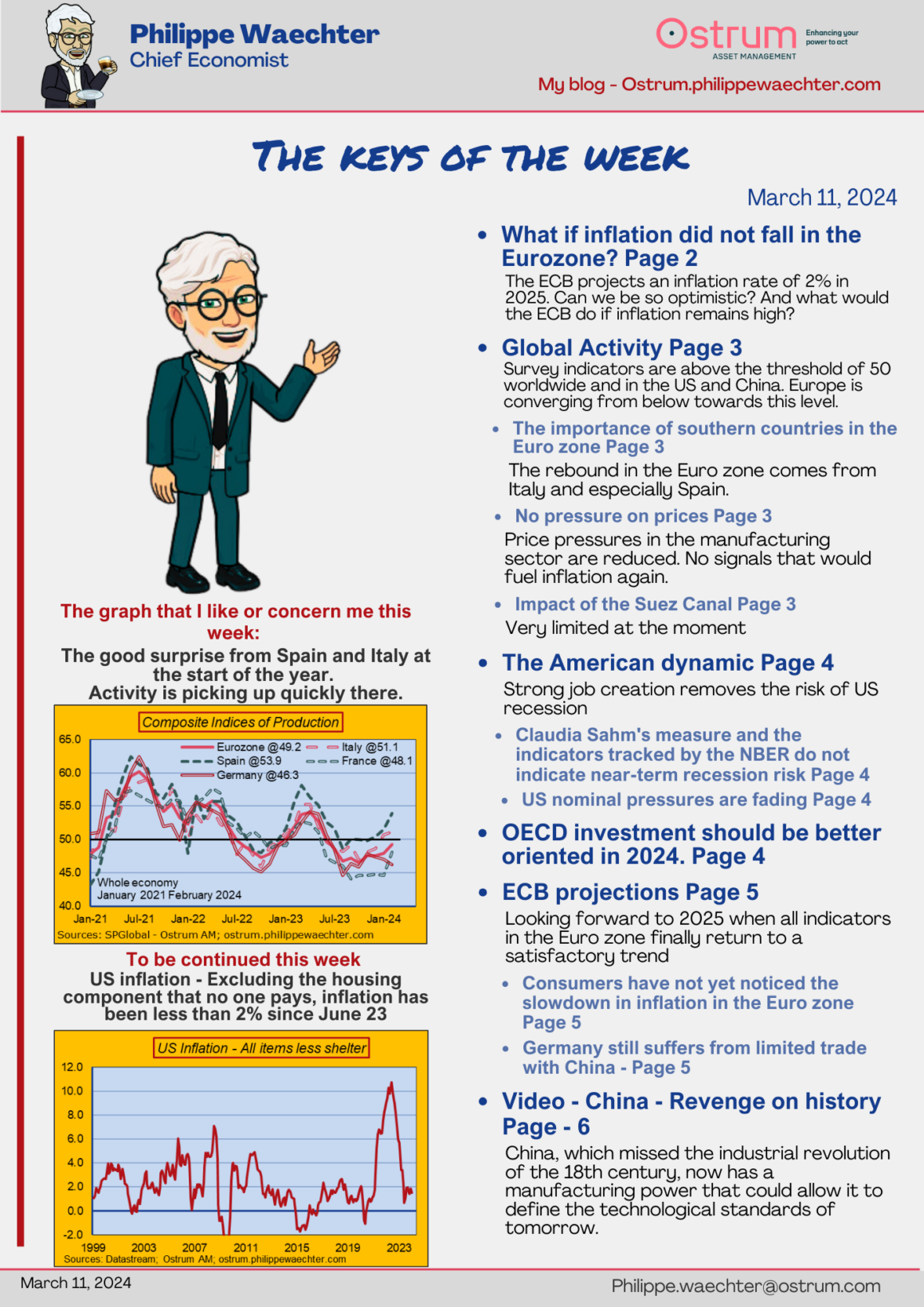

My point of attention: Countries in the South are driving growth in the Eurozone

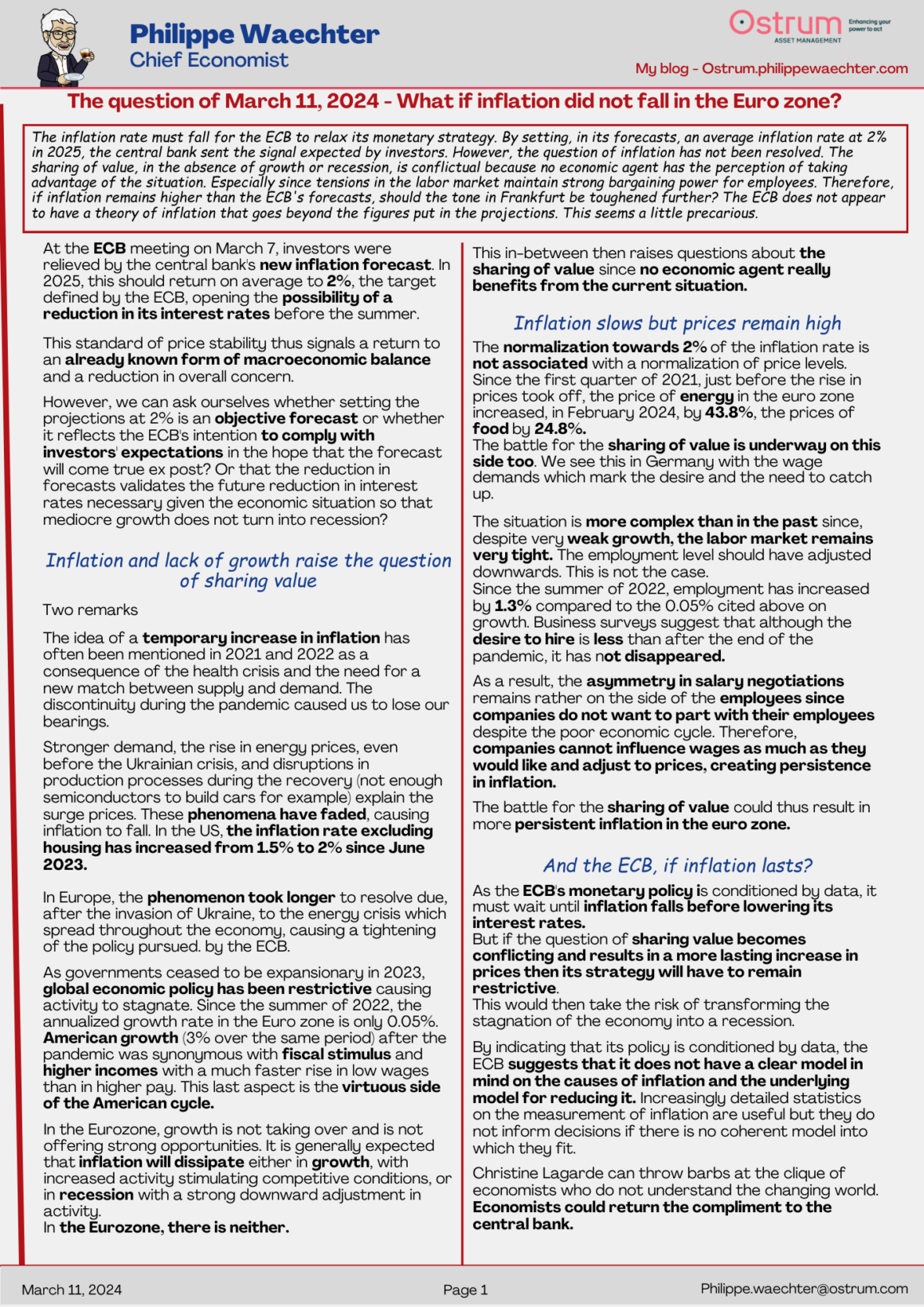

Next week’s update: US inflation rate

Six themes this week

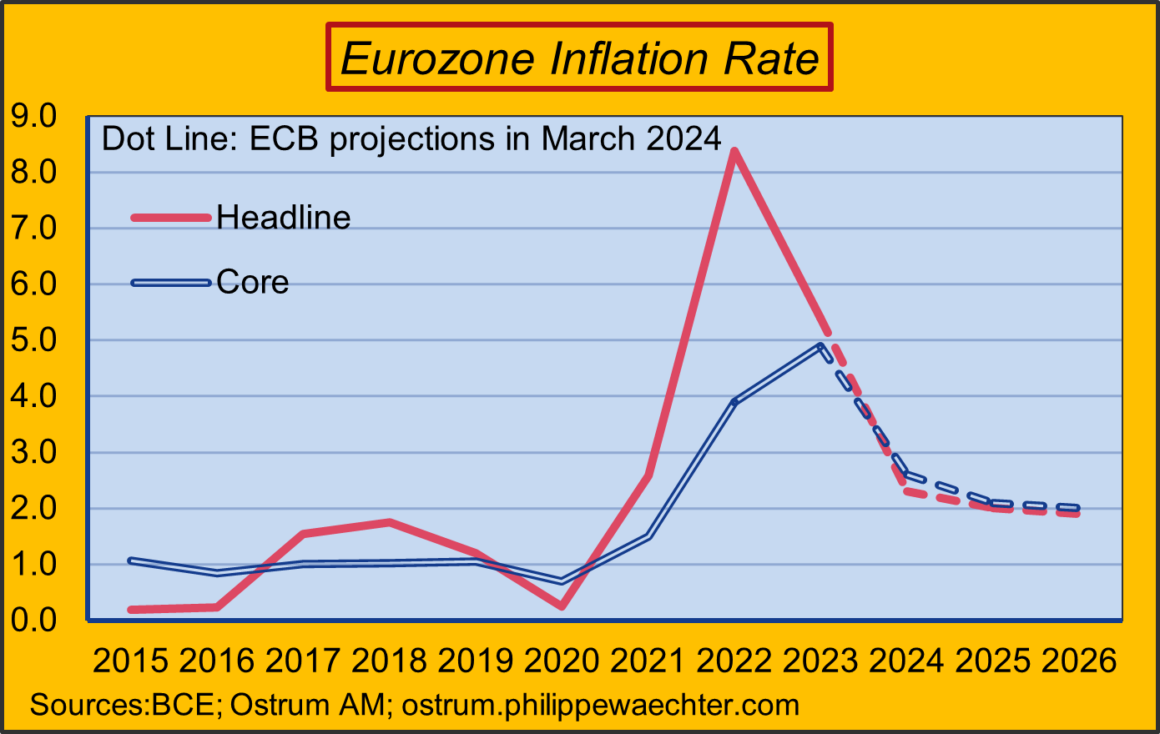

=>What if inflation did not fall in the Eurozone? Page 2

The ECB projects an inflation rate of 2% in 2025.

Can we be so optimistic? And what would the ECB do if inflation remains high?

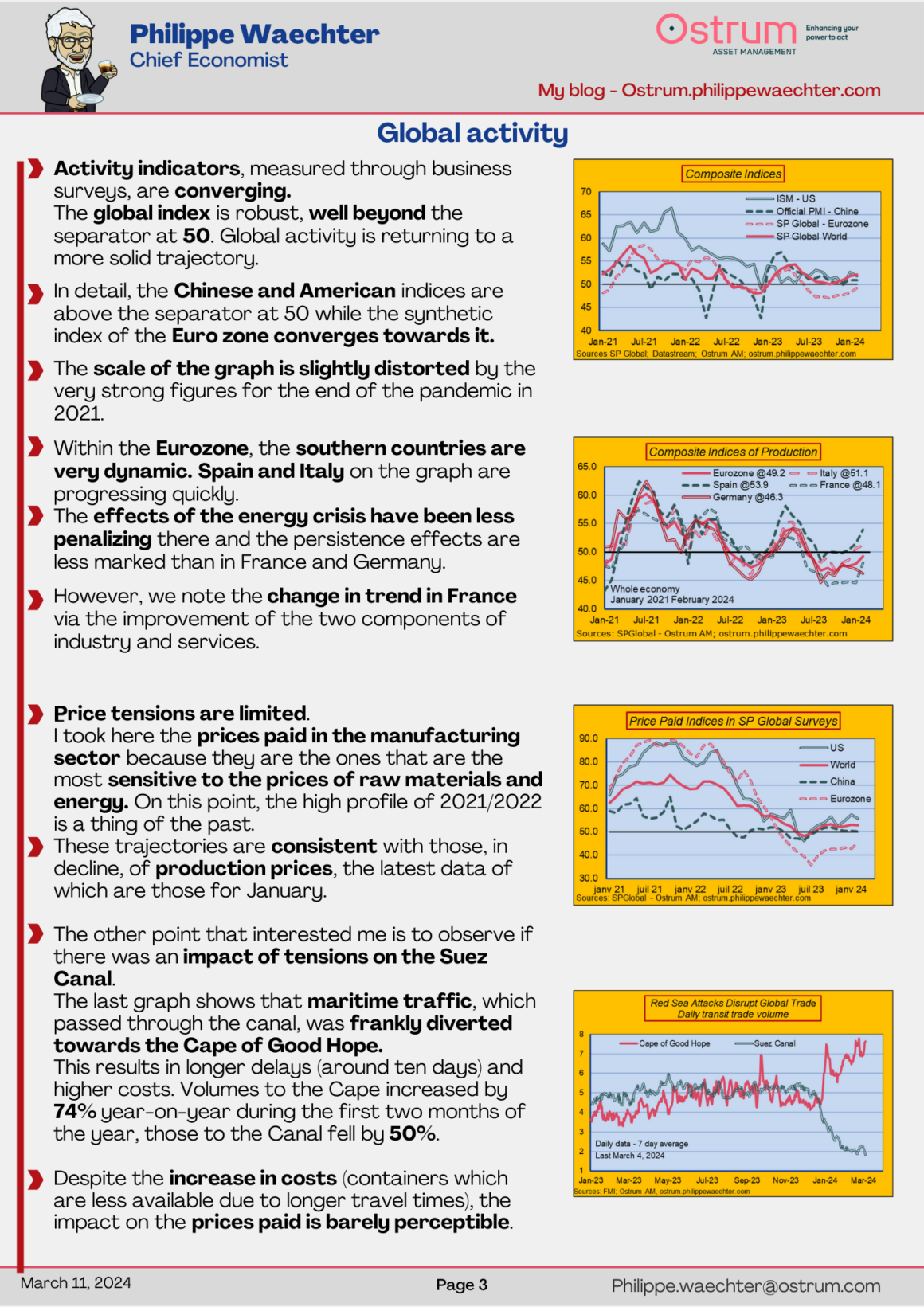

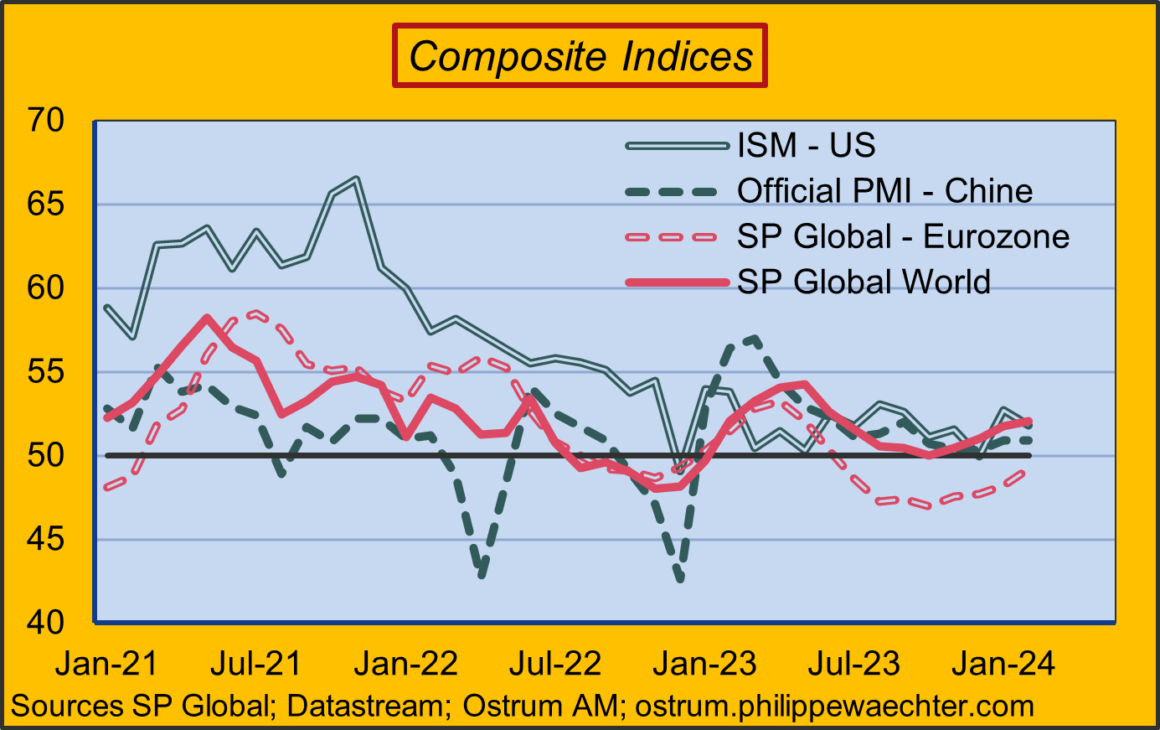

=>Global Activity Page 3

Survey indicators are above the threshold of 50 in the world and in the US and China. Europe is converging from the bottom towards this level

>The Eurozone rebound comes from Italy and especially from Spain. Page 3 > No price tensions Page 3

>Price pressures in the manufacturing sector are reduced. No signals that would fuel inflation again.

>Impact of the Suez Canal Page 3

Very limited for now

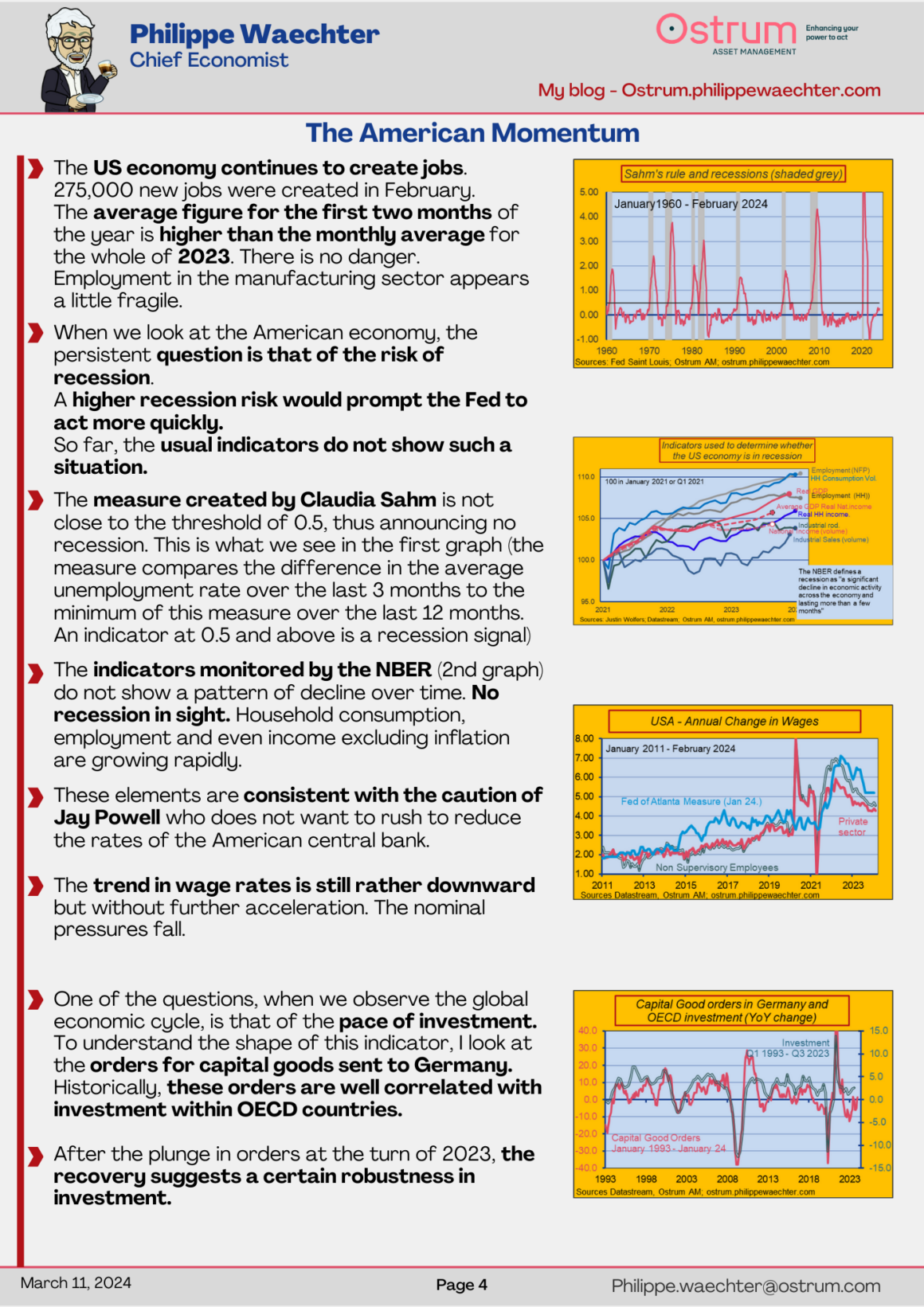

=>The American dynamic Page 4

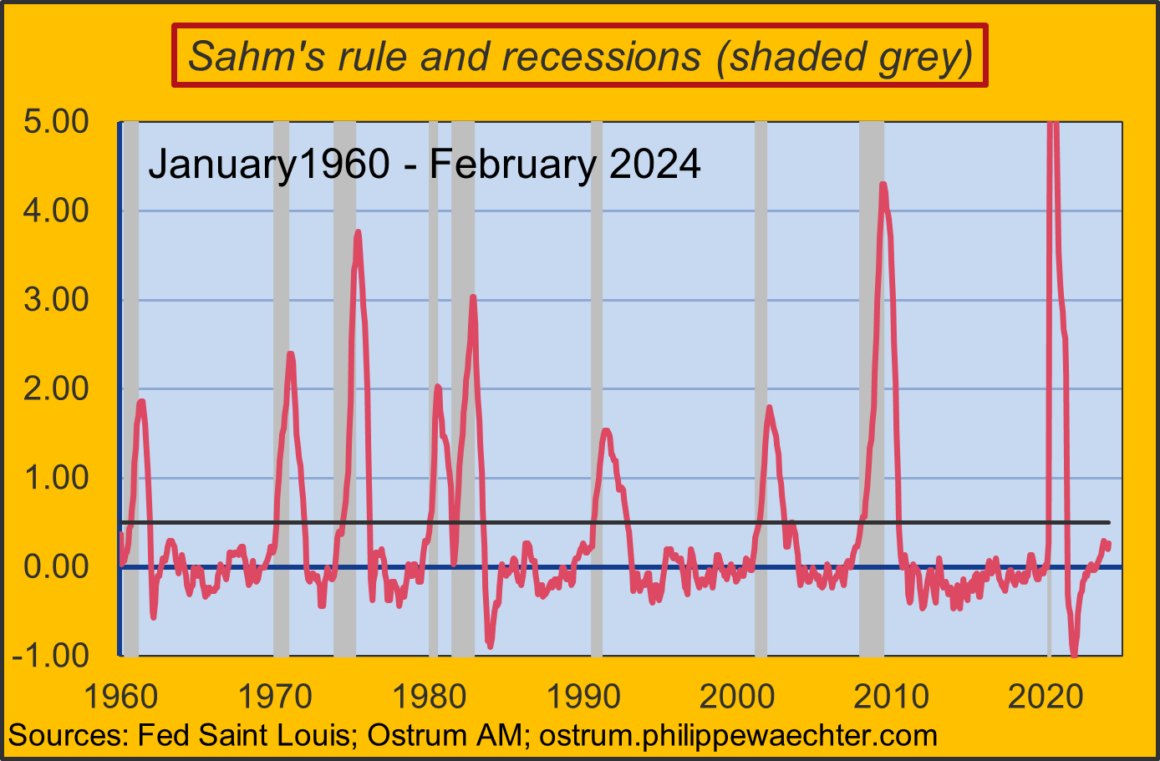

Strong job creation drives US recession risk further away

> Claudia Sahm measure and NBER indicators do not indicate recession risk in the short term Page 4

>US nominal pressures fade Page 4

=>OECD investment should be better oriented in 2024. Page 4

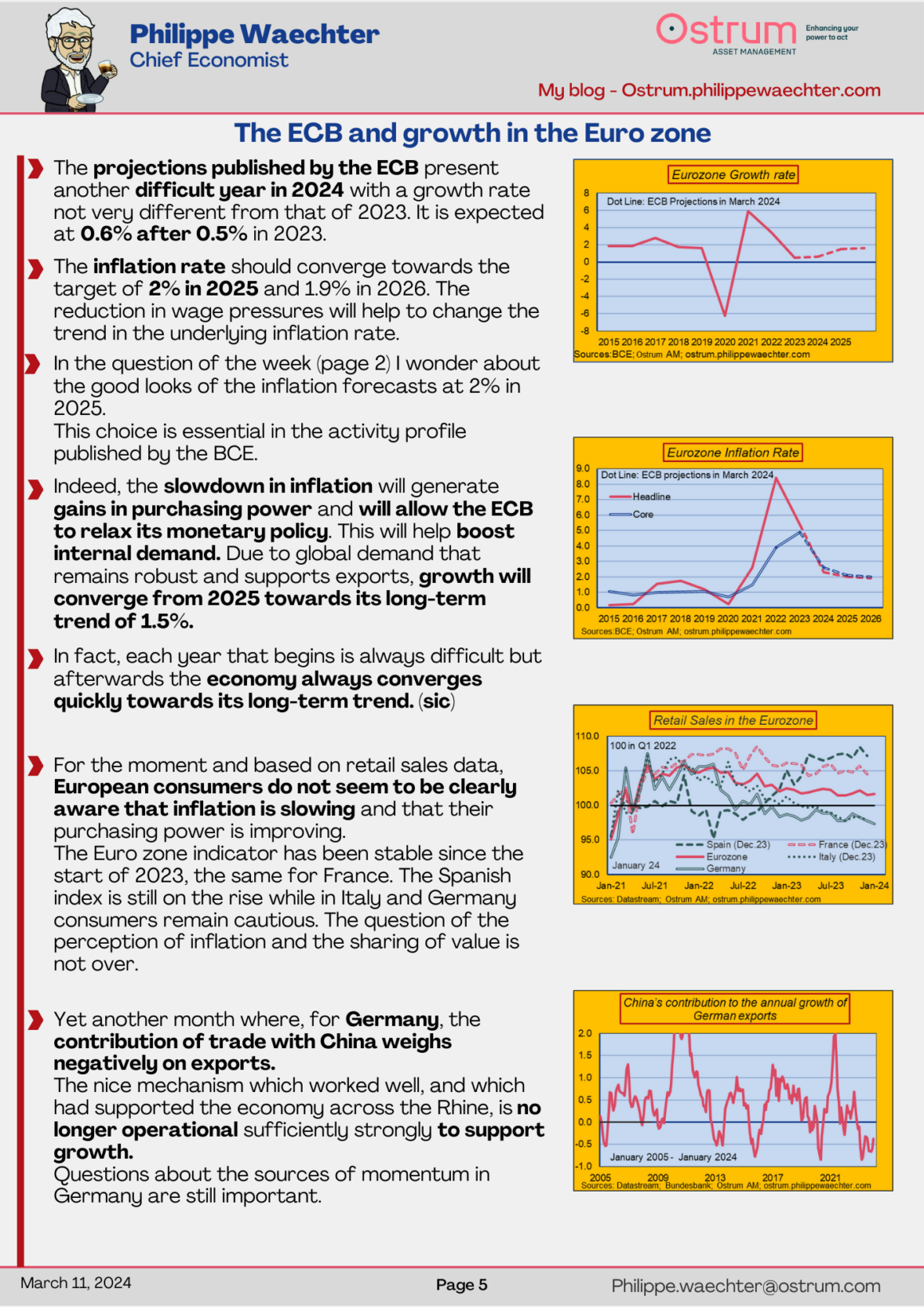

=>ECB projections Page 5

> Strongly 2025 that all euro area indicators finally return to a satisfactory trend

>Consumers still not aware of euro area inflation slowdown Page 5 > Germany still suffers from limited trade with China – Page 5

=>Video – China – Revenge on history Page – 6

China, which missed the industrial revolution of the 18th century, now has a manufacturing power that could enable it to define the technological standards of tomorrow.